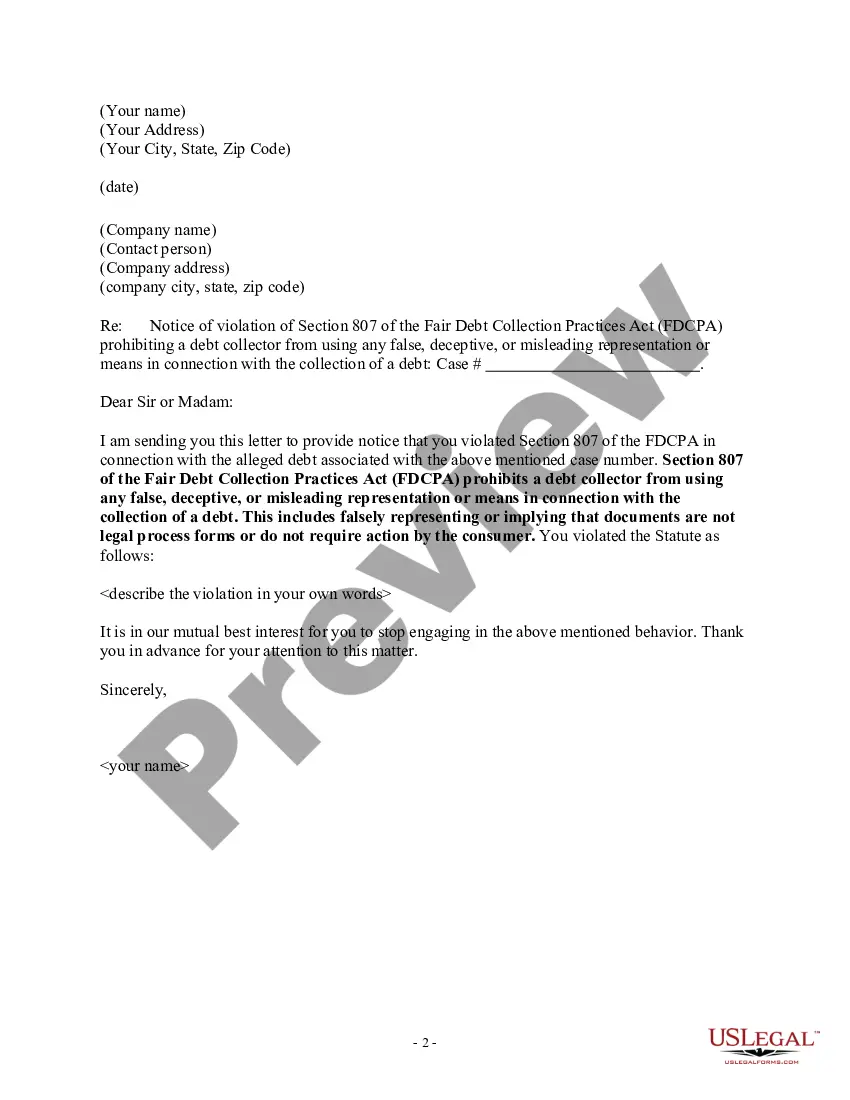

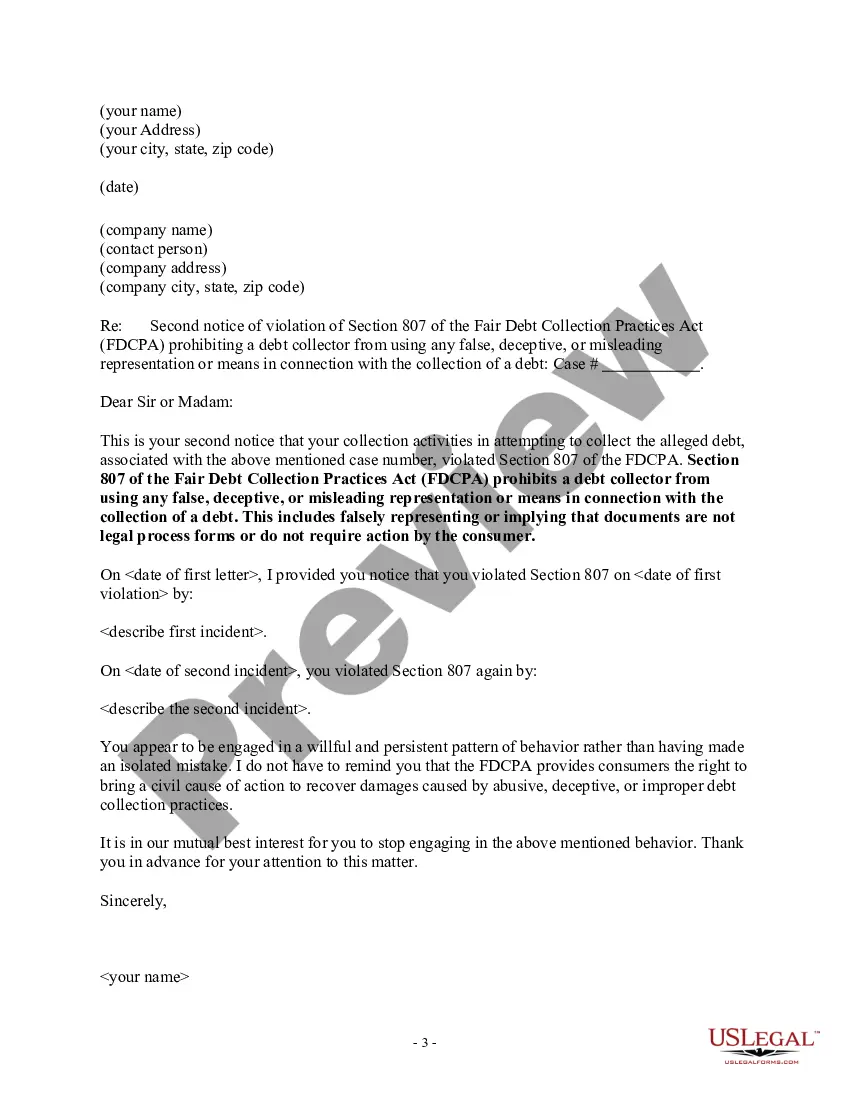

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

You can spend numerous hours online looking for the valid document template that meets the federal and state requirements you need. US Legal Forms provides a wide range of legitimate forms that are reviewed by experts.

It's easy to download or print the Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action from your assistance.

If you already have a US Legal Forms account, you can sign in and click on the Obtain button. Then, you can fill out, modify, print, or sign the Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action. Every legitimate document template you purchase is yours permanently.

Complete the purchase. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can fill out, modify, sign, and print the Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action. Access and print a multitude of document templates using the US Legal Forms website, which offers the leading collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To get another copy of a purchased form, go to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow these simple instructions.

- First, make sure you have selected the correct document template for your state/city. Review the form details to ensure you have picked the right one.

- If available, utilize the Preview feature to examine the document template as well.

- If you wish to obtain another version of the form, use the Search field to find the template that suits your needs.

- Once you have found the template you seek, click on Buy now to continue.

- Select the payment plan you prefer, enter your details, and create your account on US Legal Forms.

Form popularity

FAQ

Fighting a false debt collector starts with documenting all communication and identifying any misleading information about the debt. You have the right to dispute any invalid claims and can send a formal letter to request validation of the debt. If a debt collector sends an 'Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action', your legal footing becomes stronger. Utilizing platforms like US Legal Forms can assist you in preparing the correct legal documents to defend your position.

Outsmarting a debt collector often involves knowing your rights and maintaining control over the situation. Always verify the debt and refuse to engage in pressure tactics. If you suspect receiving an 'Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action', assert your rights confidently. Consider using legal document services like US Legal Forms to prepare necessary responses that showcase your knowledge of the law.

The Fair Debt Collection Practices Act, applicable in Oklahoma, governs how debt collectors can legally interact with consumers. It prevents harassment and requires debt collectors to provide validation upon request. Recognizing your rights under this act is crucial, especially when facing an 'Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action' scenario. Leveraging resources from platforms like US Legal Forms can help you understand your legal protection better.

The 7 7 7 rule suggests that creditors should make contact seven times within seven days to initiate collections within a week. This approach helps in assessing debtor responsiveness. However, understanding that an 'Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action' can also prevent aggressive tactics helps you navigate these processes more confidently. Knowing these guidelines helps you protect your rights effectively.

When you encounter a debt collector, start by understanding your rights under the Fair Debt Collection Practices Act. Respond calmly and request written verification of the debt they claim you owe. It's crucial to document all communications and be aware that an 'Oklahoma Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action' can highlight your rights in misleading situations. Using platforms like US Legal Forms can provide you with essential documentation to address these collectors effectively.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.