Oklahoma Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

Are you presently inside a place where you require papers for either enterprise or person uses virtually every day? There are plenty of legitimate papers themes available online, but getting kinds you can rely isn`t effortless. US Legal Forms offers thousands of develop themes, such as the Oklahoma Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock, which can be published to meet state and federal specifications.

Should you be already familiar with US Legal Forms site and get an account, just log in. Afterward, it is possible to download the Oklahoma Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock design.

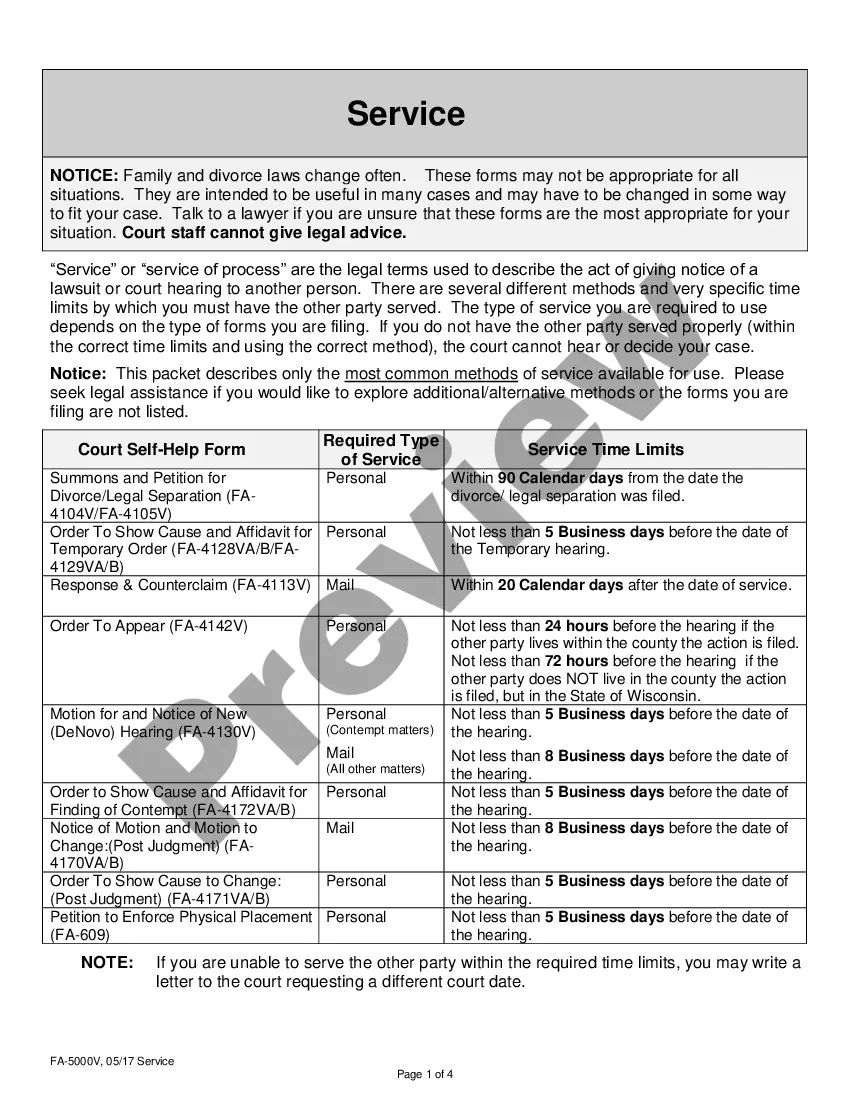

Unless you come with an accounts and want to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is to the right area/state.

- Utilize the Review option to analyze the shape.

- Read the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re looking for, use the Lookup area to obtain the develop that suits you and specifications.

- Whenever you discover the right develop, simply click Purchase now.

- Select the rates plan you would like, submit the specified information to produce your account, and purchase the transaction utilizing your PayPal or charge card.

- Select a hassle-free file formatting and download your version.

Discover all the papers themes you have bought in the My Forms menus. You may get a additional version of Oklahoma Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock whenever, if necessary. Just go through the required develop to download or produce the papers design.

Use US Legal Forms, the most comprehensive assortment of legitimate forms, to save time as well as prevent faults. The services offers professionally produced legitimate papers themes that can be used for an array of uses. Produce an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

In a 2-for-1 split, for example, the value per share typically will be reduced by half. As such, although the number of outstanding shares and the price change, the total market value remains constant.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.

A stock's price is also affected by a stock split. After a split, the stock price will be reduced (because the number of shares outstanding has increased). In the example of a 2-for-1 split, the share price will be halved.

A reverse stock split, as opposed to a stock split, is a reduction in the number of a company's outstanding shares in the market. It is typically based on a predetermined ratio. For example, a reverse stock split would mean that an investor would receive 1 share for every 2 shares that they currently own.

A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall market capitalization of the company and the value of each shareholder's stake remains the same. Say you have one share of a company's stock.

Let's look at a common scenario, which is a 2-for-1 split: Investors receive one additional share for each share they already own. The stock price is halved?$50 becomes $25, for example?and the number of shares outstanding doubles.

The only effects of a stock split are on the number of shares outstanding and on the par value of the stock. The assets, total stockholders' equity, and the additional paid?in capital accounts of the company are not affected.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

Impact on par value per share: Decrease. Impact on retained earnings: No effect. Splitting the share will increase the number of shares and will decrease the per-share value of the share as the shares are issued without any cost, and as the cost of the splitting shares is covered through already issued shares.