Oklahoma Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.

Description

How to fill out Long Term Performance And Restricted Stock Incentive Plan Of Ipalco Enterprises, Inc.?

Have you been in the situation that you need documents for either organization or person functions virtually every time? There are a variety of authorized record web templates accessible on the Internet, but discovering kinds you can depend on isn`t easy. US Legal Forms provides 1000s of form web templates, like the Oklahoma Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc., that happen to be written in order to meet federal and state specifications.

If you are currently familiar with US Legal Forms site and also have a free account, merely log in. After that, you are able to down load the Oklahoma Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. template.

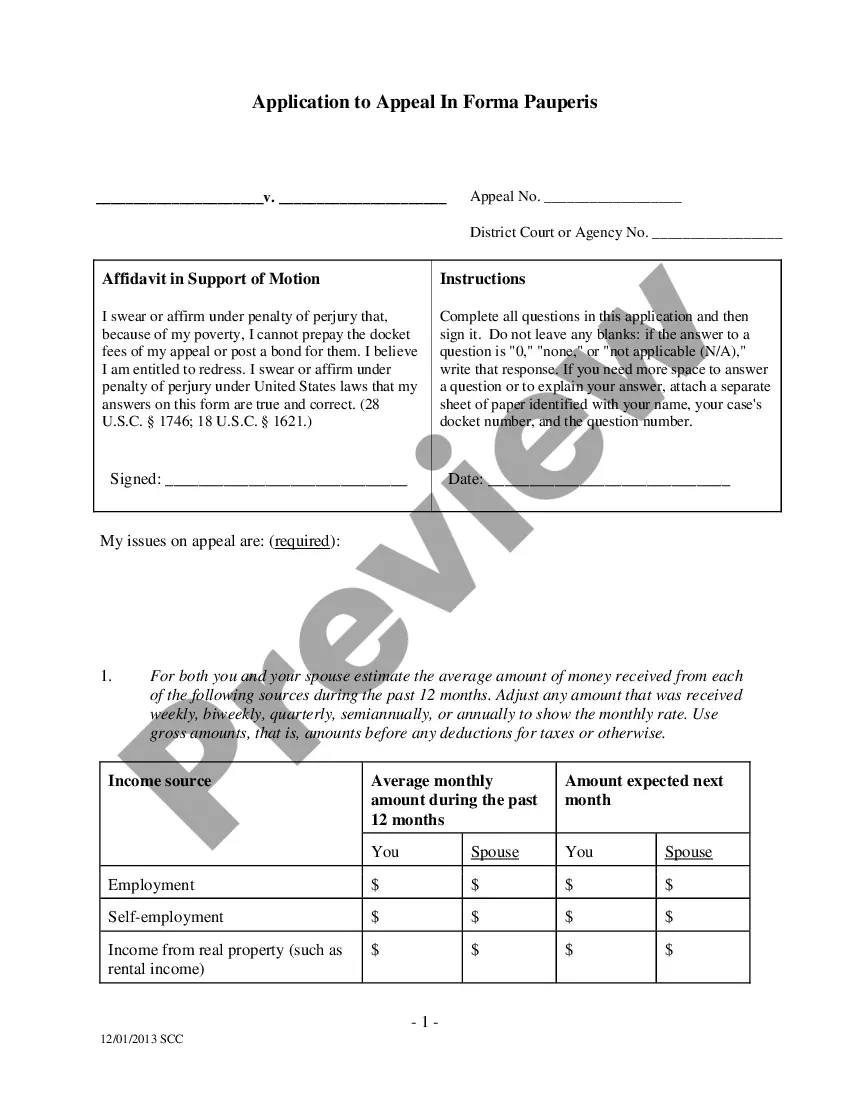

Should you not provide an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for your proper town/region.

- Use the Review switch to examine the form.

- Browse the outline to ensure that you have selected the right form.

- When the form isn`t what you are trying to find, make use of the Look for industry to find the form that suits you and specifications.

- When you get the proper form, click on Purchase now.

- Pick the prices program you need, complete the required info to generate your money, and buy the order with your PayPal or credit card.

- Decide on a practical paper formatting and down load your copy.

Locate all of the record web templates you have purchased in the My Forms food list. You can aquire a more copy of Oklahoma Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. at any time, if possible. Just go through the required form to down load or printing the record template.

Use US Legal Forms, one of the most considerable assortment of authorized types, to save lots of efforts and steer clear of mistakes. The assistance provides skillfully manufactured authorized record web templates which can be used for a selection of functions. Produce a free account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Each RSU will correspond to a certain number and value of employer stock. For example, suppose your RSU agreement states that one RSU corresponds to one share of company stock, which currently trades for $20 per share. If you're offered 100 RSUs, then your units are worth 100 shares of stock with a value of $2,000.

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.

In summary, RSUs in public companies offer more immediate liquidity, allowing employees to sell their shares as soon as they vest. On the other hand, private company RSUs involve waiting for specific events or finding a willing buyer to access the value of the shares.

RSU's are effectively deferred employee bonuses. When the RSU's vest (when you're able to sell them), you'll receive a taxable benefit equal to the value of the shares received or cash received. This amount should be reported on your T4 from your employer.

Restricted stocks are unregistered shares that are non-transferable for holders until they meet certain conditions. Well-established companies offer restricted stocks to company executives and directors as a form of equity compensation. Some restrictive conditions may be particular tenure or specific performance goals.

Taxation of RSUs The amount reported will equal the fair market value of the stock on the date of vesting, which is also the date of delivery in this case. Therefore, the value of the stock is reported as ordinary income in the year the stock becomes vested.

A company can choose to grant equity based on a predefined value on the grant date or predefined number of shares (the former is more popular). Unlike an appreciation-based award, a restricted stock will still have value upon vesting even if the per-stock value decreases.

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options.