Oklahoma Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Are you currently in a situation that you need documents for sometimes organization or person reasons nearly every day? There are a variety of legal record layouts available online, but getting types you can rely is not straightforward. US Legal Forms delivers a huge number of kind layouts, much like the Oklahoma Proposal to approve material terms of stock appreciation right plan, which can be created to satisfy federal and state requirements.

In case you are previously acquainted with US Legal Forms website and have a merchant account, simply log in. Following that, you may download the Oklahoma Proposal to approve material terms of stock appreciation right plan design.

Unless you have an profile and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for the appropriate town/area.

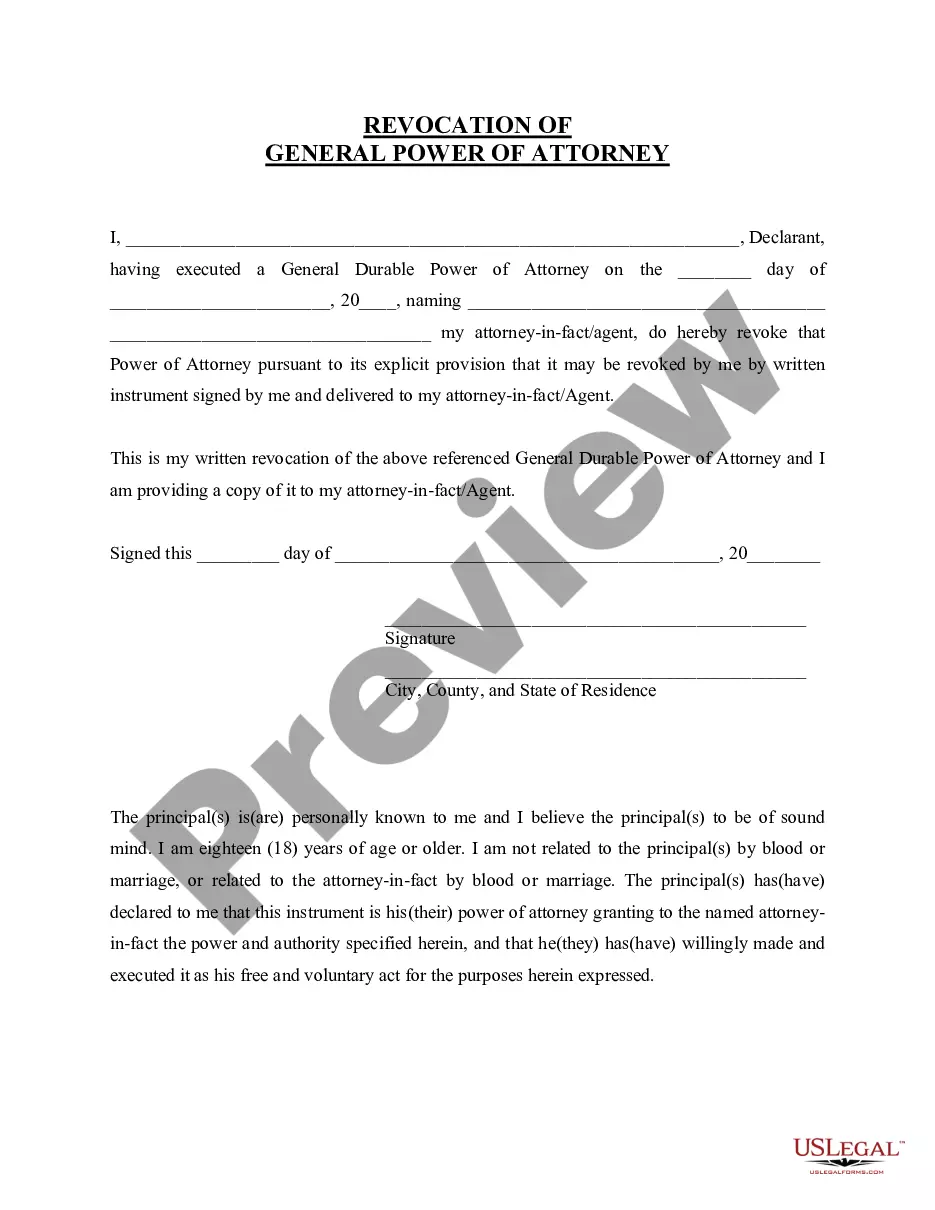

- Use the Review option to examine the shape.

- Browse the explanation to actually have chosen the appropriate kind.

- When the kind is not what you are trying to find, use the Lookup discipline to discover the kind that meets your needs and requirements.

- If you obtain the appropriate kind, just click Purchase now.

- Pick the rates plan you desire, complete the specified info to make your bank account, and purchase the order with your PayPal or bank card.

- Select a handy data file file format and download your copy.

Locate every one of the record layouts you may have purchased in the My Forms menu. You can aquire a further copy of Oklahoma Proposal to approve material terms of stock appreciation right plan any time, if possible. Just select the essential kind to download or print out the record design.

Use US Legal Forms, by far the most comprehensive selection of legal forms, to save lots of efforts and avoid mistakes. The services delivers appropriately made legal record layouts that you can use for a variety of reasons. Make a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

Stock Appreciation Rights are similar to Stock Options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a SAR vests, an employee can exercise it at any time prior to its expiration.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For example, let's say you were granted stock appreciation rights on 10 shares of your company ABC's stock, valued at $10 per share. Over time, the share price increases from $10 to $12. This means you'd receive $2 per share since that was the increased value.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.