Connecticut Web Site Use Agreement

Description

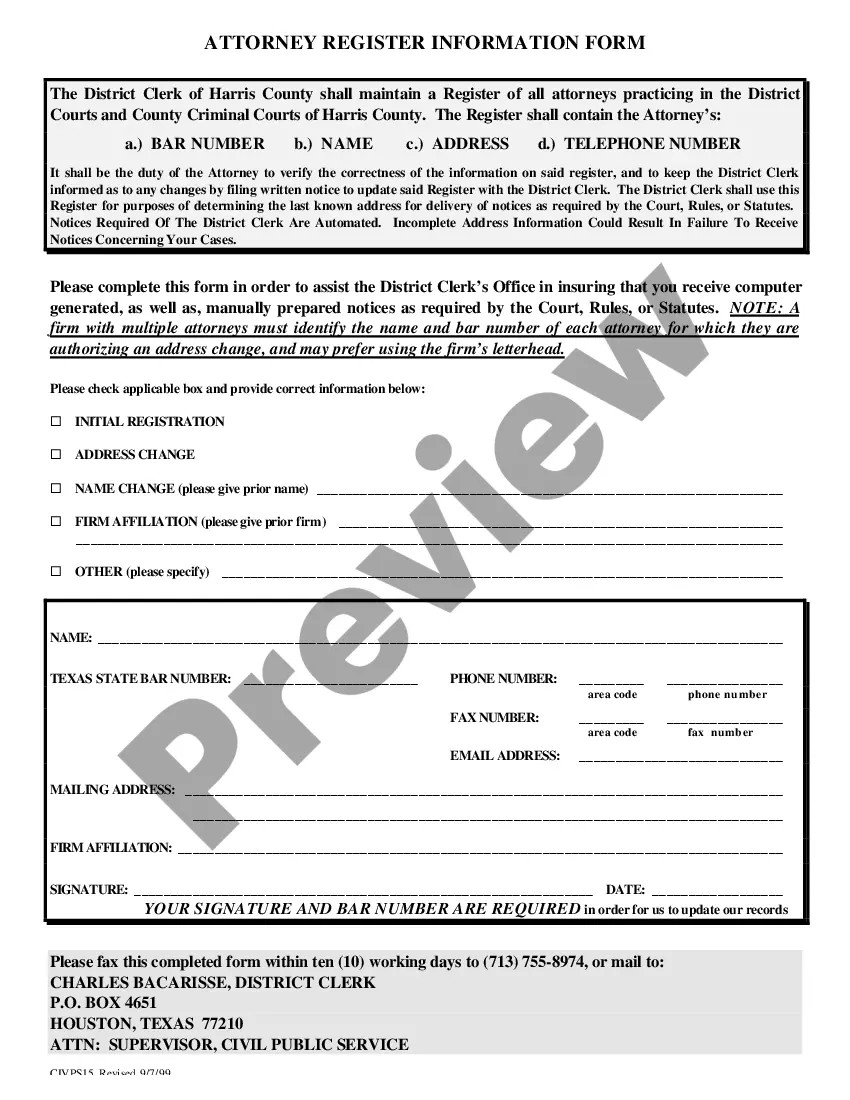

How to fill out Web Site Use Agreement?

Are you in the situation where you will need files for either enterprise or personal reasons almost every time? There are a lot of legal file themes accessible on the Internet, but finding kinds you can depend on is not easy. US Legal Forms offers a huge number of type themes, just like the Connecticut Web Site Use Agreement, which can be created to meet federal and state requirements.

Should you be currently informed about US Legal Forms website and have a free account, just log in. Afterward, you can obtain the Connecticut Web Site Use Agreement design.

Unless you come with an profile and want to begin to use US Legal Forms, abide by these steps:

- Get the type you want and make sure it is for the appropriate city/region.

- Utilize the Preview option to check the shape.

- Browse the information to actually have chosen the right type.

- When the type is not what you are searching for, take advantage of the Look for area to obtain the type that suits you and requirements.

- Once you obtain the appropriate type, click on Get now.

- Select the prices plan you want, fill out the required information and facts to create your account, and purchase the order using your PayPal or charge card.

- Choose a convenient data file format and obtain your version.

Locate each of the file themes you have purchased in the My Forms menus. You can get a extra version of Connecticut Web Site Use Agreement whenever, if needed. Just select the necessary type to obtain or produce the file design.

Use US Legal Forms, by far the most considerable assortment of legal forms, in order to save efforts and prevent faults. The service offers expertly manufactured legal file themes which can be used for a variety of reasons. Make a free account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies. Connecticut Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? connect... avalara.com ? taxrates ? state-rates ? connect...

The sales tax DOES NOT APPLY to the sales of gas, electricity, or heating fuel USED IN ANY RESIDENTIAL DWELLING (i.e. any building whose predominant use is residential). TSSN20 Special Notice Sales and Use Tax - CT.gov ct.gov ? DRS ? Publications ? TSSNs ? TSS... ct.gov ? DRS ? Publications ? TSSNs ? TSS...

A Connecticut title transfer requires a bill of sale that includes the following information: The names and addresses of both the new owner and seller. The vehicle identification number (VIN) The vehicle, year, make, model, and color. The purchase price and purchase date. The seller's signature. Connecticut DMV Title Transfer Guide - CarRegistration.com carregistration.com ? blog ? connecticut-dm... carregistration.com ? blog ? connecticut-dm...

Businesses operating in Connecticut are required to apply the upwardly revised sales tax rates by the Department of Revenue Services (DRS) from October 1, 2019. Currently, the sale of meals and certain beverages applies the overall sales tax rate of 7.35% (6.35% standard tax rate plus 1% tax). Connecticut Sales Tax Basics for Gas Stations and Convenience Stores salestaxhelper.com ? resources ? blog ? july salestaxhelper.com ? resources ? blog ? july

How to sell your vehicle without a title: Request and complete a Supplemental Assignment of Ownership Form (Form Q1). This form is also available at your local DMV office. Without this form, we are unable to transfer ownership. Selling a vehicle without a title | CT.gov ct.gov ? dmv ? vehicle-title-service ? sell-v... ct.gov ? dmv ? vehicle-title-service ? sell-v...

*Connecticut imposes a 7.75% luxury tax on sales of apparel, handbags, luggage, umbrellas, wallets, and watches with a sales price exceeding $1,000. This is significantly higher than the state's general rate of 6.35%. The sales and use tax on clothes is subject to limited exceptions in several states. What states require you to collect sales tax on clothing? - Avalara avalara.com ? blog ? north-america ? 2020/02 avalara.com ? blog ? north-america ? 2020/02

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see. Sales and Use Tax Information - CT.gov ct.gov ? DRS ? Sales-Tax ? Tax-Information ct.gov ? DRS ? Sales-Tax ? Tax-Information

There are many services that are taxable in Connecticut: Advertising and public relations services. Business analysis, management, management consulting and public relations services. Cable and satellite television services. Car wash services, including coin-operated car washes. Does Connecticut Charge Sales Tax on Services? - TaxJar taxjar.com ? blog ? 2022-12-does-connectic... taxjar.com ? blog ? 2022-12-does-connectic...