Oklahoma Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Are you presently in the placement that you need papers for sometimes enterprise or individual reasons nearly every working day? There are tons of legal record themes available on the net, but discovering ones you can rely is not simple. US Legal Forms offers 1000s of kind themes, like the Oklahoma Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, that happen to be composed in order to meet federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and have a free account, basically log in. Afterward, you are able to down load the Oklahoma Ratification and approval of directors and officers insurance indemnity fund with copy of agreement design.

Unless you have an account and need to begin using US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is for your right town/area.

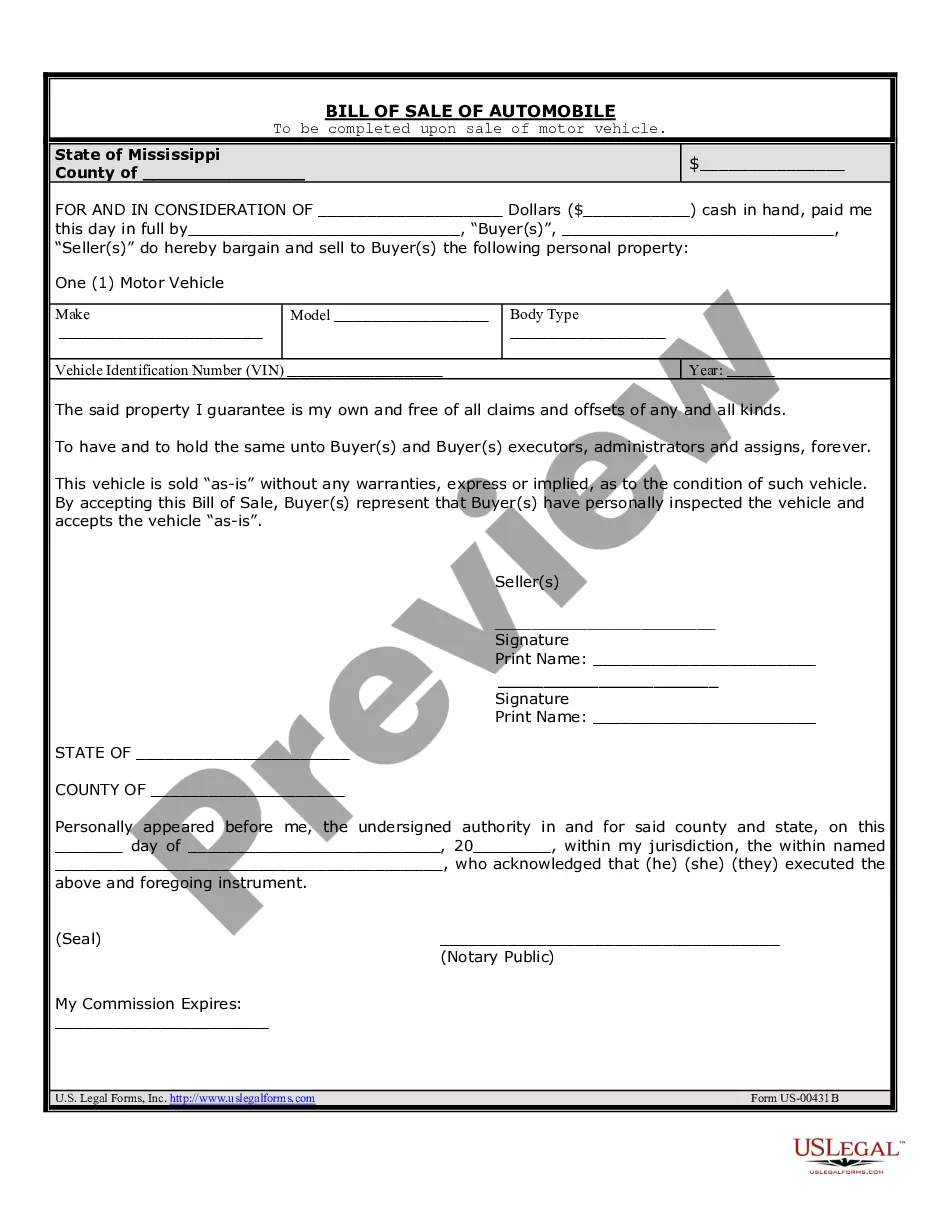

- Utilize the Review switch to examine the shape.

- See the description to ensure that you have chosen the correct kind.

- In case the kind is not what you`re seeking, make use of the Lookup area to obtain the kind that suits you and needs.

- Whenever you obtain the right kind, simply click Acquire now.

- Choose the pricing plan you desire, complete the necessary details to make your money, and pay for an order making use of your PayPal or bank card.

- Select a hassle-free document file format and down load your version.

Discover each of the record themes you possess purchased in the My Forms menu. You can aquire a additional version of Oklahoma Ratification and approval of directors and officers insurance indemnity fund with copy of agreement anytime, if necessary. Just click on the needed kind to down load or print the record design.

Use US Legal Forms, by far the most extensive collection of legal types, in order to save efforts and avoid blunders. The assistance offers expertly manufactured legal record themes that you can use for an array of reasons. Generate a free account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

This form of a Release Agreement, Indemnity Agreement and Hold Harmless Agreement releases a party from certain specified liabilities. Releases are used to transfer risk from one party to another and protect against the released party or reimburse the released party for damage, injury, or loss.

THIS INDEMNITY AGREEMENT (the ?Agreement? or this ?Indemnity Agreement?), is made and entered into as of this date, by and between party name 1 (the ?Indemnifying Party?), a state corporation, with a registered office located at address and party name 2, a state corporation, with a registered office located at address ...

A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, other than an action by or in the right of the corporation, by reason of the ...

Indemnity is a type of insurance compensation paid for damage or loss. When the term is used in the legal sense, it also may refer to an exemption from liability for damage. Indemnity is a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.