Oklahoma Salaried Employee Appraisal Guidelines - General

Description

How to fill out Salaried Employee Appraisal Guidelines - General?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal templates you can download or generate.

By utilizing the website, you can access thousands of documents for business and personal needs, organized by categories, states, or keywords. You can find the latest editions of forms such as the Oklahoma Salaried Employee Appraisal Guidelines - General in seconds.

If you have a subscription, Log In and download the Oklahoma Salaried Employee Appraisal Guidelines - General from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved documents within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Fill in, modify, and print and sign the saved Oklahoma Salaried Employee Appraisal Guidelines - General. Every template added to your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, just go to the My documents section and click on the document you require. Access the Oklahoma Salaried Employee Appraisal Guidelines - General with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

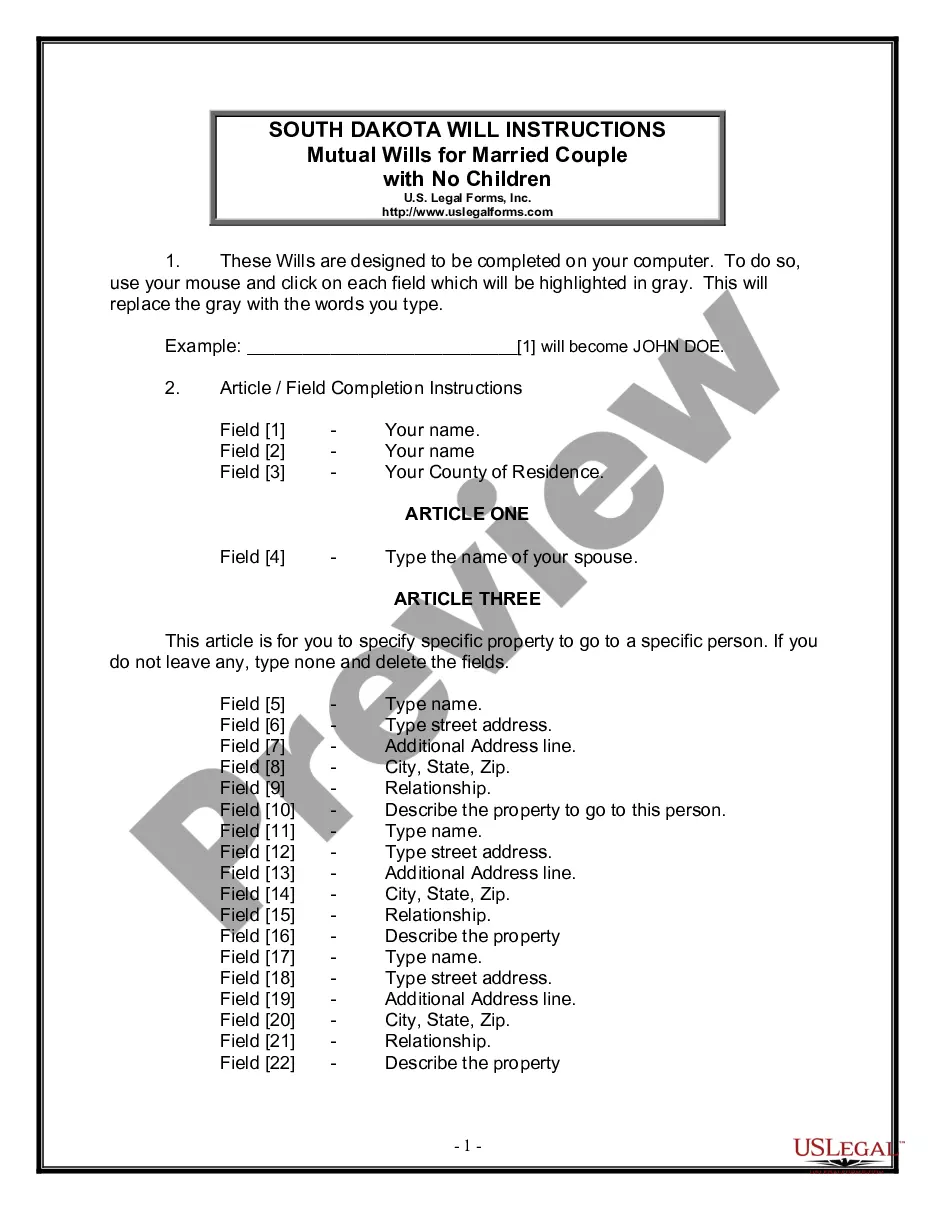

- Ensure you have selected the correct document for your state/region.

- Click the Review button to examine the document's details.

- Look at the document information to confirm that you have chosen the right document.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Overtime. Oklahoma employees who are paid a salary may still get overtime pay if they work more than 40 hours during a work week. Employees may only be exempt from overtime requirements if they make at least $455 per week and work in certain white collar jobs.

The best way to ensure your company is paying employees fairly is to conduct a pay equity audit. A compensation audit will look at the effectiveness and competitiveness of salaries, bonuses, incentives, and equity programs. HR teams should audit compensation regularly.

No, only if you've agreed to keep your salary secret in your employment contract. While your salary is your personal information, the Privacy Act doesn't require you to keep it confidential.

A: The short answer is Yes, even salaried employees are entitled to overtime pay. Overtime must be paid at a rate of at least one and one-half times the employee's regular rate of pay for each hour worked in a workweek in excess of the maximum allowable in a given type of employment.

From an employer perspective, the salary range is the amount of compensation paid for a specific position. For example, if the starting pay for a job is $30,000 and the maximum salary for the position, after merit increases and tenure on the job, is $40,000, the salary range for the job is $30,000 to $40,000.

Employers generally determine salaries based on five (5) types of information: the job's responsibilities, what their competitors are paying, how valuable the job is to their organization, how they pay people in similar roles based on their pay structure, and their budget/organizational needs.

How Many Hours a Week Does the Average Salaried Employee Work? While 40 hours of work per week is considered full-time, the average salaried employee does not often exceed 45-50 hours per week.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

An exempt employee must be paid at least $23,600 per year ($455 per week), be paid on a salary basis, and perform exempt job duties.

Neither the state nor the federal law sets any limit as to the number of hours employees can work. Employers have the right to set the number of hours an employee may work and can change those hours at any time without advance notice to the employee. The only exception is for employees who are 14 or 15 years of age.