Oklahoma Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

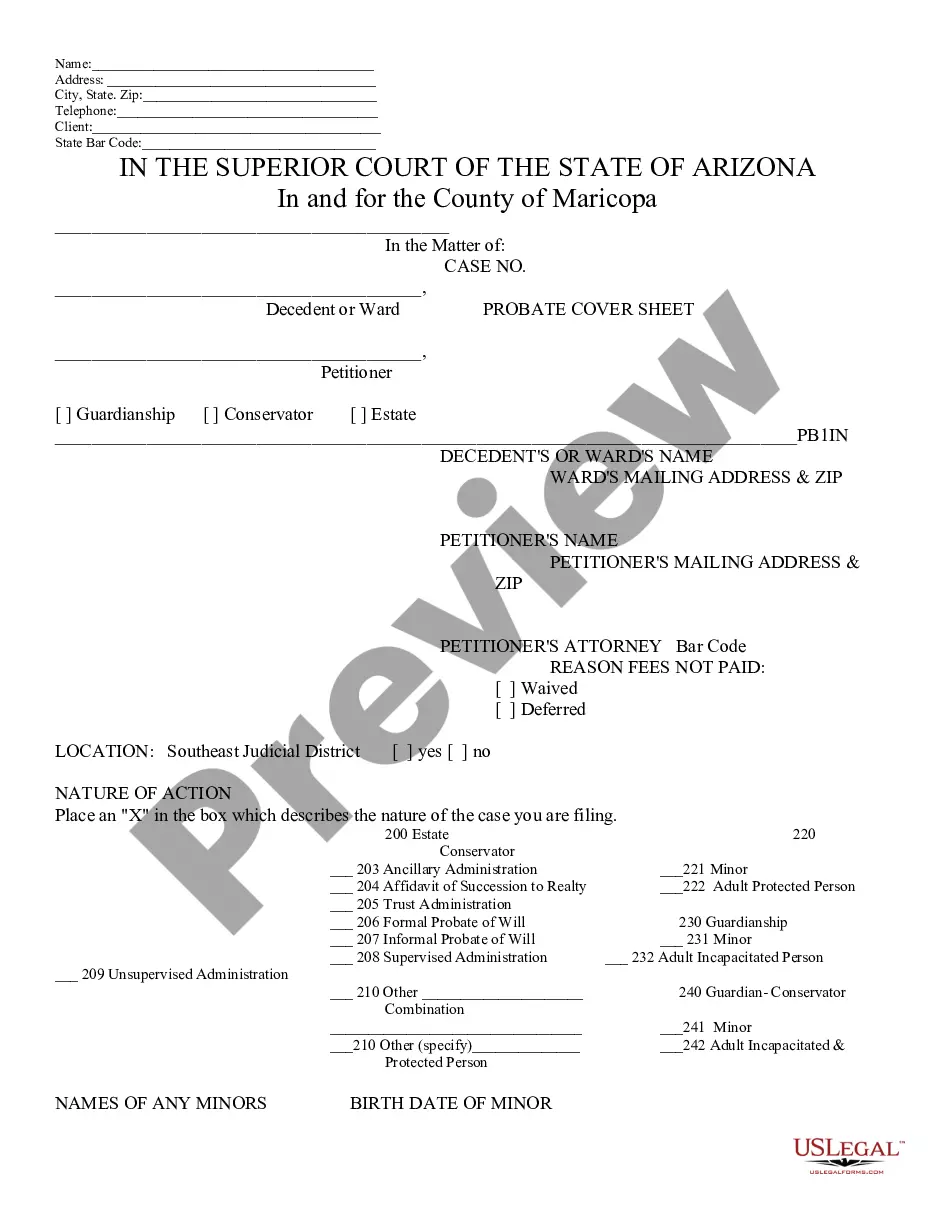

If you need to finish, download, or print official document templates, utilize US Legal Forms, the largest selection of official forms available online.

Employ the site’s user-friendly and efficient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find different versions of your legal form template.

Step 4. Once you have found the form you desire, click the Buy Now button. Select the payment plan you prefer and enter your information to register for an account.

- Utilize US Legal Forms to obtain the Oklahoma Separation Notice for 1099 Employee with just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click the Download button to access the Oklahoma Separation Notice for 1099 Employee.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

Form popularity

FAQ

An independent contractor is: one who engages to perform certain service for another, according to his own manner and method, free from control and direction of his employer in all matters connected with the performance of the service, except as to the result or product of the work. Defined by Oklahoma Case Law.

Collecting Unemployment After Being Fired If, however, you were fired for misconduct, you will be disqualified from receiving benefits. Under Oklahoma law, misconduct includes dishonesty, violating a safety rule, willfully violating or neglecting your job duties, and unexplained absences.

Independent contractors still have a remedy if they're injured at work. As with any injured party, the independent contractor can file a personal injury lawsuit against the company or other third parties for negligence.

PUA provides unemployment benefits to people who are unable to work because of a COVID-19 related reason but are not eligible for traditional unemployment. Independent contractors, freelancers, and self-employed individuals may be eligible for PUA.

Since Unemployment Insurance (UI) is an insurance paid by Oklahoma employers, it is not available for self-employed, contract, or gig workers.

If you quit your job voluntarily, you will typically not be able to collect Oklahoma unemployment benefits. However, if you had good cause for quitting say, because of unsafe work conditions or unfair treatment you may qualify for unemployment benefits.

Self-employed Oklahomans, gig-workers and independent contractors are eligible for Pandemic Unemployment Assistance thanks to the CARES Act.

Independent Contractors - Independent contractors are not "employees" and therefore are not covered under Oklahoma workers' compensation law.

Self-employed Oklahomans, gig-workers and independent contractors are eligible for Pandemic Unemployment Assistance thanks to the CARES Act.

Independent contractors are not considered employees and are exempt from workers' comp coverage. The state of Oklahoma uses a complex, multipart test to determine if a worker is a contractor vs. an employee.