Oklahoma Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Accept Resignation Of Officer Of The Company?

Are you currently in a position where you require documents for either business or personal purposes almost on a daily basis.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Oklahoma Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company, designed to comply with state and federal requirements.

Choose the payment plan you prefer, fill out the necessary details to create your account, and complete your purchase using PayPal or a credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can get another copy of the Oklahoma Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company at any time, if needed. Just click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oklahoma Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for your specific city/county.

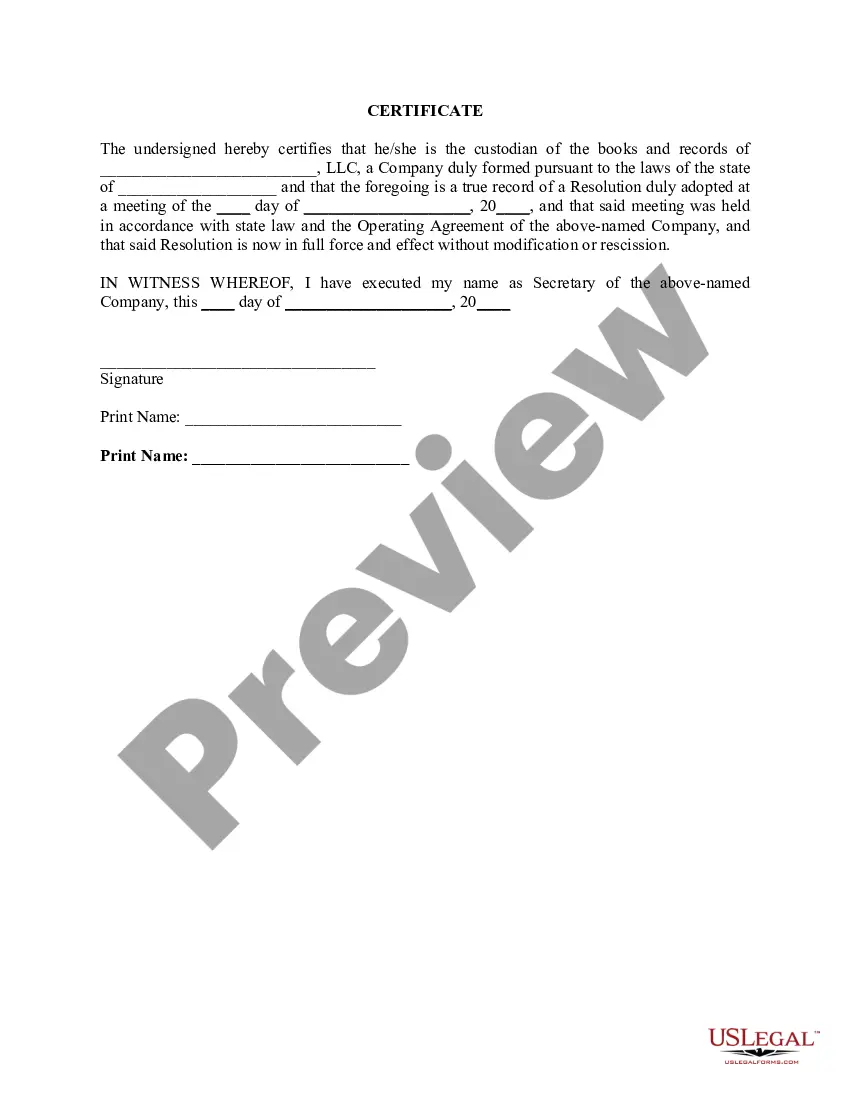

- Utilize the Review option to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

- If you find the correct form, simply click Get now.

Form popularity

FAQ

Follow these steps for a smooth process when you add an owner to an LLC.Understand the Consequences.Review Your Operating Agreement.Decide on the Specifics.Prepare and Vote on an Amendment to Add Owner to LLC.Amend the Articles of Organization (if Necessary)File any Required Tax Forms.02-May-2022

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

An LLC is not a partnership, though many LLC owners casually refer to their co-owners as business partners." All LLC ownersknown formally as members"are protected from personal liability for business debts. Limited liability partnership. Most states allow limited liability partnerships.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.

An LLC is a limited liability company, which is a type of legal entity that can be used when forming a business. An LLC offers a more formal business structure than a sole proprietorship or partnership.

Is an LLC Operating Agreement required in Oklahoma? Operating Agreements are not legally required in the state of Oklahoma, but they are strongly recommended as a way to protect your interests and those of your business.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.