Oklahoma Domestic Partnership Dependent Certification Form

Description

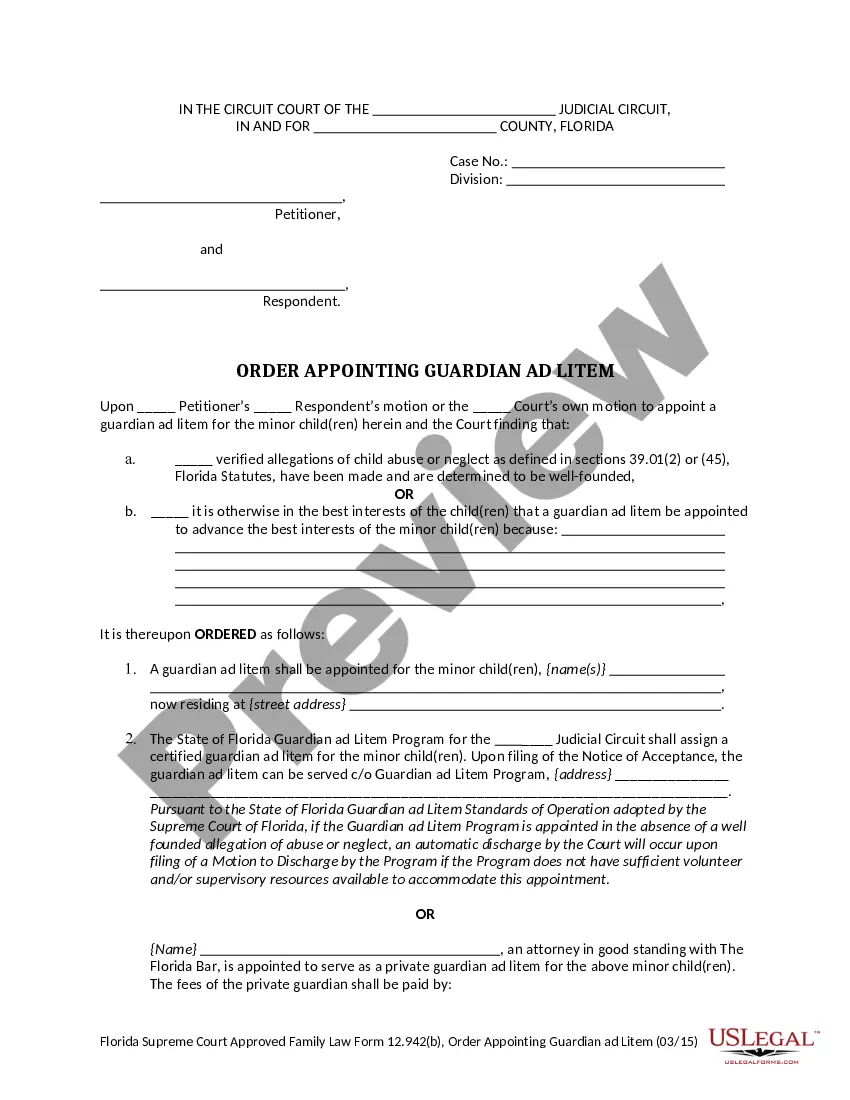

How to fill out Domestic Partnership Dependent Certification Form?

US Legal Forms - among the largest collections of legal documents in the USA - offers a range of legal template documents that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest editions of forms like the Oklahoma Domestic Partnership Dependent Certification Form in moments.

If you already have an account, Log In and retrieve the Oklahoma Domestic Partnership Dependent Certification Form from the US Legal Forms library. The Obtain button will appear on every form you view. All previously saved forms can be accessed in the My documents section of your account.

Complete the purchase. Use a Visa or Mastercard or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Oklahoma Domestic Partnership Dependent Certification Form. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to obtain or print another copy, simply navigate to the My documents section and click on the form you wish to access. Gain access to the Oklahoma Domestic Partnership Dependent Certification Form with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are some basic steps to get you started.

- Ensure you have selected the correct form for your locality/region.

- Click the Review option to examine the content of the form.

- Read the description of the form to make sure you have chosen the correct one.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

If you determine you and your partner are eligible to file a Declaration of Domestic Partnership, you can complete the Declaration of Domestic Partnership Form DP-1 or Confidential Declaration of Domestic Partnership Form DP-1A online, print it and have your signatures notarized.

Under specific circumstances, one partner in an unmarried couple can claim a cohabiting partner as a dependent and qualify for a tax break. The IRS defines dependents as either close relatives or unrelated persons who live in the taxpayer's household as the principal place of abode and are supported by the taxpayer.

1. Spouse, as defined by Oklahoma State Law (common-law spouses may be accepted but not same sex or domestic partners).

Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

You can claim someone as a dependent on your tax return if, according to IRS rules, they are a qualifying relative - boyfriend/girlfriend, sibling, etc. - or a qualifying child dependent. A Qualifying Relative is a person who meets the IRS requirements to be your dependent for tax purposes.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.