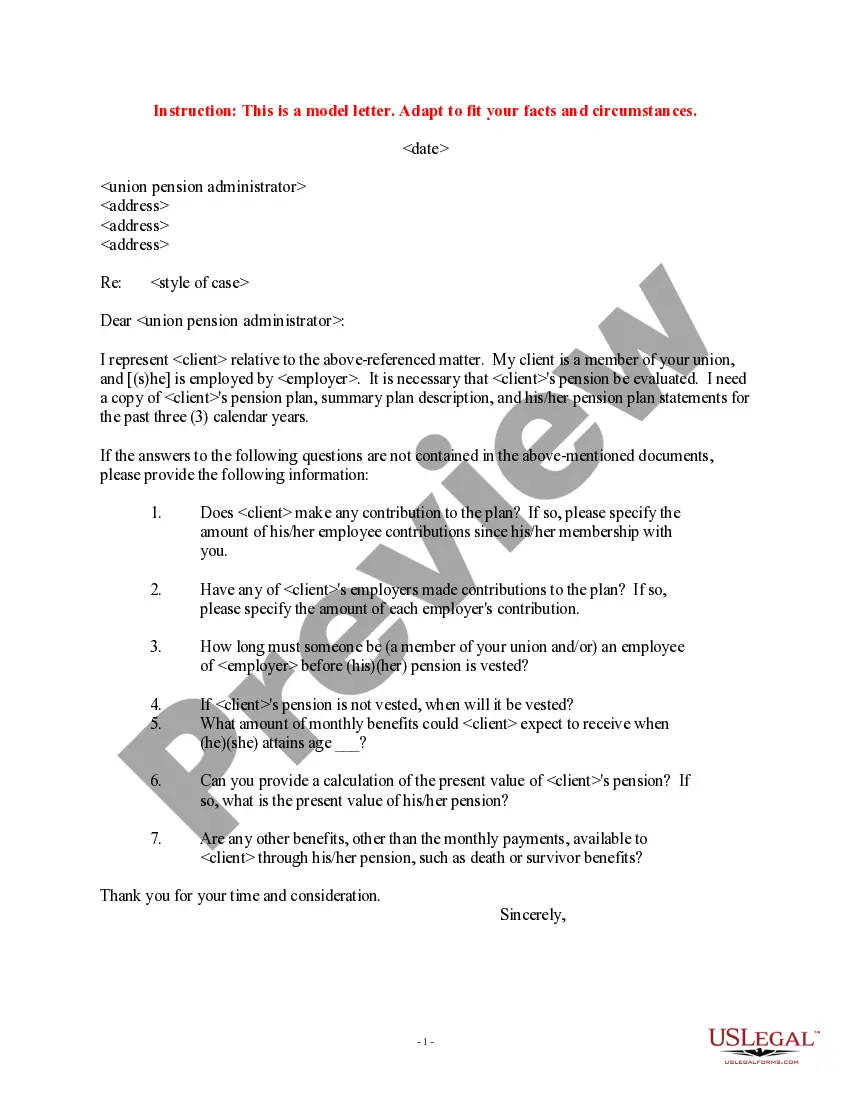

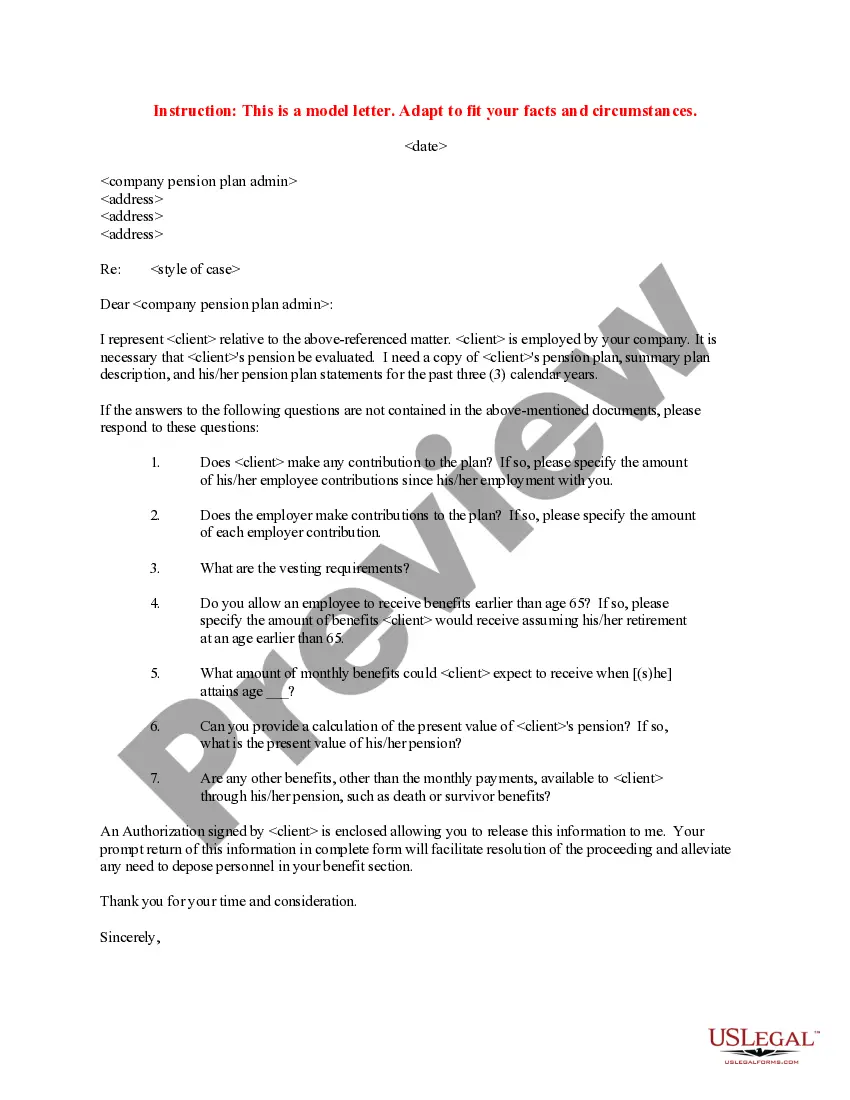

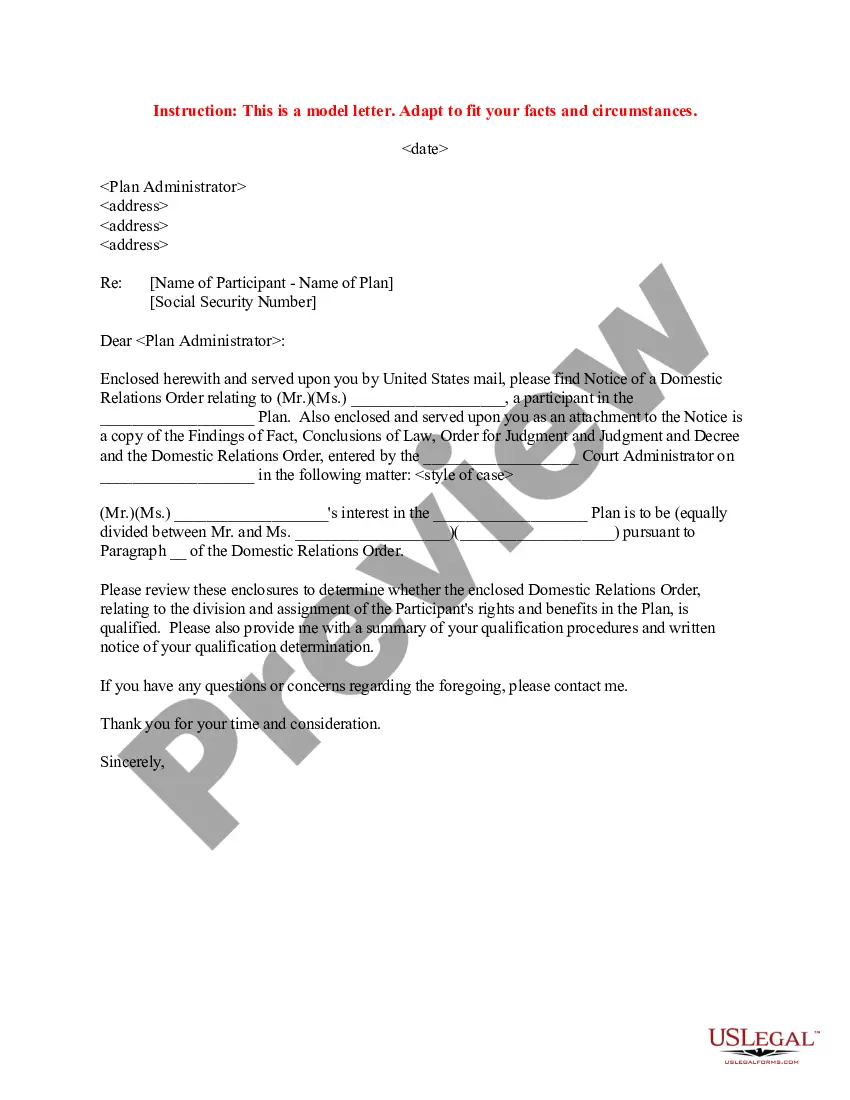

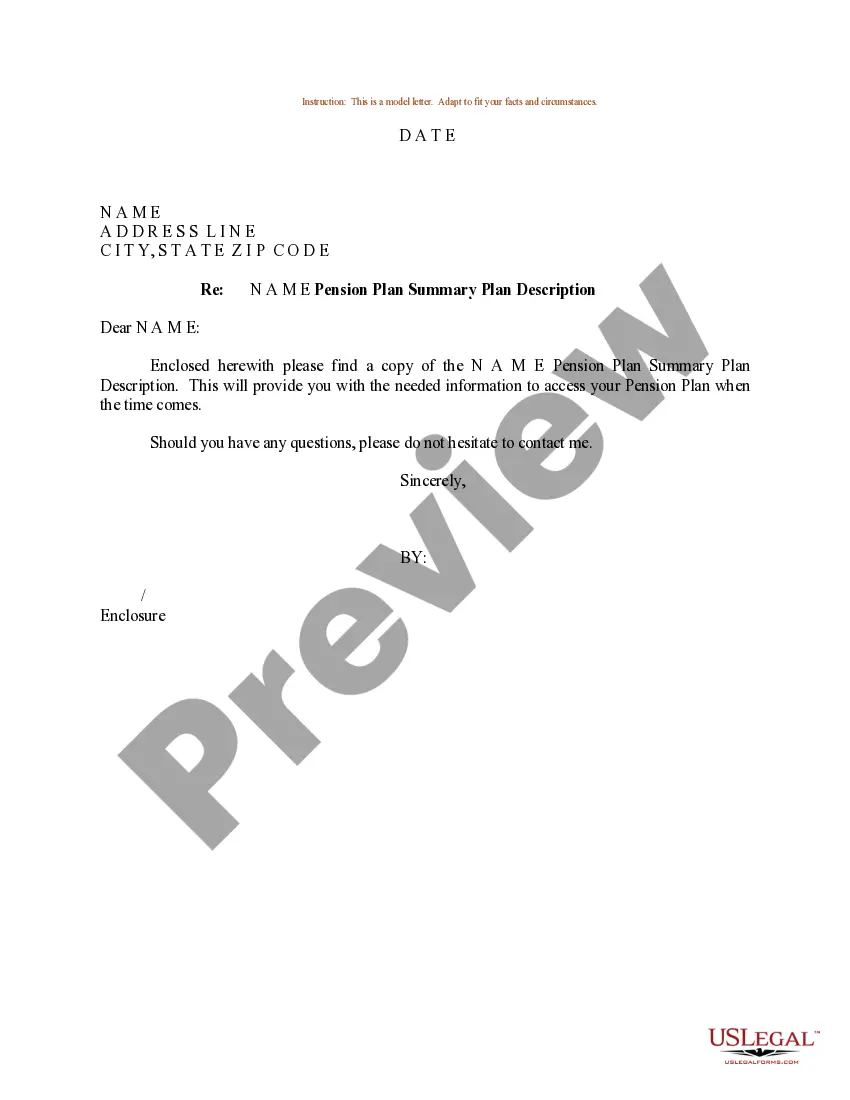

Oklahoma Sample Letter for Pension Plan Summary Plan Description

Description

How to fill out Sample Letter For Pension Plan Summary Plan Description?

If you have to complete, obtain, or produce legitimate record layouts, use US Legal Forms, the largest selection of legitimate forms, that can be found on the web. Use the site`s simple and practical lookup to discover the files you will need. Different layouts for organization and individual functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to discover the Oklahoma Sample Letter for Pension Plan Summary Plan Description in just a few mouse clicks.

In case you are presently a US Legal Forms client, log in to the profile and then click the Down load switch to have the Oklahoma Sample Letter for Pension Plan Summary Plan Description. You may also access forms you previously acquired from the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your appropriate metropolis/country.

- Step 2. Use the Preview method to examine the form`s content. Never forget to learn the description.

- Step 3. In case you are not happy using the develop, use the Lookup field towards the top of the display to get other types in the legitimate develop web template.

- Step 4. When you have identified the shape you will need, select the Buy now switch. Choose the rates plan you choose and include your qualifications to sign up to have an profile.

- Step 5. Process the transaction. You may use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Select the structure in the legitimate develop and obtain it on your gadget.

- Step 7. Full, modify and produce or indicator the Oklahoma Sample Letter for Pension Plan Summary Plan Description.

Every legitimate record web template you buy is yours for a long time. You may have acces to every single develop you acquired with your acccount. Click on the My Forms portion and choose a develop to produce or obtain yet again.

Compete and obtain, and produce the Oklahoma Sample Letter for Pension Plan Summary Plan Description with US Legal Forms. There are millions of skilled and status-distinct forms you can use for your organization or individual requirements.

Form popularity

FAQ

Median Pension Benefit In 2022, one out of three older adults received income from private company or union pension plans, federal, state, or local government pension plans, or Railroad Retirement, military or veterans pensions. The median private pension benefit of individuals age 65 and older was $11,040 a year.

The Oklahoma Teachers' Retirement System offers a tax-deferred installment plan for the purchase of years of service for OTRS. Perhaps you withdrew years of service in the past and would now like to make catch-up contributions for retirement.

The Oklahoma Public Employees Retirement System (OPERS) administers retirement plans for several different types of Oklahoma state and local government employees. The primary plan is a defined benefit retirement plan.

A pension plan is an employee benefit plan established or maintained by an employer or by an employee organization (such as a union), or both, that provides retirement income or defers income until termination of covered employment or beyond.

A pension plan is funded and controlled by the employer, while a 401(k) is primarily funded by the employee, who may choose how the money is invested. Some employers will match a portion of your 401(k) contributions.

As an example, a pension plan might pay 1% for each year of the person's service times their average salary for the final five years of employment. 2 So an employee with 35 years of service at that company and an average final-years salary of $50,000 would receive $17,500 a year.

Pathfinder is composed of a 401(a) Plan for mandatory and matching contributions and a 457(b) Plan for additional voluntary contributions. With each paycheck you make a mandatory contribution of 4.5% of your pretax salary to the 401(a) Plan. Your employer also contributes 6% of your pretax salary into the plan.

A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the organization. The employee receives regular payments in retirement. Pensions differ from 401(k)s, though both are employer-sponsored retirement plans.