Oklahoma Worksheet - Self-Assessment

Description

How to fill out Worksheet - Self-Assessment?

Are you facing a scenario where you require documentation for both business and personal purposes nearly all the time? There are numerous legal document templates available online, but finding reliable options can be challenging.

US Legal Forms provides thousands of template forms, including the Oklahoma Worksheet - Self-Assessment, which are designed to fulfill federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can obtain the Oklahoma Worksheet - Self-Assessment template.

- Locate the form you need and confirm it is for the correct region/county.

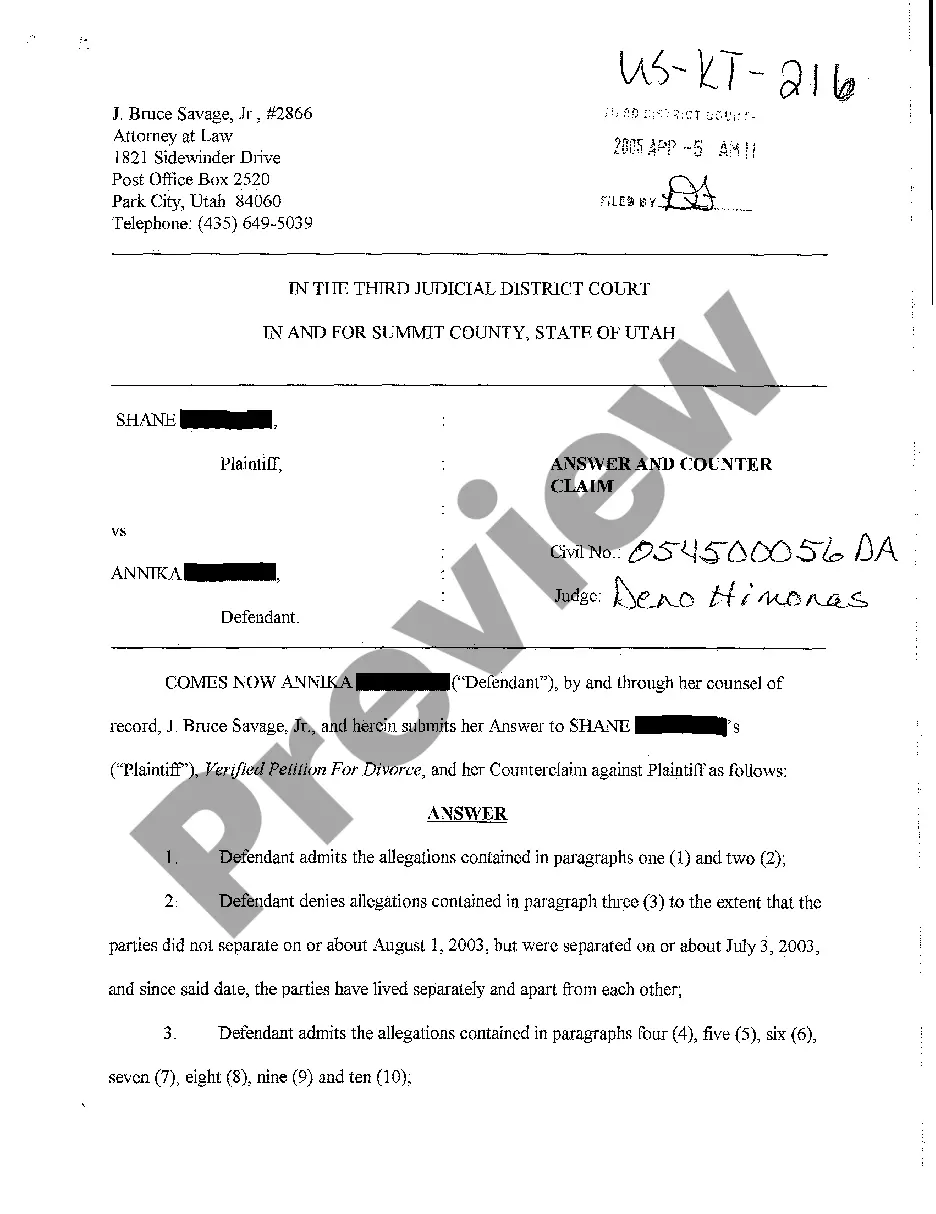

- Use the Review button to examine the document.

- Read the description to ensure you have selected the right form.

- If the document is not what you're looking for, utilize the Search field to find the form that suits your needs and specifications.

- Once you find the right form, click on Buy now.

- Select the pricing plan you wish to choose, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

assessment worksheet is a structured document that helps you analyze your personal financial situation, including income, deductions, and credits. This worksheet guides you through calculating your tax liability and provides a roadmap for submitting your tax returns accurately. The Oklahoma Worksheet SelfAssessment serves this purpose effectively by organizing critical information in an easytounderstand format.

If you earned less than $1,000, you may not be required to file a tax return depending on your total income, age, and specific circumstances. However, filing might still be beneficial if you are eligible for certain tax credits or refunds. The Oklahoma Worksheet - Self-Assessment from UsLegalForms can help you determine your need to file and guide you through the decision-making process.