Oklahoma Location Worksheet

Description

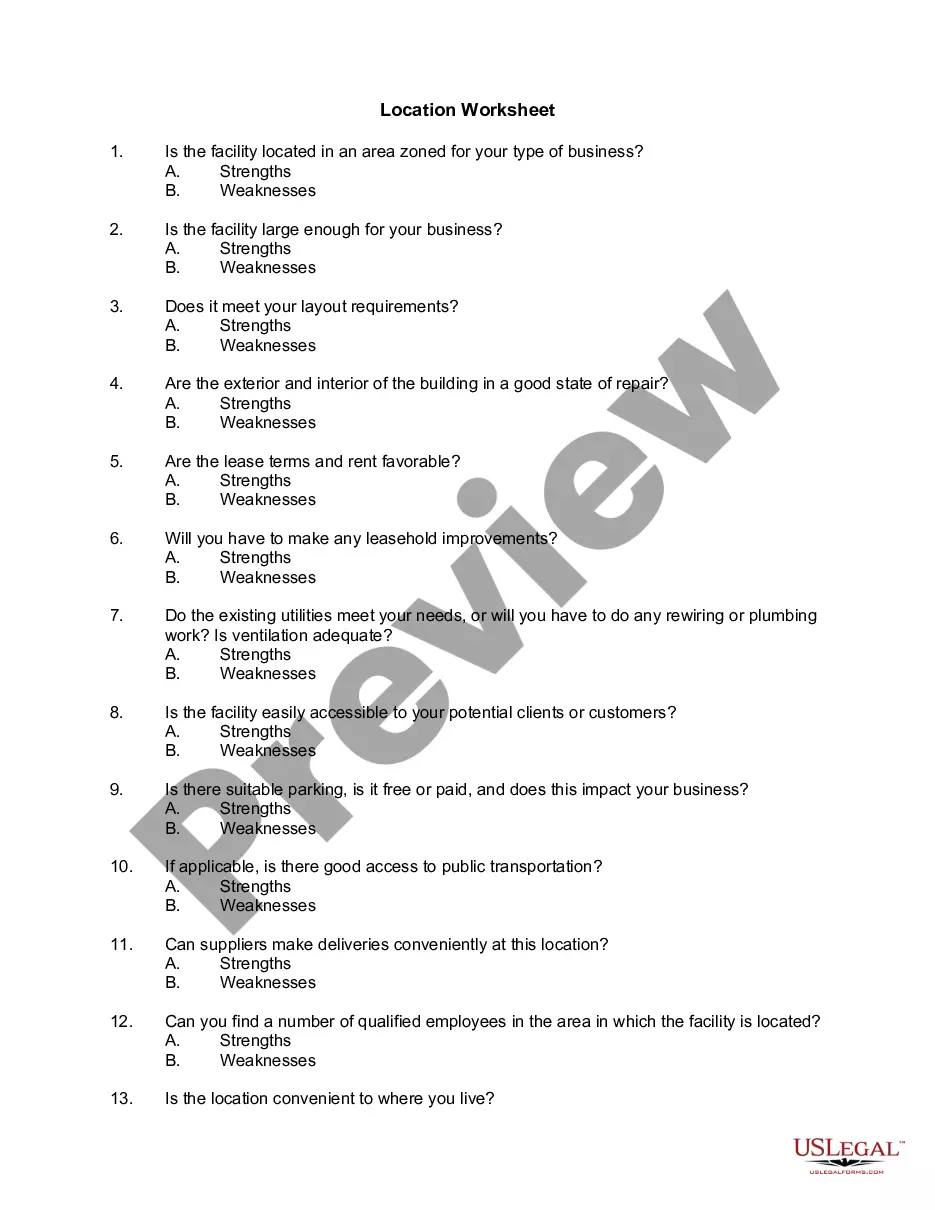

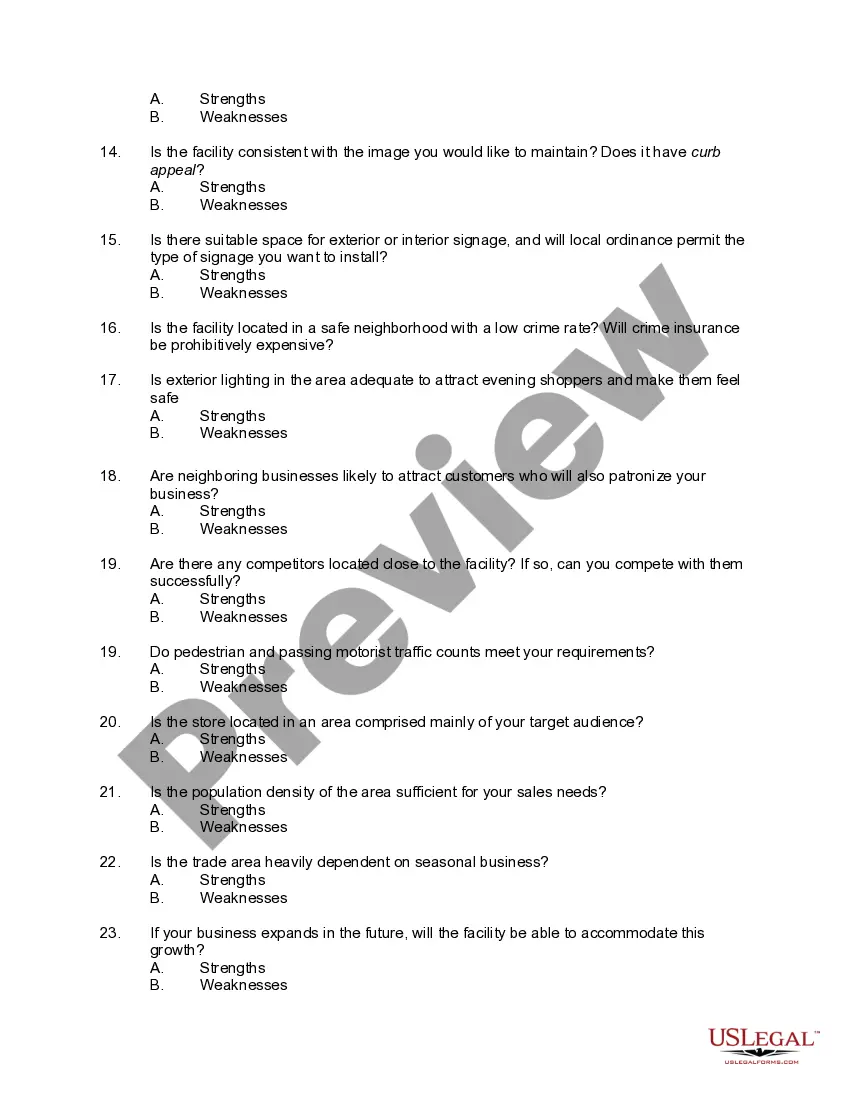

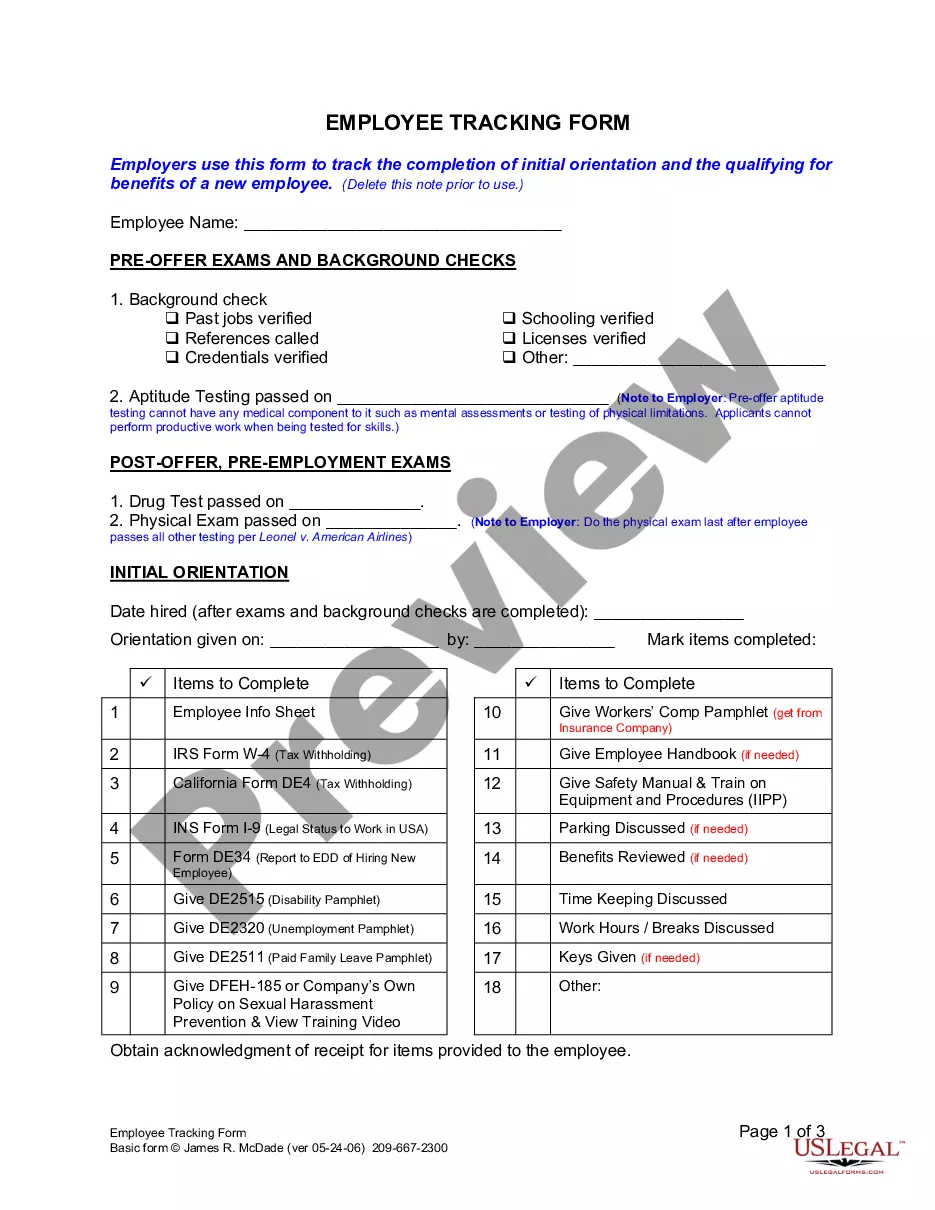

How to fill out Location Worksheet?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal form templates that you can download or print.

By using the website, you can discover numerous forms for both business and personal purposes, categorized by types, states, or keywords. You can obtain the latest documents like the Oklahoma Location Worksheet in just a few minutes.

If you currently maintain a monthly subscription, Log In to download the Oklahoma Location Worksheet from the US Legal Forms collection. The Download button will appear on every form you view. You will have access to all forms previously acquired in the My documents section of your account.

Choose the format and download the form to your device.

Make modifications. Fill out, edit, and print and sign the downloaded Oklahoma Location Worksheet. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply visit the My documents section and click on the form you desire.

- If you're using US Legal Forms for the first time, here are some simple steps to help you begin.

- Ensure you have chosen the correct form for your city/state.

- Click the Review button to examine the form's contents. Read the form description to ensure you have selected the right one.

- If the form does not meet your needs, utilize the Search area at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Next, choose the pricing plan you prefer and enter your details to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Oklahoma capital gains tax is generally taxed at the state’s income tax rates, which range depending on your income bracket. As of now, it can go up to 5%. By accurately completing the Oklahoma Location Worksheet, you can strategically manage your assets and navigate through potential tax liabilities effectively.

When filing your Oklahoma state taxes, send your completed forms to the Oklahoma Tax Commission at the designated address provided in your forms. Ensure you check for any specific instructions related to your filing status or the type of form you are submitting. Utilizing the Oklahoma Location Worksheet allows you to organize your tax documentation and streamline the filing process.

One simple strategy to avoid capital gains tax on real estate is to use a 1031 exchange, which allows you to defer taxes by reinvesting proceeds into a similar property. This approach not only preserves your capital but also enhances your investment portfolio. Employing the Oklahoma Location Worksheet can assist you in identifying properties eligible for such exchanges and maximizing your benefits.

To qualify for the Oklahoma capital gain deduction, you must sell a capital asset and reinvest the proceeds into specific qualifying assets. This often includes real property or certain types of investments that benefit the local economy. Using the Oklahoma Location Worksheet can help you track your investments and determine your eligibility for this valuable deduction.

In Oklahoma, net operating losses (NOL) can be limited to 80% of taxable income. Understanding how this rule applies requires careful planning, and using the Oklahoma Location Worksheet can streamline your calculations. It's vital to keep track of your income and expenses to determine your NOL effectively. For specific guidance on managing your NOL, consider exploring the resources available on the uslegalforms platform.

To avoid Oklahoma capital gains tax on real estate, you may consider a 1031 exchange, which allows you to defer taxes by reinvesting the proceeds. Utilizing the Oklahoma Location Worksheet can help you understand the nuances of your property transactions. Additionally, seeking advice from a tax professional can provide personalized strategies to minimize your tax burden. The uslegalforms platform offers numerous resources to assist you in navigating these complexities.

Yes, you generally need to file an Oklahoma tax return if you earn income in the state. The Oklahoma Location Worksheet can help you determine your residency status and calculate your tax obligations. It's crucial to stay compliant with state tax laws, so reviewing your situation will provide clarity. Consider using resources like the uslegalforms platform for accurate guidance on tax filing.