Oklahoma Invoice Template for Self Employed

Description

How to fill out Invoice Template For Self Employed?

If you need to finalize, obtain, or create legal document templates, rely on US Legal Forms, the largest collection of legal forms, accessible online.

Utilize the site’s simple and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select your preferred payment plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to get the Oklahoma Invoice Template for Self Employed in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to retrieve the Oklahoma Invoice Template for Self Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

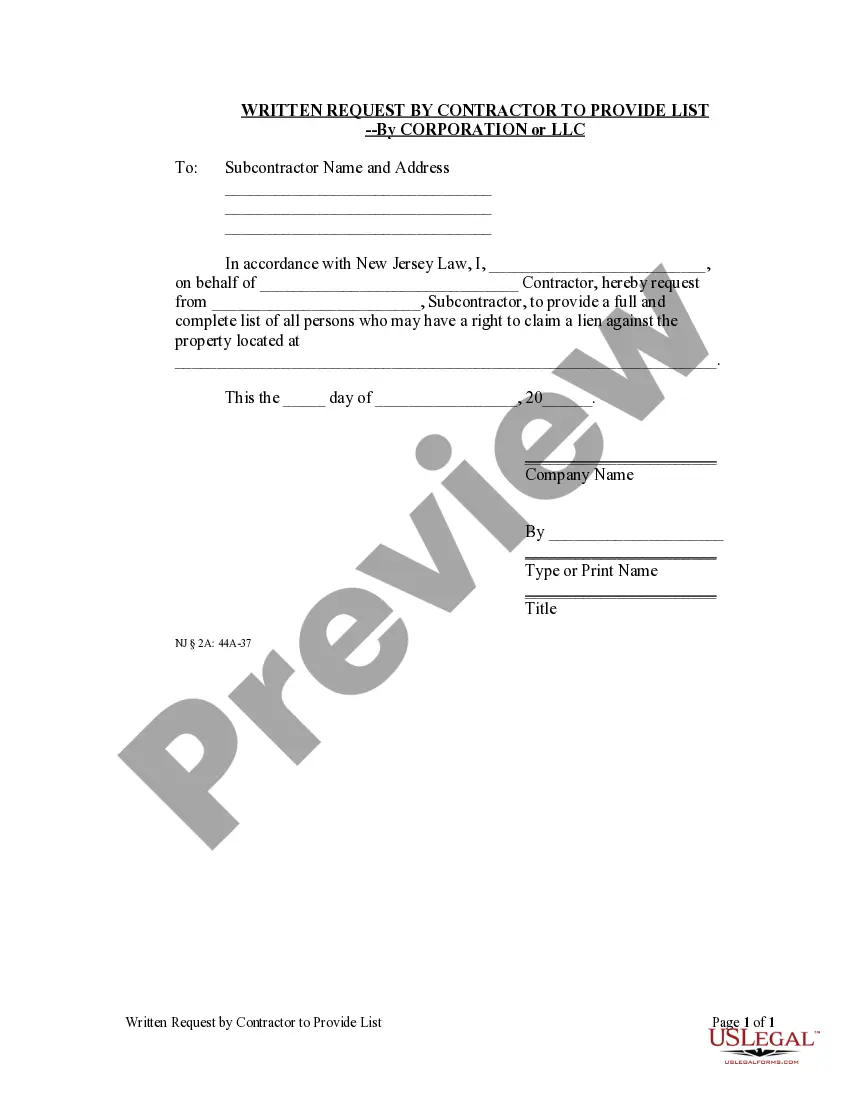

- Step 2. Use the Preview option to review the form’s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

Filling out an invoice template is straightforward when you follow a few basic steps. Start by including your name, contact information, and the client’s details at the top. The Oklahoma Invoice Template for Self Employed guides you in specifying the services rendered, their description, and the respective costs. Finally, include payment terms and any due dates to ensure that everything is clear for both you and your client.

Yes, you can create an invoice without forming an LLC. An Oklahoma Invoice Template for Self Employed allows you to bill clients efficiently, even if you operate as a sole proprietor. You simply need to include your business information, the services you provided, and any payment terms. Using a template makes this process simple and ensures professionalism in your invoicing.

To create a self-employed invoice, include your business name, contact information, client details, a breakdown of services rendered, and total payment due. Using a template can greatly streamline this process. The Oklahoma Invoice Template for Self Employed is designed to make invoice creation quick, easy, and professional.

To send a self-employed invoice, create a clear and detailed document listing your services and payment terms. You can utilize email or business management software for delivery. The Oklahoma Invoice Template for Self Employed can help you present your invoices professionally and ensure you cover all necessary information.

Yes, you need receipts for self-employment expenses, especially for amounts over $75, to substantiate your claims during tax filing. Keeping organized documentation improves the accuracy of your records. The Oklahoma Invoice Template for Self Employed can assist in tracking your expenses alongside your income efficiently.

To submit an invoice to an independent contractor, create a clear and professional document that outlines the work completed and total payment due. Sending it via email or a designated invoicing system is standard practice. Leverage the Oklahoma Invoice Template for Self Employed to streamline this process and present yourself professionally.

To make a self-invoice, start with your contact information, your client's details, a description of the services provided, and the total amount due. You can personalize this using a template, such as the Oklahoma Invoice Template for Self Employed, which simplifies the formatting and ensures you include all necessary details.

To show proof of income when self-employed, you can provide documents like tax returns, bank statements, and invoices issued from your services. Maintaining proper records of your transactions is vital, and the Oklahoma Invoice Template for Self Employed helps in this regard by offering a structured way to track your earnings.

To legally send an invoice, ensure it contains essential elements like your name, business address, invoice date, and a clear description of services rendered. You can send it electronically or by mail; just make sure to keep a copy for your records. For convenience, consider using the Oklahoma Invoice Template for Self Employed, which helps you comply with legal requirements while looking professional.

To send an invoice as an independent contractor, you should first create a detailed document that includes your services and the amount due. Once you have your invoice ready, you can send it via email or a secure online platform. Utilizing the Oklahoma Invoice Template for Self Employed can make this task straightforward and professional.