Oklahoma Franchise Feasibility Test

Description

How to fill out Franchise Feasibility Test?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Oklahoma Franchise Feasibility Test within minutes.

If you already have an account, Log In to obtain the Oklahoma Franchise Feasibility Test from the US Legal Forms library. The Download button will appear on every document you view. You have access to all previously saved documents in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the document to your device. Make edits. Complete, modify, print, and sign the downloaded Oklahoma Franchise Feasibility Test. Each template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print an additional copy, simply visit the My documents section and click on the document you need. Retrieve the Oklahoma Franchise Feasibility Test from US Legal Forms, one of the most extensive libraries of legal document templates. Access a multitude of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your city/state.

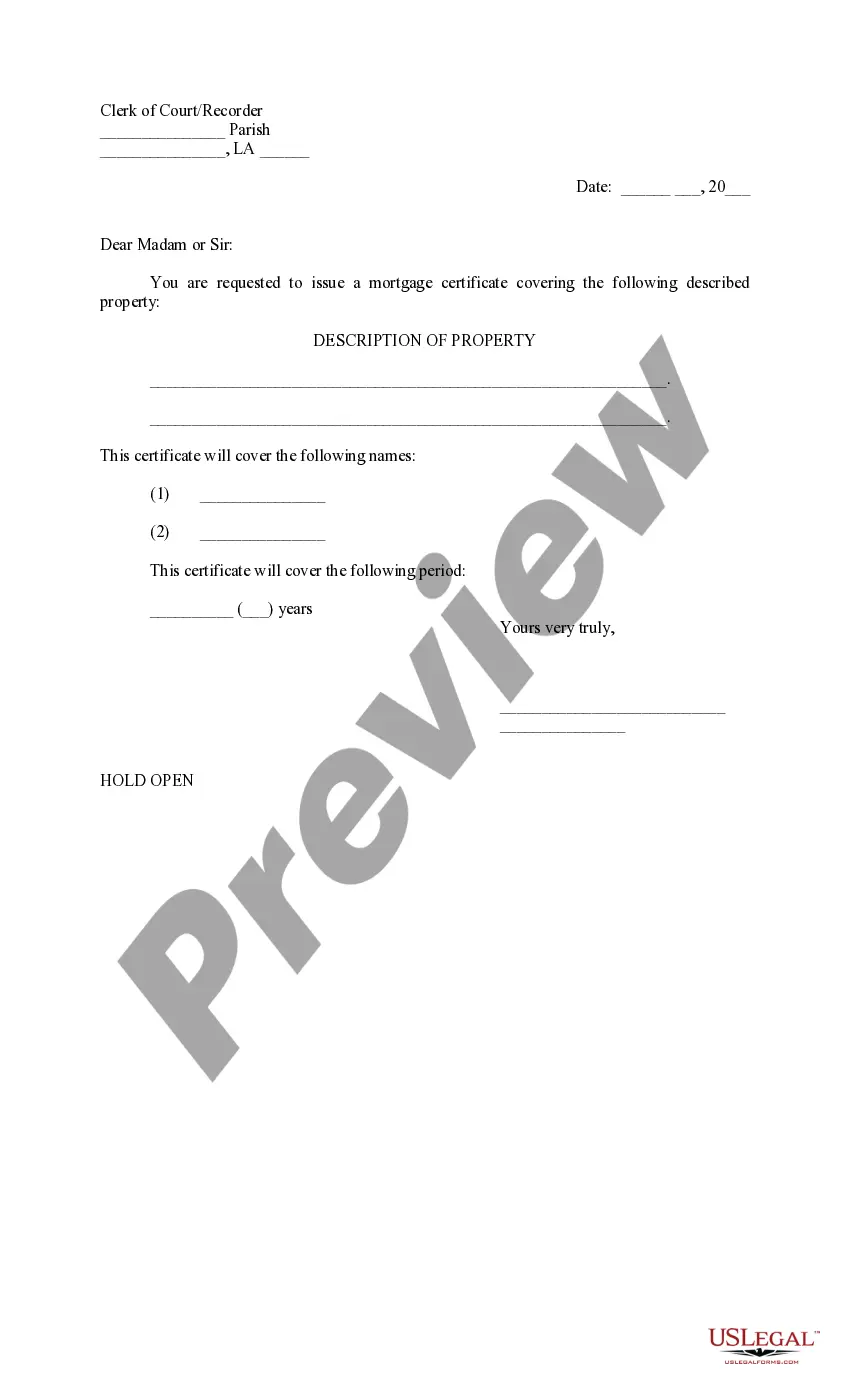

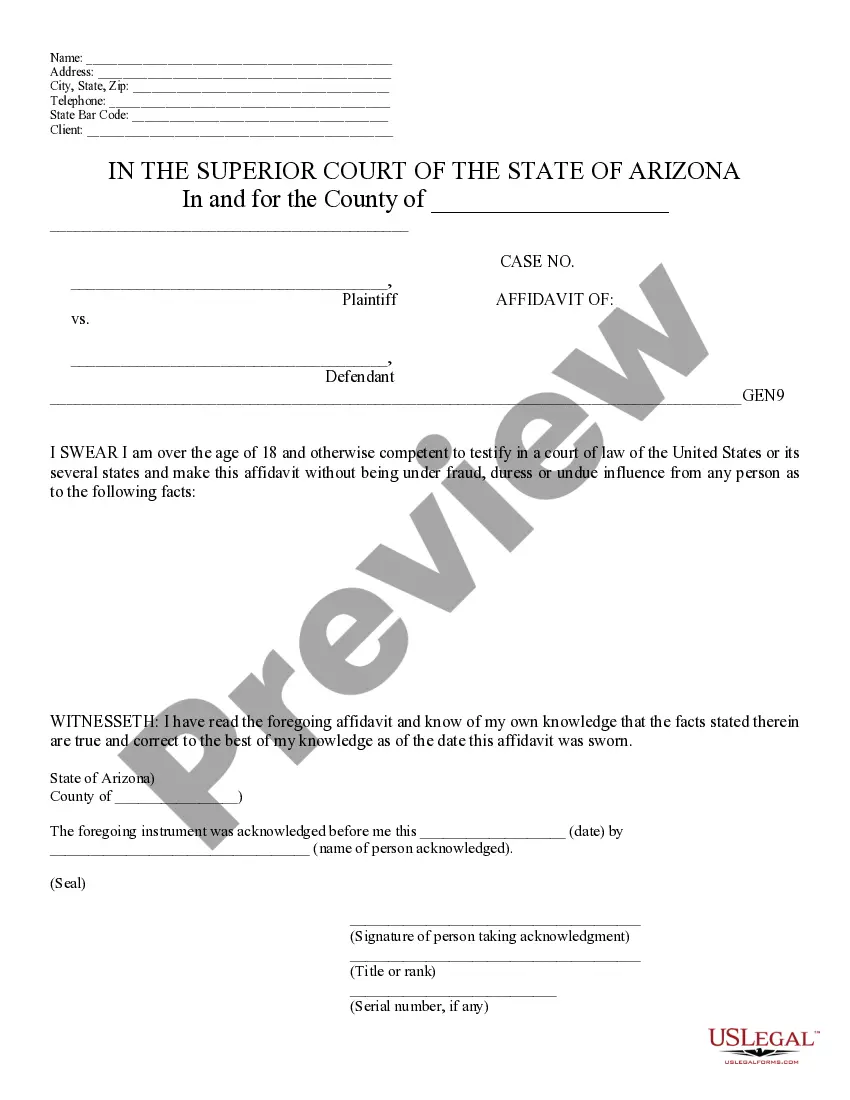

- Click on the Preview button to review the document's details.

- Check the document details to confirm that you have chosen the appropriate document.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking on the Download now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Any corporation operating in Oklahoma is required to file the Oklahoma franchise tax. This includes both domestic and foreign corporations that are doing business within the state. Understanding the Oklahoma Franchise Feasibility Test can be crucial for these entities, as it helps determine their compliance obligations. It is important to stay informed and ensure you meet all necessary filing requirements to avoid penalties.

Filing an annual report in Oklahoma involves submitting specific documents to the Oklahoma Secretary of State. This process is crucial for maintaining good standing with the state and flourishing in your Oklahoma Franchise Feasibility Test. You can easily file your report online or by mail, following the guidelines provided on the official website. Uslegalforms offers templates and assistance, making it simpler for you to complete this essential task accurately and efficiently.

The Oklahoma franchise tax has been repealed for most businesses, which can significantly influence your business strategy during the Oklahoma Franchise Feasibility Test. However, certain entities may still have tax responsibilities that you need to consider. It's essential to stay updated on the latest regulations to ensure compliance. With Uslegalforms, you can find detailed information and tools to help you understand your obligations and plan effectively.

You can mail your Oklahoma 512, which is the income tax return for partnerships, to the Oklahoma Tax Commission. Ensure that you send it to the correct office address to avoid any delays, especially when conducting your Oklahoma Franchise Feasibility Test. Additionally, consider using Uslegalforms to access the necessary mailing information and to find resources that streamline your filing process. Proper submission ensures compliance and fosters business growth.

The PTE tax, or Pass-Through Entity tax, in Oklahoma affects various business structures such as partnerships and S corporations. Understanding this tax is vital when considering your obligations in the state, particularly when evaluating your Oklahoma Franchise Feasibility Test. By complying with tax regulations, you can make informed decisions about your business's financial health. Uslegalforms can provide you with necessary forms and guidance, helping you navigate this aspect with confidence.

Yes, Oklahoma imposes an 80% limitation on the usage of Net Operating Losses. This means that businesses can only use NOLs to offset 80% of their taxable income. Understanding this limitation is vital when engaging in the Oklahoma Franchise Feasibility Test, as it can influence how companies forecast their tax obligations and financial strategies. Consider utilizing tools like US Legal Forms to navigate these regulations seamlessly.

The 80% NOL rule in Oklahoma began in the early 1990s, allowing companies to use losses to offset up to 80% of their taxable income. This regulation was designed to enhance the business environment by providing financial relief during challenging times. For those undergoing the Oklahoma Franchise Feasibility Test, understanding this rule is essential for effective financial planning and strategy. Knowing the historical context can help in projecting future revenue outcomes.

In Oklahoma, the franchise tax applies to businesses with a revenue threshold above a specified limit. The Oklahoma Franchise Feasibility Test considers this tax essential, as it helps business owners determine their financial obligations. Compliance with franchise tax regulations ensures operational integrity while measuring the long-term viability of a business model. Make sure to assess this aspect properly to avoid unexpected liabilities.

The Net Operating Loss (NOL) limit in Oklahoma is important for businesses when evaluating their financial strategies. For the Oklahoma Franchise Feasibility Test, understand that companies can carry forward NOLs for up to 5 years. This helps businesses offset future taxable income, providing relief and financial flexibility. Accessing this benefit is crucial for any entity aiming to thrive in Oklahoma.

To calculate the Oklahoma franchise tax, you typically take your total gross assets and apply the tax rate as defined by the state. Since the franchise tax has been eliminated, understanding the historical calculations can be helpful for newer businesses performing the Oklahoma Franchise Feasibility Test. Familiarizing yourself with these computations can guide you through various financial scenarios. For further assistance, explore the tools available on uslegalforms.