Oklahoma Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons

Description

How to fill out Letter To Foreclosure Attorney - General Demand To Stop Foreclosure And Reasons?

Are you in the place that you need to have documents for sometimes enterprise or individual uses nearly every day? There are plenty of authorized record web templates available on the Internet, but locating types you can depend on isn`t effortless. US Legal Forms delivers a huge number of develop web templates, such as the Oklahoma Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons, which are written to fulfill state and federal specifications.

In case you are presently acquainted with US Legal Forms website and have a merchant account, simply log in. Next, you may download the Oklahoma Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons template.

Unless you come with an accounts and wish to start using US Legal Forms, follow these steps:

- Find the develop you need and make sure it is to the correct area/area.

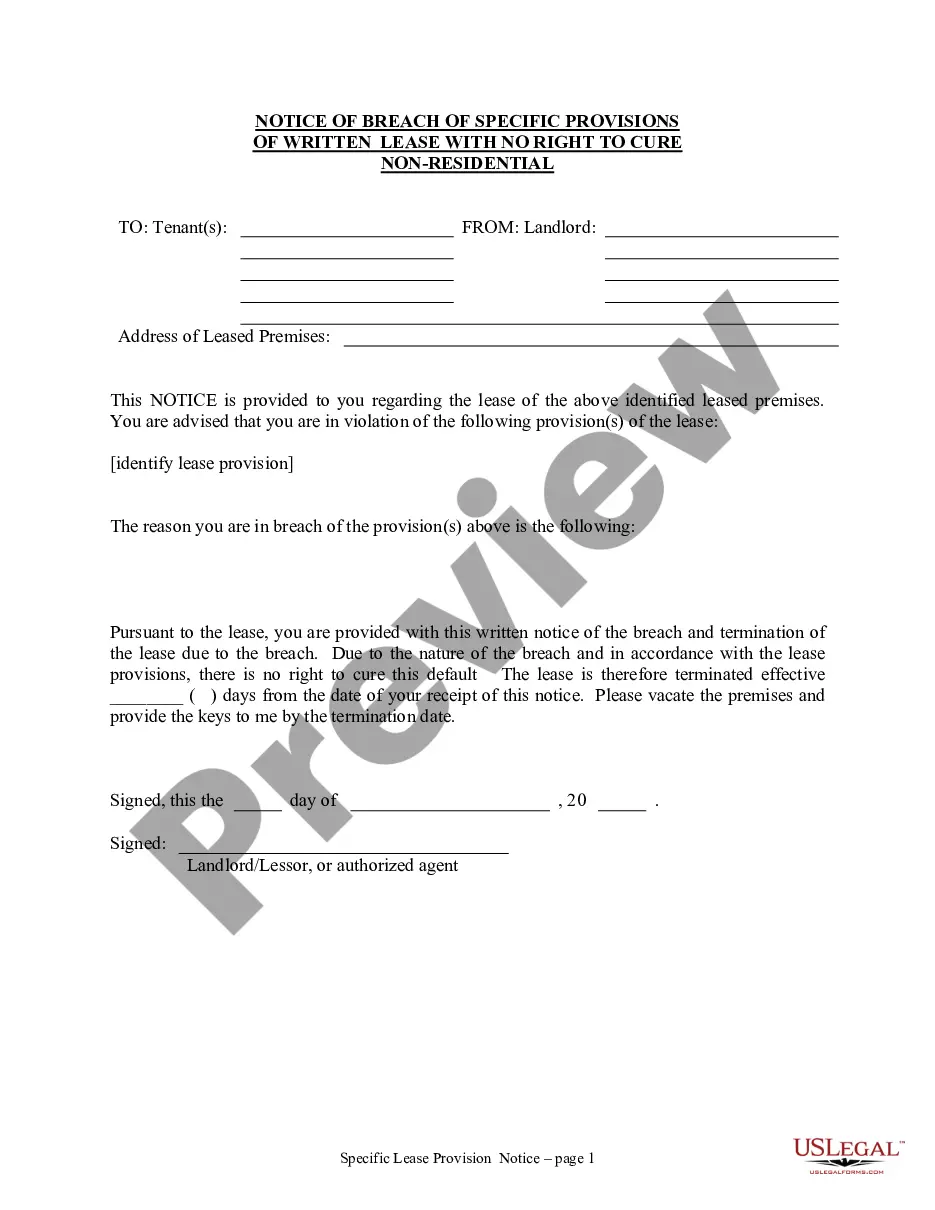

- Utilize the Review button to check the shape.

- See the information to ensure that you have selected the right develop.

- In the event the develop isn`t what you are trying to find, use the Lookup field to obtain the develop that suits you and specifications.

- If you get the correct develop, just click Get now.

- Choose the costs program you desire, fill in the required information to create your bank account, and pay money for the transaction utilizing your PayPal or charge card.

- Select a hassle-free data file formatting and download your duplicate.

Locate each of the record web templates you possess purchased in the My Forms menus. You may get a further duplicate of Oklahoma Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons at any time, if necessary. Just click on the essential develop to download or printing the record template.

Use US Legal Forms, the most substantial assortment of authorized varieties, in order to save time and avoid errors. The service delivers skillfully manufactured authorized record web templates which you can use for a variety of uses. Produce a merchant account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

How Can I Stop a Foreclosure in Oklahoma? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale (or for a short period after the sale), or filing for bankruptcy.

You may redeem this property from the mortgage company by paying off the entire amount due plus the costs and fees incurred. You retain this "right to redeem" the property until the Sheriff's sale is confirmed by the court.

A ?deed in lieu of foreclosure? is another type of loss mitigation where the mortgage servicer agrees to take a deed from you in full satisfaction of the mortgage debt.

Based on information compiled by the National Consumer Law Center (NCLC), at least 10 states can be generally classified as non-recourse for residential mortgages: Alaska, Arizona, California, Hawaii, Minnesota, Montana, North Dakota, Oklahoma, Oregon, and Washington.

The Foreclosure Process ? Power of Sale Clause The notice gives the borrower 35 days to cure the default and bring the mortgage current. If the borrower has been in default three time in the last 24 months or four times in 24 for a homestead, no other notice has to be given before the lender proceeds to the sale.