Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

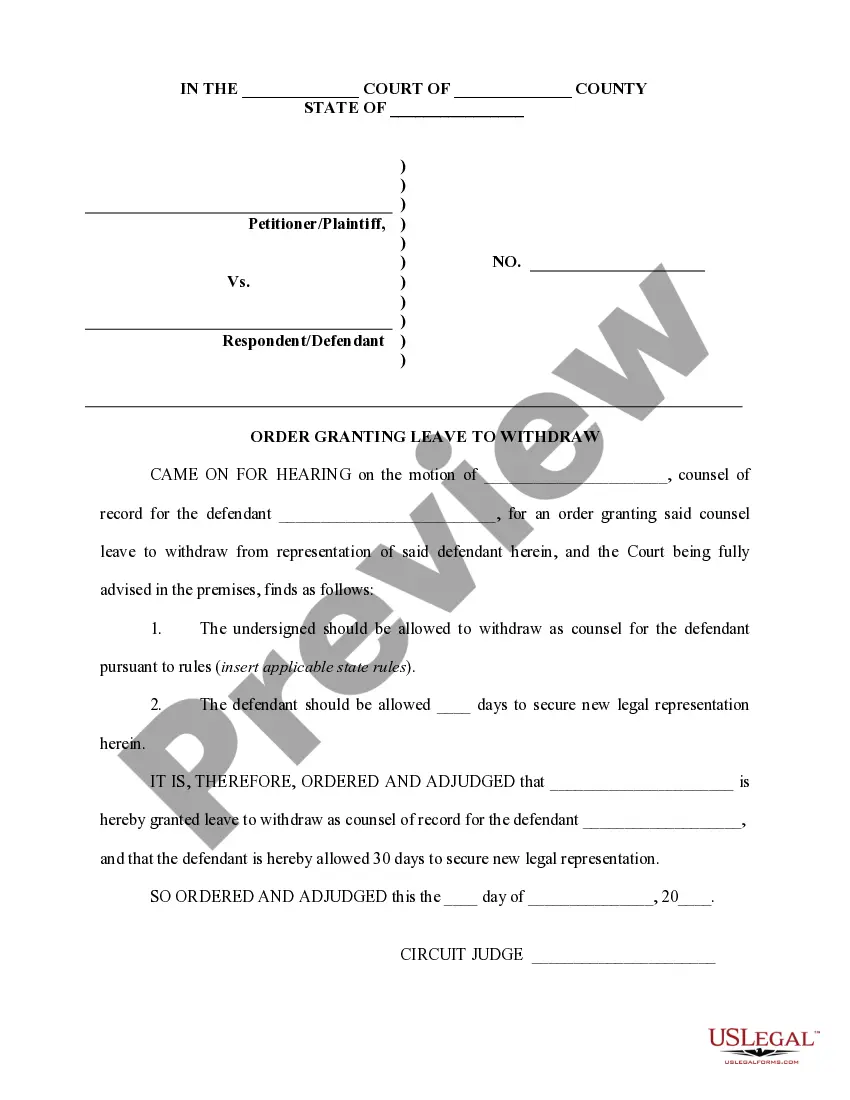

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Selecting the ideal approved document template can be challenging.

Of course, there is a multitude of templates accessible online, but how do you find the legal document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home, suitable for both business and personal purposes.

You can preview the form using the Preview button and review the form description to confirm it is the right one for you.

- All the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click the Download button to obtain the Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home.

- Use your account to browse the legal documents you have previously ordered.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

It is recommended that the security agreement include a provision giving the creditor a right to enter on the debtor's premises and retake the collateral in the event of default. Second, the creditor can file a claim & delivery lawsuit and have a court order the property be turned over to the creditor.

The mortgage or deed of trust is the document that pledges the property as security for the debt and permits a lender to foreclosure if you fail to make the monthly payments. The promissory note is the IOU that contains the promise to repay the loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

Hypothecation occurs when an asset is pledged as collateral to secure a loan. The owner of the asset does not give up title, possession, or ownership rights, such as income generated by the asset.

A deed of trust is used to secure a loan on real property. Learn how this legal document can be an easy way for a lender to collateralize a loan.