In most states a certificate or memorandum of a trust agreement which conveys or entrusts an interest in real property may be recorded with the land records clerk of the appropriate county in lieu of the entire trust agreement. The certificate must be executed by the trustee and it must contain the following: (a) the name of the trust; (b) the street and mailing address of the office, and the name and street and mailing address of the trustee; (c) the name and street and mailing address of the trustor or grantor; (d) a legally sufficient description of all interests in real property owned by or conveyed to the trust; (e) the anticipated date of termination of the trust; and (f) the general powers granted to the trustee.

Oklahoma Certificate or Memorandum of Trust Agreement

Description

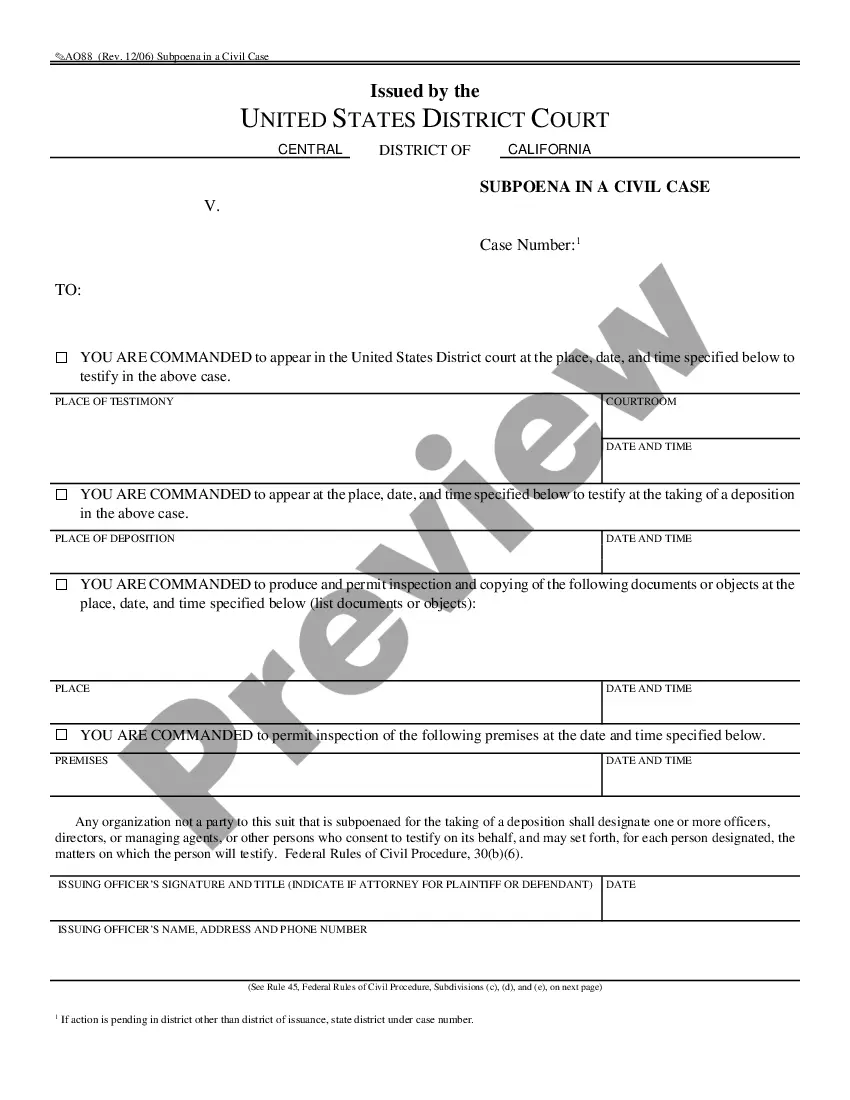

How to fill out Certificate Or Memorandum Of Trust Agreement?

Choosing the right legal document template could be a battle. Of course, there are tons of layouts accessible on the Internet, but how would you find the legal form you need? Make use of the US Legal Forms site. The service gives thousands of layouts, such as the Oklahoma Certificate or Memorandum of Trust Agreement, which can be used for organization and private requirements. All the forms are inspected by experts and meet federal and state needs.

Should you be currently listed, log in to the accounts and click on the Obtain option to obtain the Oklahoma Certificate or Memorandum of Trust Agreement. Make use of accounts to check through the legal forms you possess bought earlier. Go to the My Forms tab of your accounts and have an additional version from the document you need.

Should you be a new end user of US Legal Forms, listed below are simple guidelines for you to follow:

- Initial, be sure you have selected the proper form for your town/state. You may check out the form while using Review option and look at the form outline to ensure this is basically the best for you.

- If the form is not going to meet your requirements, take advantage of the Seach industry to find the right form.

- Once you are certain that the form would work, go through the Buy now option to obtain the form.

- Choose the prices plan you would like and enter the needed info. Make your accounts and pay for your order making use of your PayPal accounts or credit card.

- Choose the submit structure and obtain the legal document template to the gadget.

- Total, modify and print out and indicator the acquired Oklahoma Certificate or Memorandum of Trust Agreement.

US Legal Forms is definitely the most significant library of legal forms that you can find various document layouts. Make use of the company to obtain professionally-created files that follow express needs.

Form popularity

FAQ

Complexity and Cost Establishing and maintaining a trust can be complex and expensive. Trusts require legal expertise to draft, and ongoing management by a trustee may involve administrative fees. Additionally, some trusts require regular tax filings, adding to the overall cost.

Beneficiaries have a right to receive all beneficial interests in an estate, such as property, money, stocks, and bonds. The executor of the estate must make sure all beneficiaries receive their full share of the estate.

The customary security instrument utilized in Oklahoma is the Mortgage. Every Deed of Trust on real property, intended as a security instrument, shall be subject to all statutory provisions and laws relating to mortgages.

Your heirs have immediate and continuous access to all the property and no reason to make all of the details of the family public in an Oklahoma probate case. The process of administering a living trust is private nothing needs to be filed publicly like with probate.

When real property is transferred or acquired in the name of the trust after the effective date of this act, the trustee shall file a memorandum of trust with the county clerk in which the real property is located.

What Assets Cannot Be Placed in a Trust? Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

The cost of creating a trust in Oklahoma varies, but a basic Revocable Living Trust generally ranges from $1,000 to $3,000. The cost may be higher for more complex trusts or if you require the assistance of an attorney. Online legal services can offer more affordable alternatives for creating trusts.

In Oklahoma, trusts are deemed to be revocable unless the document creating the trust specifically says the trust is irrevocable. An irrevocable trust will generally be required to achieve minimization of estate or income taxes.

Create the trust document with trust-building software or with the help of an attorney. Sign the document before a public notary. Transfer assets and property into the trust by changing titles from your name (and the name of your spouse for joint trusts) to the name of the trust.

When you set up a living trust in Oklahoma you are called the grantor. You set up the trust so that it can manage your assets during your life and distribute them after your death. The more assets you transfer into the trust, the more complete the benefits of the trust will be.