Oklahoma Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

You can spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can easily acquire or print the Oklahoma Sample Letter for Tax Deeds through our service.

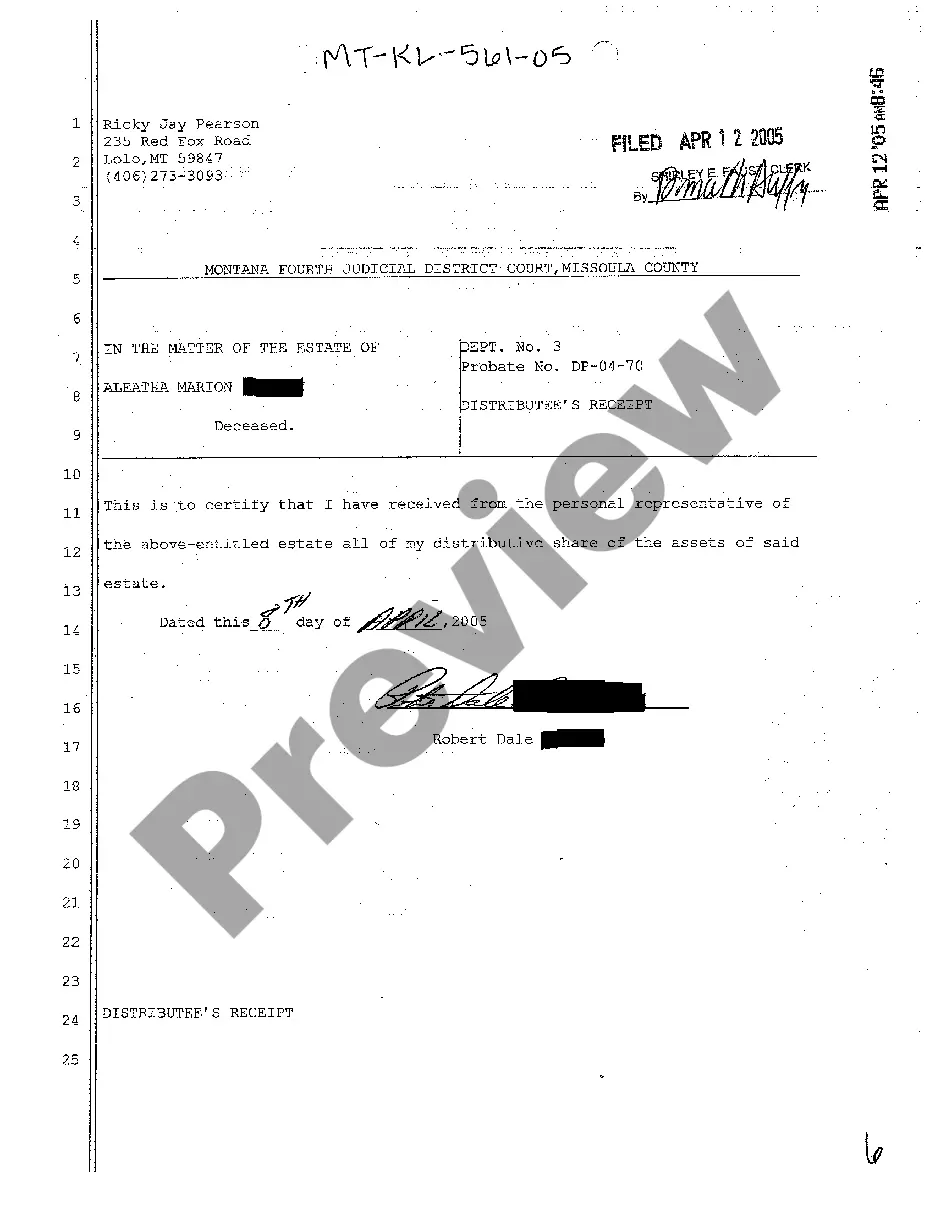

If available, use the Preview button to review the document template as well. If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you need, click Buy now to proceed. Choose the pricing plan you want, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can fill out, edit, sign, and print the Oklahoma Sample Letter for Tax Deeds. Access and print numerous document templates using the US Legal Forms site, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Oklahoma Sample Letter for Tax Deeds.

- Each legal document template you buy is yours indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your region/city of choice.

- Check the form description to confirm you have chosen the right document.

Form popularity

FAQ

All property taxes, and any applicable interest and penalties, imposed by Oklahoma and its local jurisdictions are a lien in favor of the state and the local jurisdictions upon all franchises, property, and rights to property belonging to, or subsequently acquired by, the person owing the tax.

A resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the Oklahoma return (Form 511). If another state taxes this income, the resident may qualify for this credit.

The lien of the state shall continue until the amount of the tax and penalty due and owing, and interest subsequently accruing thereon, is paid, or, except as otherwise provided herein, upon the expiration of ten (10) years after the date of the filing and indexing in the office of the county clerk in the county in ...

If your return is flagged, you will receive an Identity Protection letter asking you to complete an online verification process. You must correctly answer the questions in order to help us verify your identity.

A tax warrant that is directed to a county sheriff commands the sheriff to levy upon and sell, without any appraisement or valuation, any of the taxpayer's real or personal property within the county for the payment of the delinquent tax, plus any interest and penalties, as well as the cost of executing the warrant.

Oklahoma is a tax deed state. In a tax deed state the actual property is sold after tax foreclosure, opposed to a tax lien state where a lien is sold against the property giving the owner the right to collect the back due taxes and earn interest.

Such sales are called "tax deed sales" and are usually held at auctions. Texas holds tax foreclosure sales or tax deed sales on the first Tuesday of every month at the county, the state does not have tax lien certificate sale.