Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Oklahoma Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

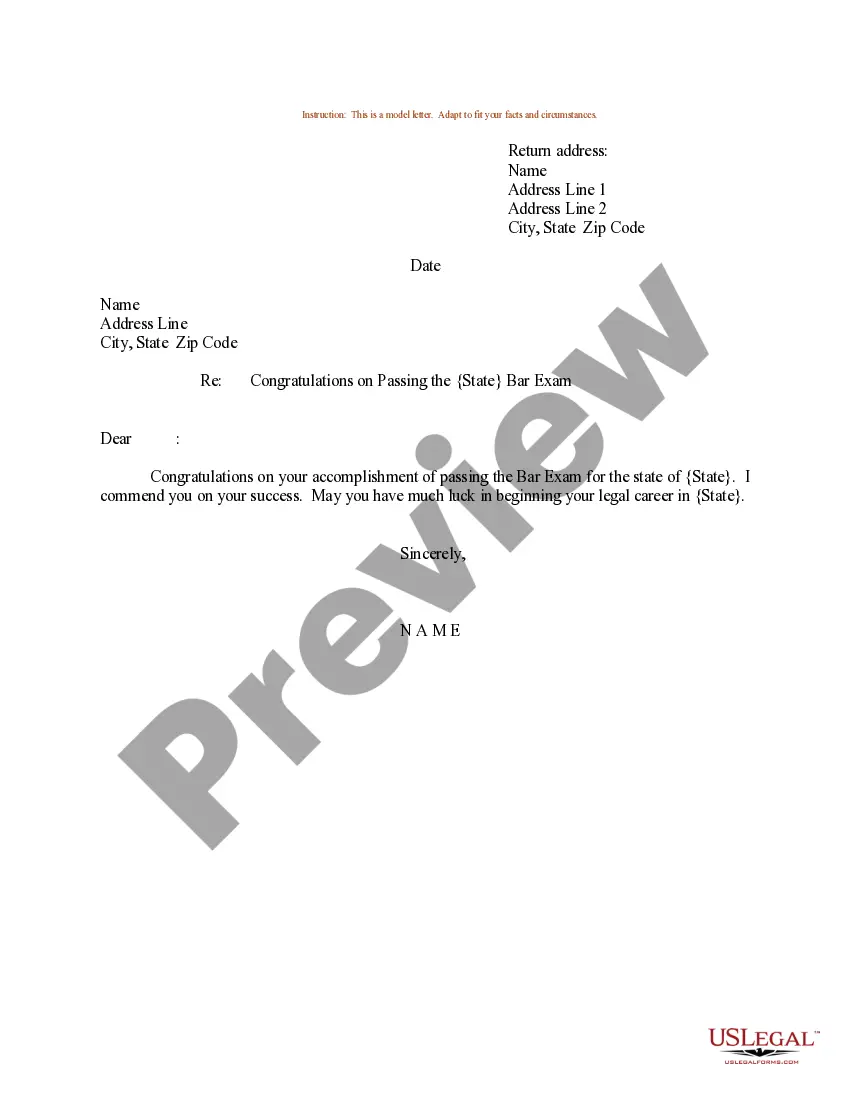

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

US Legal Forms - one of many largest libraries of legal forms in America - offers a variety of legal file layouts you may acquire or produce. While using site, you can get a large number of forms for company and specific uses, categorized by groups, says, or keywords and phrases.You will find the latest types of forms like the Oklahoma Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency within minutes.

If you already possess a subscription, log in and acquire Oklahoma Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency through the US Legal Forms catalogue. The Acquire key will appear on each form you see. You get access to all previously downloaded forms in the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed below are basic guidelines to help you started off:

- Be sure you have chosen the proper form to your area/state. Click the Review key to check the form`s articles. Read the form information to ensure that you have selected the right form.

- When the form doesn`t match your needs, make use of the Research discipline towards the top of the display screen to find the one that does.

- When you are satisfied with the form, affirm your selection by clicking the Buy now key. Then, opt for the rates strategy you want and supply your qualifications to register for the accounts.

- Procedure the purchase. Utilize your bank card or PayPal accounts to complete the purchase.

- Find the format and acquire the form on your gadget.

- Make adjustments. Load, revise and produce and sign the downloaded Oklahoma Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

Each design you included in your account does not have an expiration time and is also yours permanently. So, if you wish to acquire or produce one more version, just proceed to the My Forms portion and click on on the form you require.

Gain access to the Oklahoma Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency with US Legal Forms, one of the most comprehensive catalogue of legal file layouts. Use a large number of skilled and state-certain layouts that satisfy your company or specific needs and needs.

Form popularity

FAQ

The Fair Credit Reporting Act in Oklahoma Oklahoma House Bill 2492 provides that prior to requesting a consumer report for work, you be notified and must be given an option of a copy free of charge. Oklahoma really adds nothing with what they attempted to add with a security freeze on your credit file.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Common violations of the FCRA include: Failure to update reports after completion of bankruptcy is just one example. Agencies might also report old debts as new and report a financial account as active when it was closed by the consumer. Creditors give reporting agencies inaccurate financial information about you.

Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

Sections 623(a)(1)(A) and (a)(1)(C). If at any time a person who regularly and in the ordinary course of business furnishes information to one or more CRAs determines that the information provided is not complete or accurate, the furnisher must promptly provide complete and accurate information to the CRA.

Under what circumstance may a consumer be charged a fee for a consumer credit report provided by a CRA? Reason: A Consumer Reporting Agency (CRA) may charge a fee for a credit report when the consumer applies for a mortgage loan, but not for the other reasons listed. before 8 a.m. or after 9 p.m.

Section 1681a of the Fair Credit Reporting Act defines an ?investigative consumer report? as ?a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or ...

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

Risk-based pricing occurs when lenders offer different interest rates and loan terms to borrowers, based on individual creditworthiness. The Risk-Based Pricing Rule requires you to notify consumers if they are getting worse terms because of information in their credit report.

Section 623(a)(5): Duty of furnishers to provide date of delinquency on charge-off, collection or similar accounts | Federal Trade Commission.