Oklahoma Certificate of Trust for Mortgage

Description

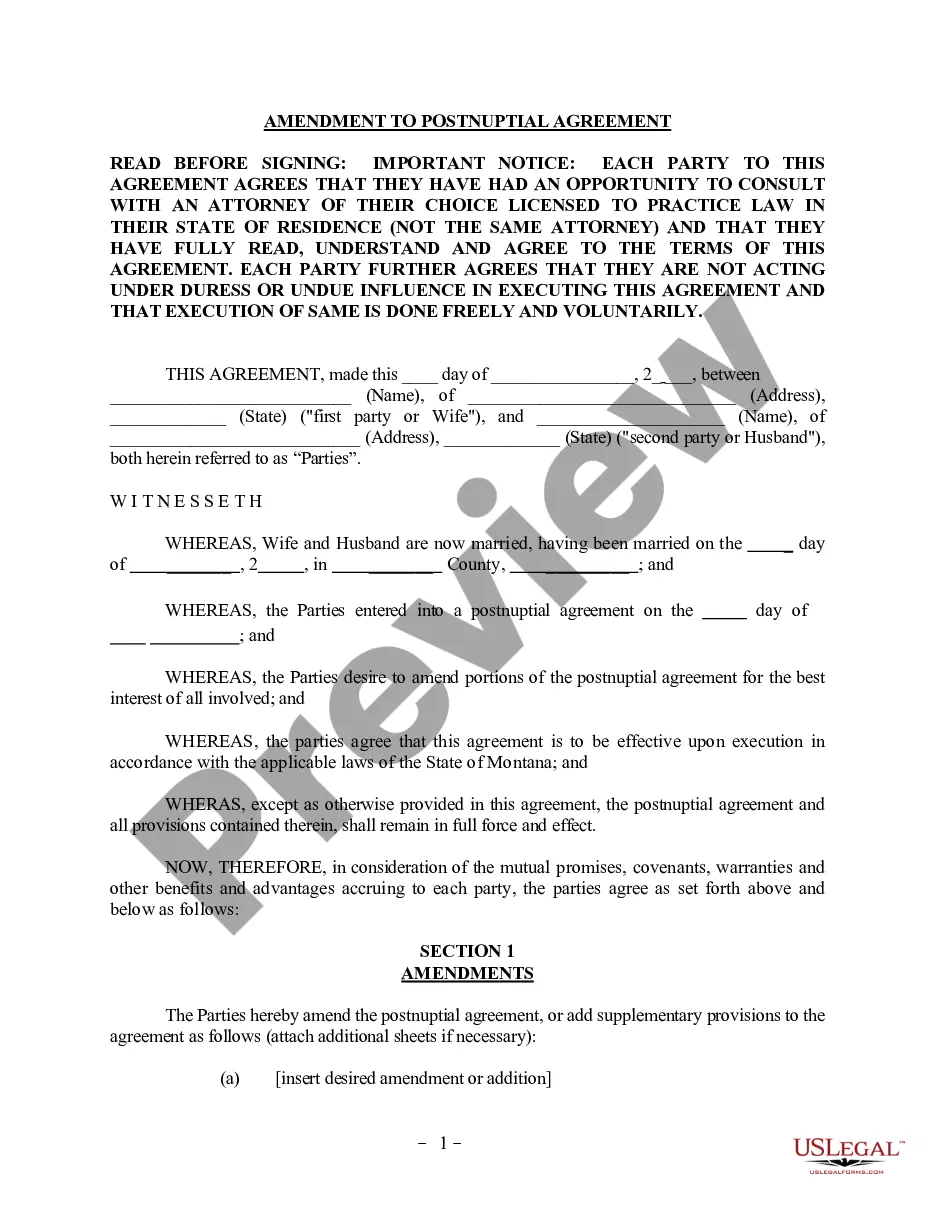

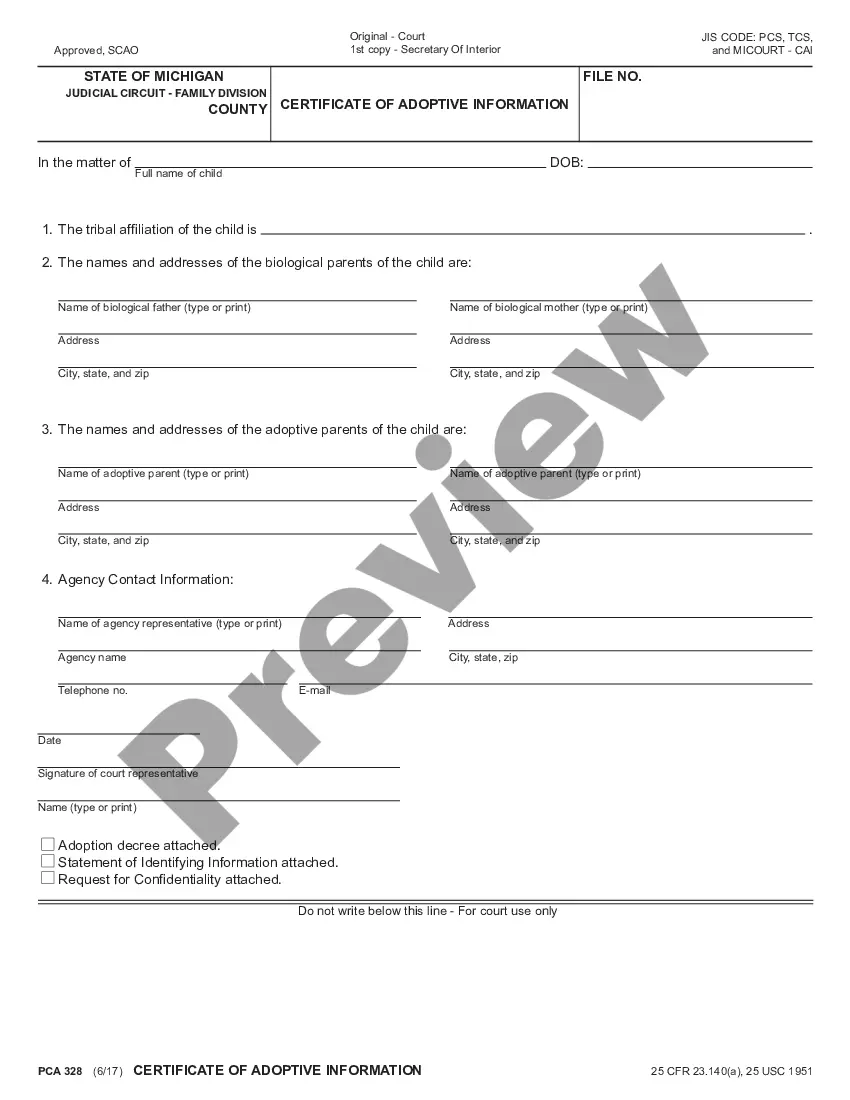

How to fill out Certificate Of Trust For Mortgage?

US Legal Forms - one of several largest libraries of lawful varieties in the United States - gives an array of lawful file layouts you may download or print. Using the web site, you will get thousands of varieties for organization and person functions, sorted by classes, claims, or key phrases.You will discover the most recent models of varieties much like the Oklahoma Certificate of Trust for Mortgage within minutes.

If you already have a registration, log in and download Oklahoma Certificate of Trust for Mortgage in the US Legal Forms local library. The Acquire button can look on every form you view. You have access to all in the past downloaded varieties inside the My Forms tab of your respective account.

If you want to use US Legal Forms initially, listed here are simple guidelines to help you began:

- Be sure to have chosen the right form to your city/region. Go through the Review button to review the form`s information. See the form description to ensure that you have chosen the right form.

- When the form doesn`t suit your demands, use the Lookup industry towards the top of the screen to get the one who does.

- When you are content with the shape, verify your selection by visiting the Buy now button. Then, select the pricing plan you want and provide your references to sign up on an account.

- Procedure the financial transaction. Use your charge card or PayPal account to finish the financial transaction.

- Select the formatting and download the shape on your product.

- Make alterations. Fill out, change and print and sign the downloaded Oklahoma Certificate of Trust for Mortgage.

Every single design you put into your bank account lacks an expiry particular date and is also the one you have for a long time. So, if you want to download or print another backup, just check out the My Forms section and then click on the form you need.

Obtain access to the Oklahoma Certificate of Trust for Mortgage with US Legal Forms, probably the most comprehensive local library of lawful file layouts. Use thousands of professional and express-distinct layouts that fulfill your small business or person demands and demands.

Form popularity

FAQ

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Both provide a way for your lender to take back your home through foreclosure. Deeds of trust and mortgages both serve the same basic purpose. They're both agreements that say that if you don't follow the terms of your loan, your lender can put your home into foreclosure.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

There are three ways to get a certificate of trust made: With a lawyer. An estate planning attorney can draft a certificate of trust for you to accompany your trust. With estate planning software. ... With a state-specific form from a financial institution or notary public.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateNorth CarolinaYNorth DakotaYOhioYOklahomaY47 more rows

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...