Oklahoma Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

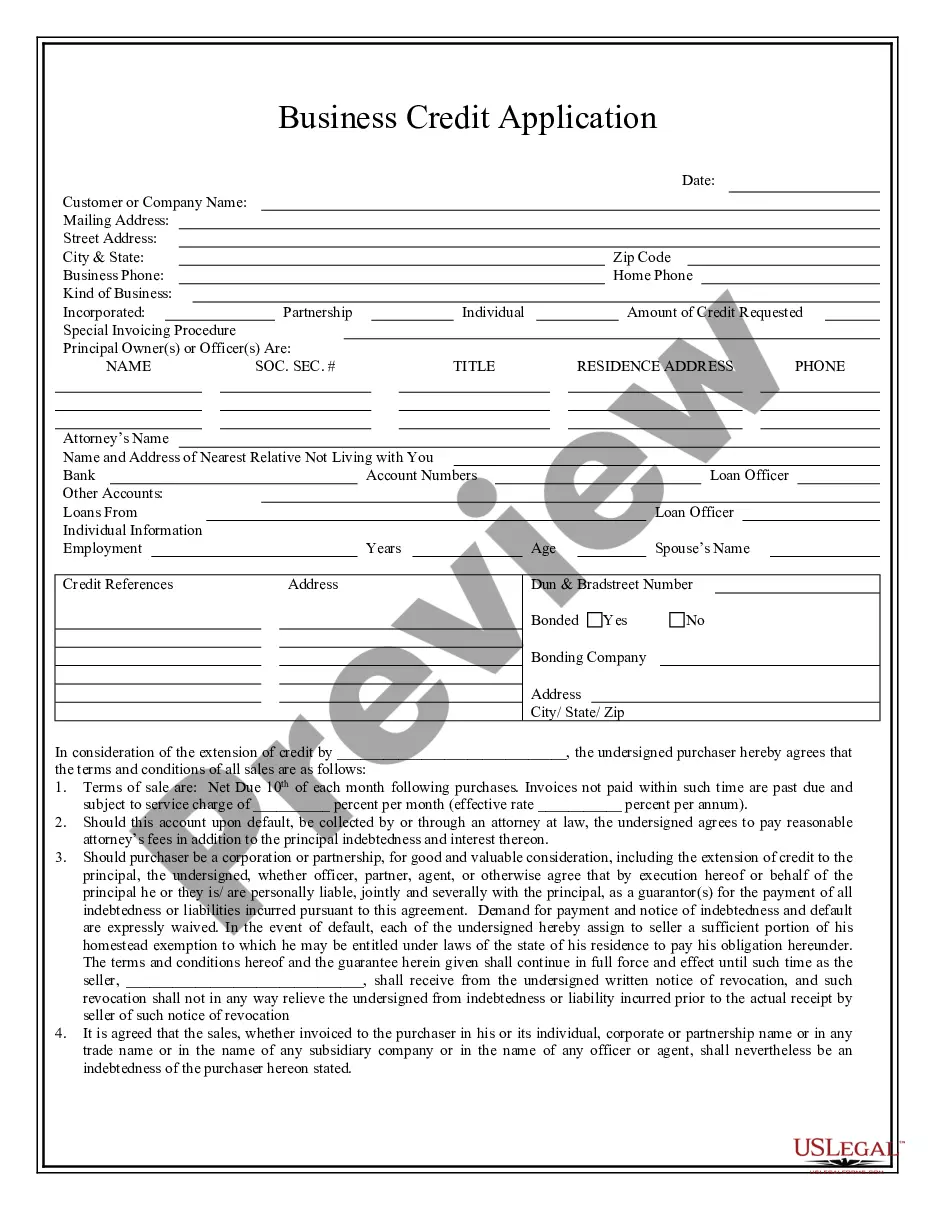

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

You may commit time on the Internet trying to find the legal file web template that suits the state and federal specifications you will need. US Legal Forms offers a huge number of legal varieties which can be analyzed by pros. It is possible to obtain or produce the Oklahoma Transfer under the Uniform Transfers to Minors Act - Multistate Form from the assistance.

If you already possess a US Legal Forms account, you may log in and click the Down load option. Following that, you may total, modify, produce, or indicator the Oklahoma Transfer under the Uniform Transfers to Minors Act - Multistate Form. Every legal file web template you purchase is your own property permanently. To have an additional version of any bought develop, go to the My Forms tab and click the related option.

If you work with the US Legal Forms internet site the very first time, follow the basic directions below:

- Very first, make sure that you have chosen the correct file web template for your area/town of your choice. See the develop description to ensure you have selected the right develop. If offered, use the Preview option to check throughout the file web template as well.

- If you want to discover an additional edition of the develop, use the Lookup field to find the web template that fits your needs and specifications.

- After you have identified the web template you would like, click on Get now to proceed.

- Pick the costs prepare you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal account to purchase the legal develop.

- Pick the structure of the file and obtain it in your product.

- Make changes in your file if possible. You may total, modify and indicator and produce Oklahoma Transfer under the Uniform Transfers to Minors Act - Multistate Form.

Down load and produce a huge number of file templates making use of the US Legal Forms web site, that provides the largest variety of legal varieties. Use skilled and status-specific templates to take on your small business or individual demands.

Form popularity

FAQ

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

What Is the UTMA? Similar to the Uniform Gift to Minors Act (UGMA), the UTMA is simply a custodial account that holds and protects assets for a minor until that minor reaches the age of majority in his/her state.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

If you want to transfer cash, stocks, or bonds, a UGMA would fit the purpose. If you want to transfer real estate, or if you want more flexibility in how the assets are used, then a UTMA may be the better option.

Cons. Greater impact on financial aid. Because they're held in the name of the child, UTMA/UGMA accounts hurt financial aid eligibility more than comparable 529 plans. Money becomes the child's at majority.

Age of Majority and Trust Termination StateUGMAUTMANorth Carolina1821North Dakota1821Ohio1821Oklahoma211849 more rows

The Uniform Transfers to Minors Act was established in 1986, and it has been adopted in most states, including Oklahoma. These accounts mirror the UGMA accounts in every way except for the fact that any type of property can be transferred into a UTMA account. Another difference is the age of majority and termination.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.