Oklahoma Notice that use of Website is Subject to Guidelines

Description

How to fill out Notice That Use Of Website Is Subject To Guidelines?

Finding the correct legal document template can be quite challenging.

Naturally, there are numerous templates available online, but how can you locate the legal form you need.

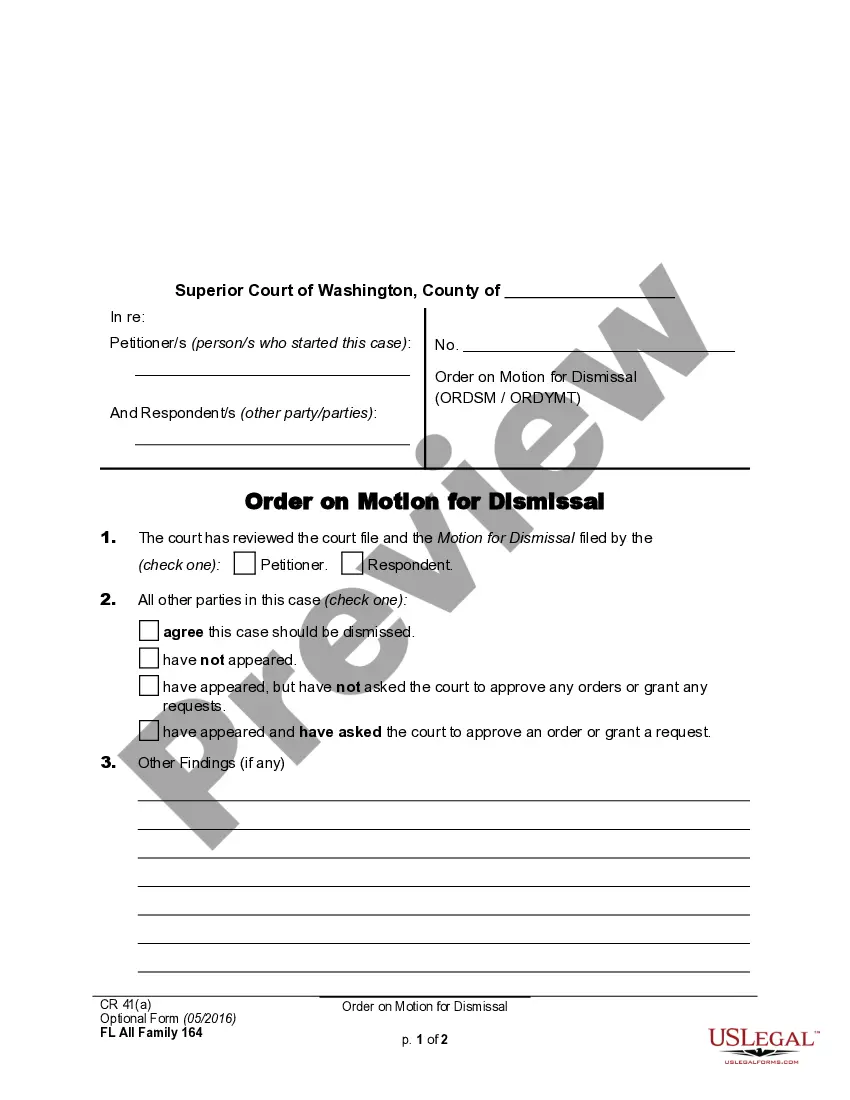

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Oklahoma Notice that Use of Website is Subject to Guidelines, which can be used for both professional and personal purposes.

You can preview the form using the View button and read the form description to confirm it is suitable for you.

- All the forms are reviewed by professionals and meet state and federal requirements.

- If you are already a registered user, Log In to your account and click the Download button to access the Oklahoma Notice that Use of Website is Subject to Guidelines.

- Use your account to view the legal forms you have purchased previously.

- Visit the My documents section of your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure that you have selected the correct form for your city/region.

Form popularity

FAQ

To obtain tax-exempt status in Oklahoma, you must complete the application process provided by the Oklahoma Tax Commission. This usually involves providing documentation that proves eligibility, such as non-profit status. Being aware of the guidelines in the Oklahoma Notice that use of Website is Subject to Guidelines will assist you throughout this process.

Yes, Oklahoma does provide a sales tax exemption certificate, which allows qualifying entities to make tax-exempt purchases. Customers must submit this certificate to sellers to exempt their purchases from sales tax. It is vital to properly manage these certificates to align with the Oklahoma Notice that use of Website is Subject to Guidelines.

In Oklahoma, items like certain food products, medical equipment, and purchases for resale are typically tax-exempt. However, it is crucial to check the specific criteria set by the Oklahoma Tax Commission. Understanding these qualifications is part of complying with the Oklahoma Notice that use of Website is Subject to Guidelines.

To obtain an Oklahoma sales tax ID number, you need to register your business with the Oklahoma Tax Commission. You can complete this process online or submit a paper application. This is an important step to adhere to the Oklahoma Notice that use of Website is Subject to Guidelines for proper tax collection.

Form 511 NR is the Oklahoma Nonresident Individual Income Tax Return. This form is for individuals who earned income in Oklahoma but do not reside there. To ensure you are submitting correctly, refer to the Oklahoma Notice that use of Website is Subject to Guidelines for guidance on tax filing.

To verify sales tax exemption in Oklahoma, you can request a sales tax exemption certificate from your customers. Once you receive the certificate, keep it on file to substantiate the exempt sales. Following the Oklahoma Notice that use of Website is Subject to Guidelines ensures that you maintain transparency and compliance.

Yes, as an online seller, you are required to collect sales tax if you have a physical presence in Oklahoma. Additionally, if your sales exceed a certain threshold, you must also comply with tax collection laws. It's essential to review the Oklahoma Notice that use of Website is Subject to Guidelines to stay informed about your obligations.

You can check your Oklahoma sales tax permit by visiting the Oklahoma Tax Commission's website. There, you can access the online portal where you can enter your business information to verify your permit status. This process ensures compliance with the Oklahoma Notice that use of Website is Subject to Guidelines, which helps keep your business operations smooth.

Yes, Oklahoma has a Freedom of Information Act (FOIA) that ensures transparency and accountability in government operations. This act grants citizens the right to access public records, fostering an environment of openness. For individuals and organizations seeking information, the Oklahoma Notice that use of Website is Subject to Guidelines provides clarity on how to navigate these requests. Being informed about FOIA can empower you to hold public institutions accountable.

Oklahoma does not have a specific statute labeled as a right to privacy law, but common law provides protections under various circumstances. This framework allows individuals to take legal action if their privacy is invaded through means such as surveillance or unauthorized use of personal information. The Oklahoma Notice that use of Website is Subject to Guidelines can educate you about these rights. Understanding your legal protections helps you navigate privacy-related concerns more effectively.