Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

You can invest hours online trying to locate the official document template that satisfies the federal and state requirements you will need.

US Legal Forms offers a vast array of official forms that are reviewed by experts.

It is easy to download or print the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form from your services.

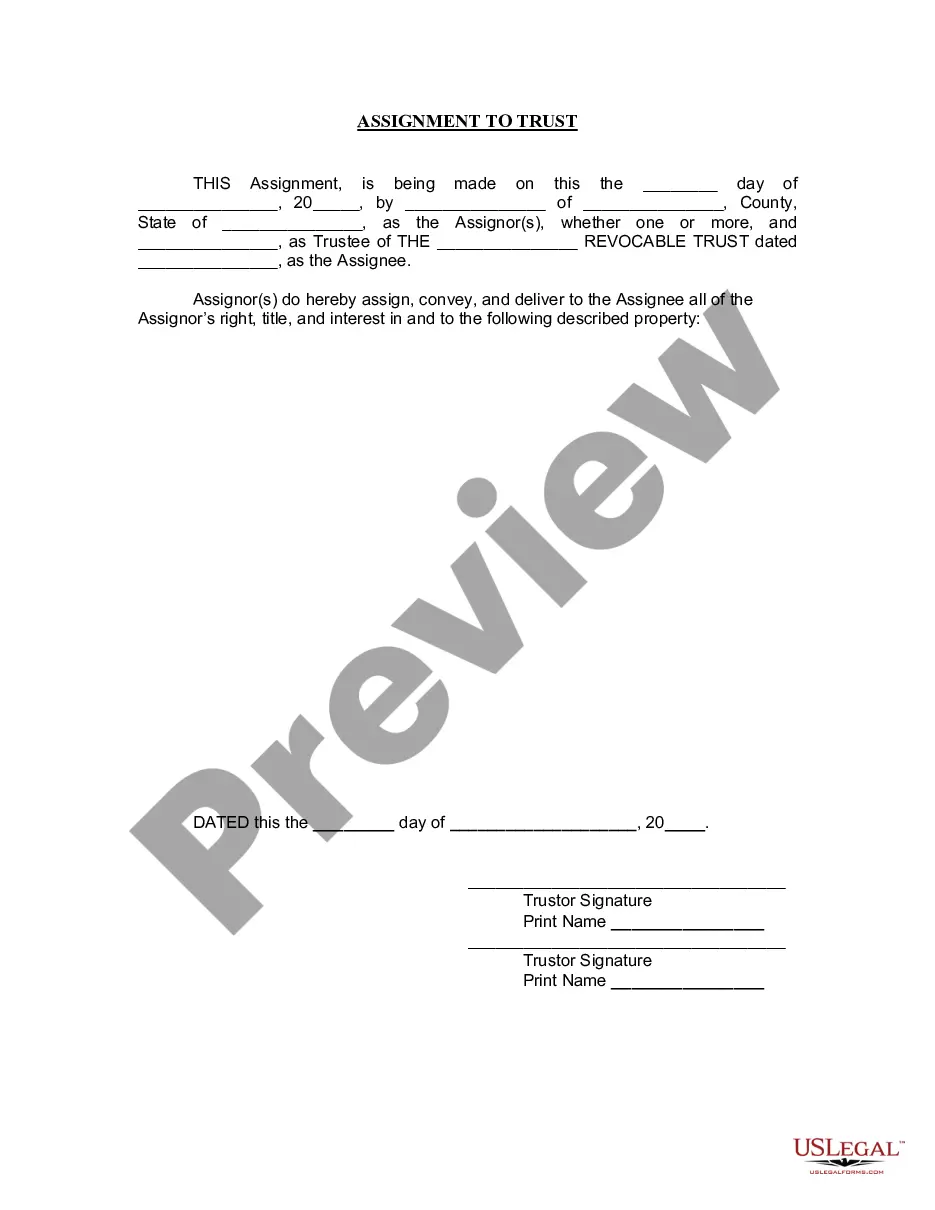

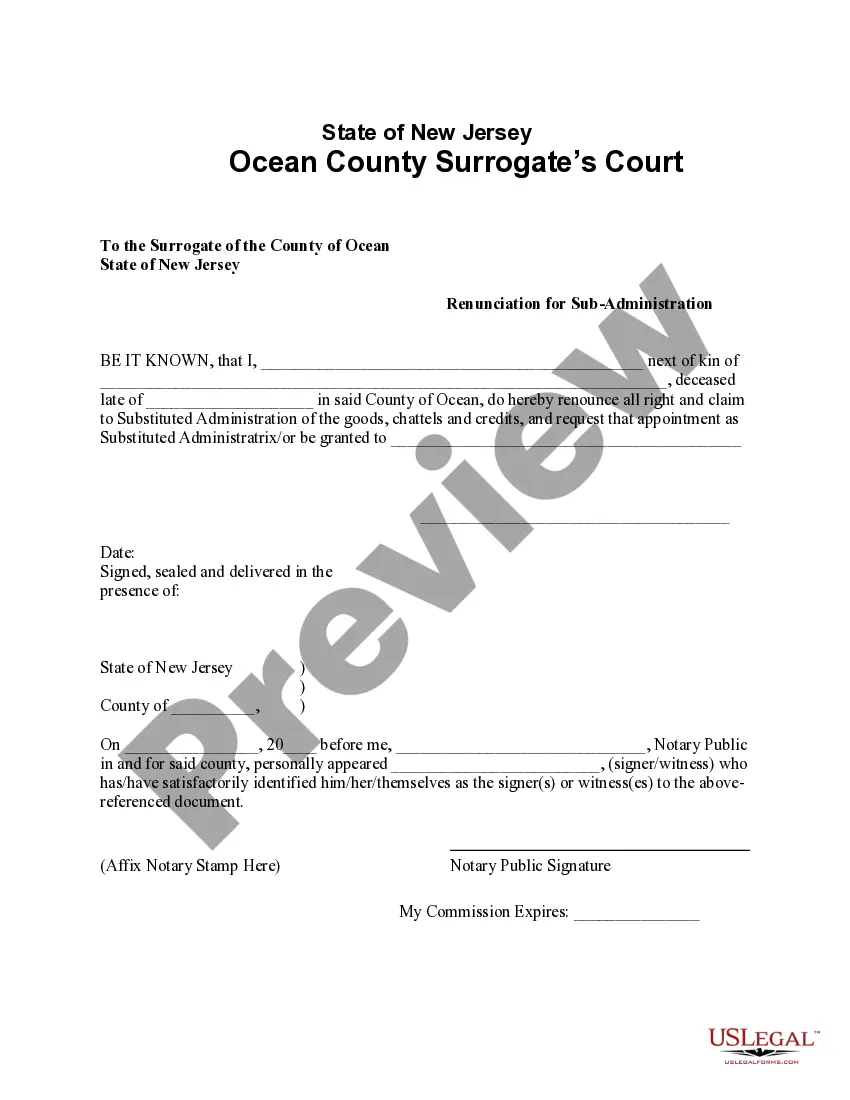

Firstly, make sure you have chosen the correct document template for your region/city of your choice. Review the form description to ensure you have selected the appropriate one. If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form.

- Every official document template you purchase is yours indefinitely.

- To get another copy of a purchased form, go to the My documents section and click the related button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

A company resolution is a written record of decisions made by a company's directors or shareholders. This document serves as evidence of official actions taken by the organization, such as opening bank accounts or appointing officers. For those navigating these processes, the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form provides a reliable framework for generating a valid resolution.

A corporate resolution for a bank is a formal declaration by a corporation regarding its banking affairs. It typically confirms who has the authority to access and manage the corporation's bank accounts and financial transactions. By using the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form, you can create a resolution that meets the bank's criteria effectively.

A company resolution to the bank is a legal document that reflects a company's decisions regarding its banking activities. This can include opening, modifying, or closing bank accounts, and it outlines who is authorized to act for the company. The Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form streamlines this process by providing a template that meets legal standards.

A corporate resolution to open a bank account is a formal decision made by a company's board or authorized individuals. This document outlines the need to establish a banking relationship and authorizes specific persons to manage the account. Using the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form can help ensure clarity and compliance with bank requirements.

Writing a resolution for a bank account involves creating a formal document that states the decision to open or manage the account. You should include the company's name, the purpose of the resolution, and details about who holds the authority to act on behalf of the business. Utilizing the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form can simplify this process, ensuring you include all necessary elements.

Filling out a banking resolution involves recording the decisions made during a corporate meeting regarding bank accounts. You should list the authorized individuals, their roles, and specific actions they can perform. By referring to the Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form, you can ensure that you provide all required information in a clear and systematic way.

To fill out a corporate resolution form, start by including the company’s name and the date. Then, list the resolutions approved during the meeting and the names of individuals authorized to act on behalf of the company. The Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form can serve as a structured template that ensures you address all necessary details effectively.

A bank resolution is a formal document from a corporation’s board authorizing actions regarding bank accounts. This includes who can access funds, make withdrawals, and manage the accounts on behalf of the company. When establishing an Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form, it is vital to outline these details clearly to avoid future disputes.

To write a banking resolution, begin by stating the company’s name and providing the date of the meeting where the resolution was approved. Clearly list the individuals authorized to manage the bank account and specify their powers. Utilizing an Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form can simplify the process and ensure all necessary elements are included.

An example of a bank resolution letter typically includes a statement affirming that the board of directors has authorized specific individuals to handle banking transactions. It highlights their names, roles, and the authorized actions they can perform, such as signing checks or withdrawing funds. Reviewing an Oklahoma Minimum Checking Account Balance - Corporate Resolutions Form can provide clarity on how to draft such a letter effectively.