Oklahoma Records — Withdrawal is a service provided by the Oklahoma State Court Network (OCN) that allows individuals to withdraw a previously filed court document or records from a court file. The types of Oklahoma Record — Withdrawal available are: Withdrawal of a Civil Case, Withdrawal of a Criminal Case, Withdrawal of a Domestic Relations Case, Withdrawal of a Juvenile Case, Withdrawal of an Appeal Case, and Withdrawal of a Probate Case. Withdrawal requests must be made in writing and supported by appropriate documentation for the court to consider. The court retains the right to grant or deny the withdrawal.

Oklahoma Records - Withdrawal

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

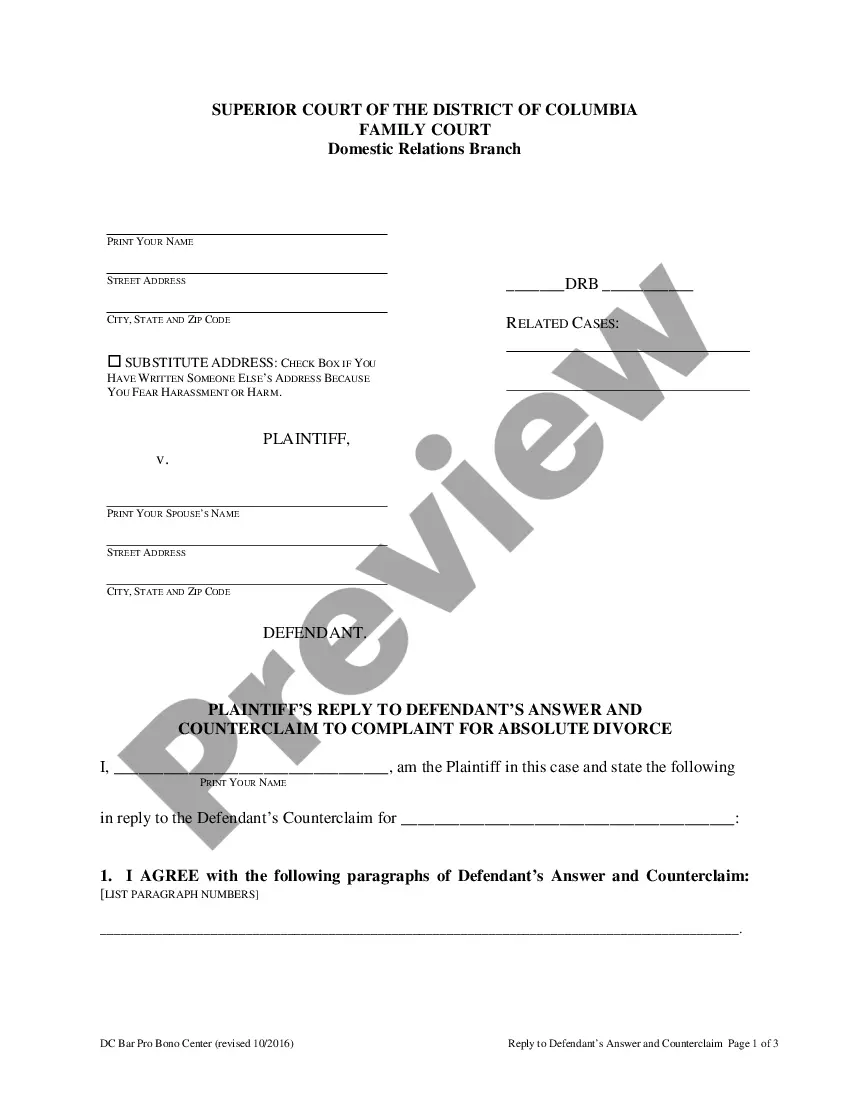

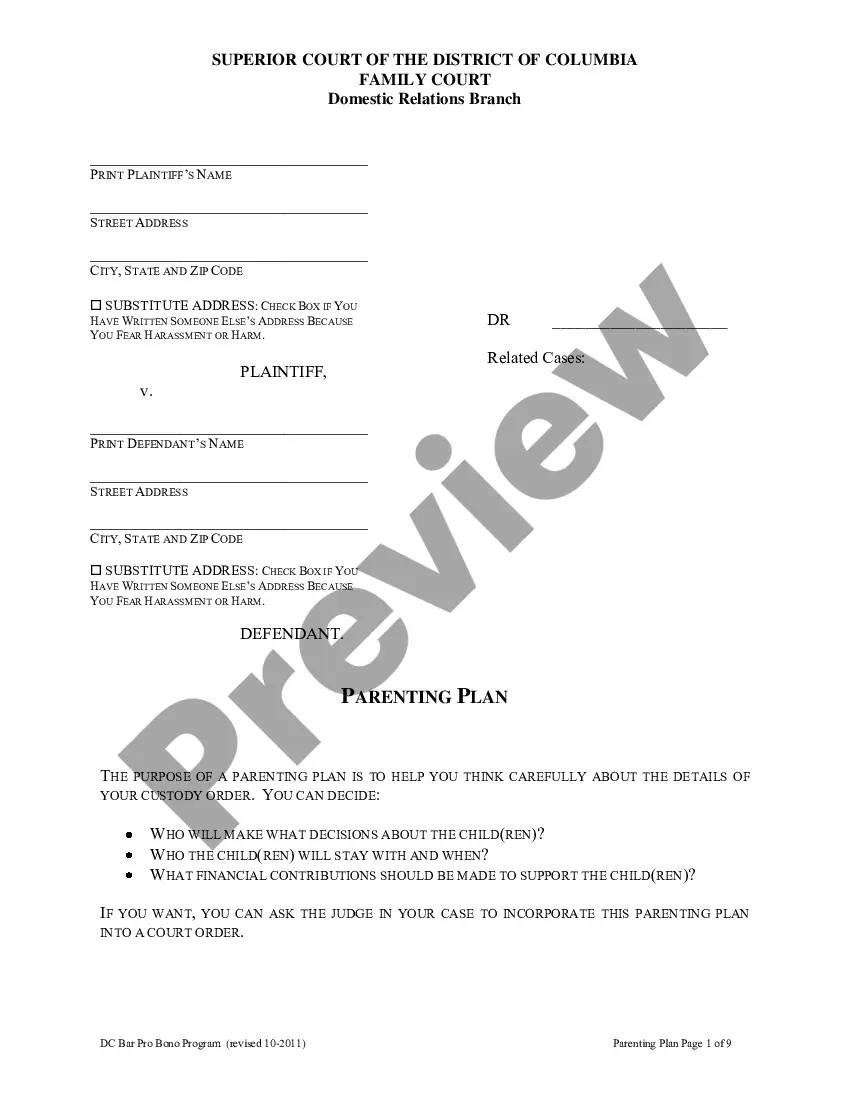

How to fill out Oklahoma Records - Withdrawal?

Coping with official documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Oklahoma Records - Withdrawal template from our service, you can be certain it meets federal and state regulations.

Working with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Oklahoma Records - Withdrawal within minutes:

- Make sure to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Oklahoma Records - Withdrawal in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Oklahoma Records - Withdrawal you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Withdrawal Privilege If you leave the job that qualified you for TRS membership and are not employed or contracted for employment within any education system/agency in Oklahoma, you may receive a refund of your contributions (see more on Withdrawing Contributions).

How To Drop a Class Go to my.okstate.edu Student Portal. Log In with your O-KEY Username (or okstate.edu email address) and Password. Click on the Self Service Icon on the HOME Tab. Click on the STUDENT tab. Click the Registration link. Click ?Add or Drop Classes? Select the Term and click the Submit button.

However, if you choose to cash out, you may be required to pay ordinary income tax on the balance plus a 10% early withdrawal penalty if you are under age 59½. In addition, employers may hold onto 20% of your account balance to prepay the taxes you'll owe. Think carefully before deciding to cash out a retirement plan.

A plan distribution before you turn 65 (or the plan's normal retirement age, if earlier) may result in an additional income tax of 10% of the amount of the withdrawal.

If you are a prospective student admitted for an upcoming term and wish to decline admission or withdraw your application, please email admissions@ou.edu or contact your OU admissions counselor. Graduate students may contact the Office of Enrollment Services by emailing enroll@ou.edu or by calling 405-325-4147.

The IRS dictates you can withdraw funds from your 401(k) account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work.

Oklahoma doesn't tax Social Security, has a lower than average income tax rate and the second lowest cost of living in the U.S. Pensions, 401(k)s and IRAs are taxable, but taxpayers over 65 receive a deduction of $10,000 on income from retirement accounts.

Generally speaking, the only penalty assessed on early withdrawals from a traditional 401(k) retirement plan is the 10% additional tax levied by the Internal Revenue Service (IRS), though there are exceptions.1 This tax is in place to encourage long-term participation in employer-sponsored retirement savings schemes.