Ohio Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations

Description

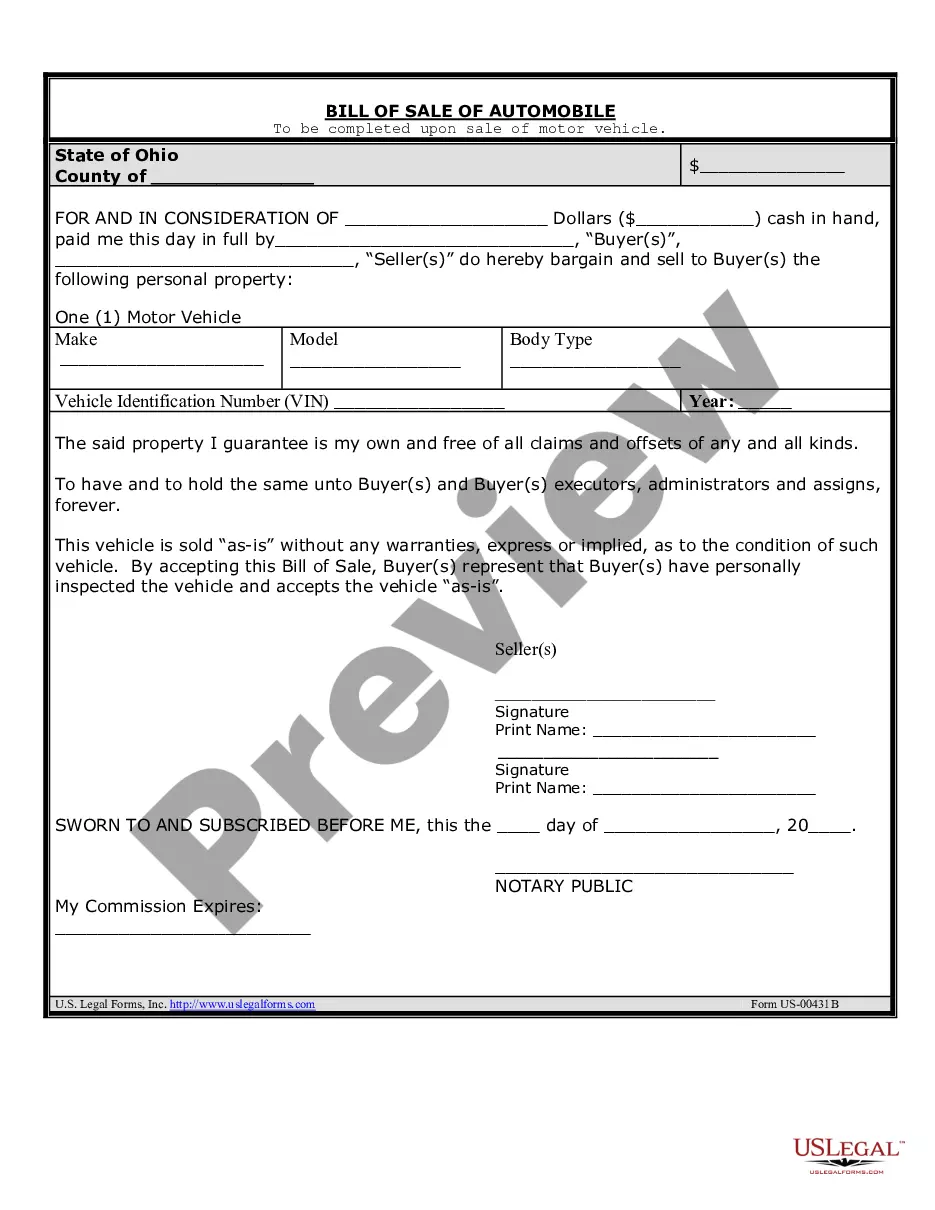

How to fill out Authorization For Wage And Employment Information With Revocation Of Any Previous Authorizations?

It is possible to commit several hours on the web trying to find the authorized file template that fits the state and federal needs you will need. US Legal Forms provides a large number of authorized forms which can be evaluated by specialists. You can easily acquire or print out the Ohio Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations from my service.

If you currently have a US Legal Forms bank account, you can log in and click on the Down load option. Following that, you can total, change, print out, or indication the Ohio Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations. Each authorized file template you buy is your own forever. To obtain one more duplicate for any obtained form, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms web site the first time, keep to the straightforward instructions beneath:

- Initially, ensure that you have selected the correct file template to the county/area of your choice. Read the form description to ensure you have selected the right form. If offered, use the Preview option to appear throughout the file template also.

- If you want to locate one more edition from the form, use the Lookup field to discover the template that meets your needs and needs.

- When you have discovered the template you would like, just click Get now to carry on.

- Choose the prices prepare you would like, enter your qualifications, and sign up for an account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal bank account to purchase the authorized form.

- Choose the file format from the file and acquire it to the system.

- Make modifications to the file if needed. It is possible to total, change and indication and print out Ohio Authorization for Wage and Employment Information with Revocation of Any Previous Authorizations.

Down load and print out a large number of file web templates using the US Legal Forms site, that provides the largest assortment of authorized forms. Use expert and status-particular web templates to tackle your business or individual requires.

Form popularity

FAQ

Every employer maintaining an office or transacting business within the state of Ohio and making payment of any compensation to an employee, whether a resident or nonresident, must withhold Ohio income tax.

Register online through the Ohio Business Gateway (Gateway) at business.ohio.gov and follow the instructions for Ohio Withholding Registration. If you have any questions about registering, call 1-888-405-4089. The employer withholding tables are posted at .

Your Ohio tax ID number allows you to open an official business bank account, hire employees and file taxes. If you are concerned with how to get a tax ID number in Ohio, GovDocFiling offers services that help make this process simple and less time consuming.

Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation.

May your employer withhold a paycheck for any reason in Ohio? The answer is ?no.? Employers are not allowed to withhold paychecks from employees. Federal and state laws require an employer to pay employees for all hours that they work.

Withholding Account Number If you cannot locate this document or account number, please call the Ohio Department of Taxation at (888) 405-4039 to request it. Visit the Ohio Business Gateway and click ?Create an Account?. The online registration process can take 1-2 days.

Under Ohio law, workers have two years to file a lawsuit for unpaid wages. If you wait too long and miss that deadline (known as the statute of limitations), you could miss out on your opportunity to obtain the financial compensation you rightfully deserve.

A failure or refusal to pay, regardless of the number of employee pay accounts involved, constitutes one offense for the first delinquency of thirty days and a separate offense for each successive delinquency of thirty days.