Ohio Assignment of Promissory Note & Liens

Description

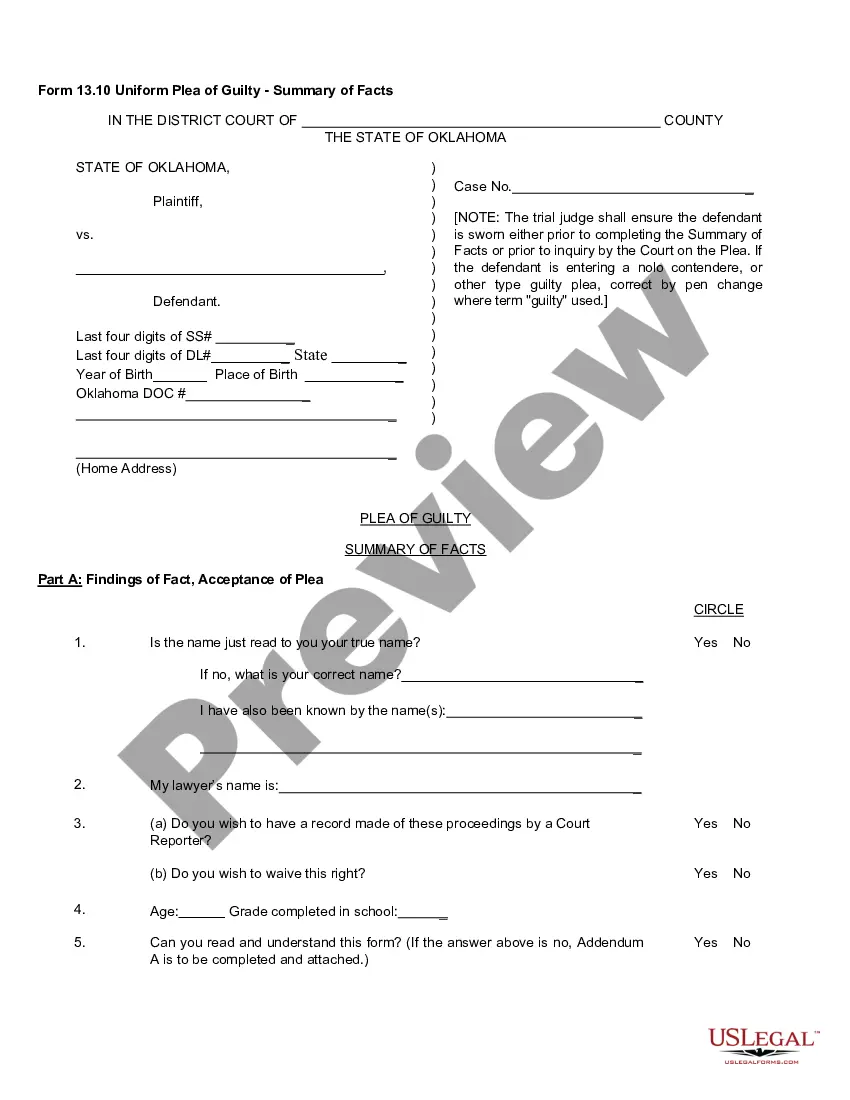

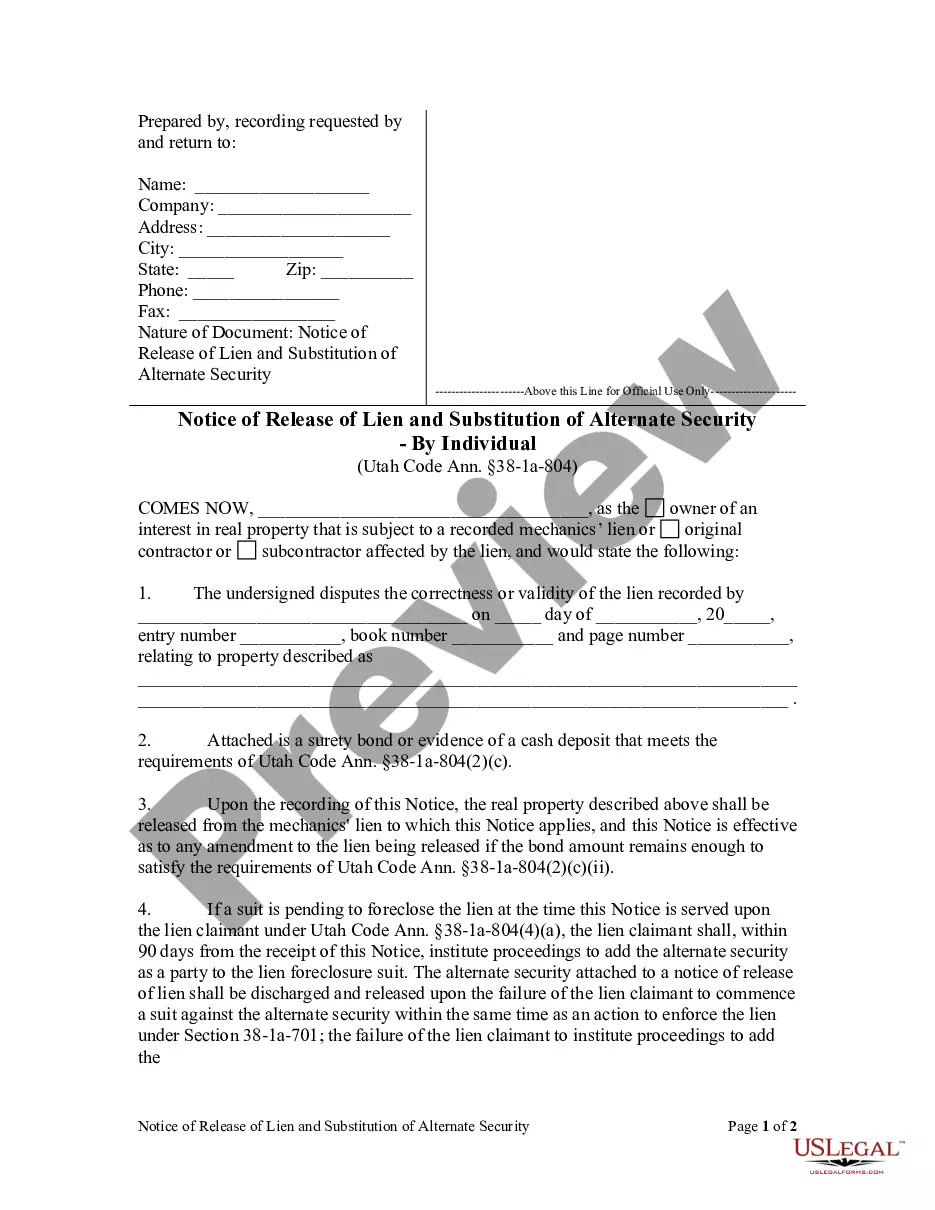

How to fill out Assignment Of Promissory Note & Liens?

Discovering the right legal document format can be a have difficulties. Needless to say, there are plenty of themes available online, but how do you obtain the legal type you will need? Utilize the US Legal Forms site. The support delivers a huge number of themes, for example the Ohio Assignment of Promissory Note & Liens, which can be used for organization and private requirements. Every one of the varieties are inspected by specialists and meet federal and state specifications.

Should you be currently authorized, log in to your account and click on the Obtain key to obtain the Ohio Assignment of Promissory Note & Liens. Use your account to look throughout the legal varieties you might have acquired in the past. Go to the My Forms tab of your own account and have another duplicate from the document you will need.

Should you be a brand new consumer of US Legal Forms, here are basic directions so that you can stick to:

- Initial, make sure you have chosen the right type for your personal city/area. You are able to examine the form utilizing the Review key and browse the form information to ensure this is basically the right one for you.

- In the event the type fails to meet your requirements, utilize the Seach discipline to find the right type.

- When you are certain that the form is acceptable, click on the Buy now key to obtain the type.

- Opt for the rates prepare you want and enter in the essential details. Make your account and pay for the order with your PayPal account or bank card.

- Select the file format and down load the legal document format to your product.

- Total, edit and print and sign the attained Ohio Assignment of Promissory Note & Liens.

US Legal Forms may be the biggest catalogue of legal varieties where you will find different document themes. Utilize the company to down load appropriately-manufactured files that stick to condition specifications.

Form popularity

FAQ

There is no federal regulation on the maximum interest rate that your issuer can charge you, though each state has its own approach to limiting interest rates. State usury laws often dictate the highest interest rate that can be charged on loans, but these often don't apply to credit card loans.

(A) The parties to a bond, bill, promissory note, or other instrument of writing for the forbearance or payment of money at any future time, may stipulate therein for the payment of interest upon the amount thereof at any rate not exceeding eight per cent per annum payable annually, except as authorized in division (B) ...

In Ohio, a Promissory Note is a document that functions as an enforceable agreement between two parties: a Borrower and a Lender. Within the template, the Borrower promises to return the money to the Lender either at an agreed time or when requested by the Lender.

A brief history of California Usury Law With some constitutional amendments, most notably the 1979 constitutional amendment, Article XV, Section 1, California's usury limit is now generally 10% per year with a broader range of exemptions.

FindLaw Newsletters Stay up-to-date with how the law affects your life Legal Maximum Rate of Interest8% (§1343.01)Penalty for Usury (Unlawful Interest Rate)Excess interest applied to principal (§1343.04)Interest Rates on JudgmentsContract rate (§1343.02), otherwise 10% (§1343.03)1 more row

(A) Except as provided in division (E) of this section, an action to enforce the obligation of a party to pay a note payable at a definite time shall be brought within six years after the due date or dates stated in the note or, if a due date is accelerated, within six years after the accelerated due date.

(D) An assignment of "the contract" or of "all my rights under the contract" or an assignment in similar general terms is an assignment of rights and unless the language or the circumstances (as in an assignment for security) indicate the contrary, it is a delegation of performance of the duties of the assignor and its ...