This form is used when all activities and operations on the Contract Area have ceased, and the Agreement is deemed, as of the Effective Date stated above, to have terminated, and the Contract Area, and all interests in it, are no longer subject to the terms and provisions of the Agreement.

Ohio Termination of Operating Agreement

Description

How to fill out Termination Of Operating Agreement?

Are you currently in a position that you need documents for possibly business or person purposes almost every day? There are tons of legitimate document web templates available on the Internet, but finding kinds you can rely on is not easy. US Legal Forms provides a large number of kind web templates, much like the Ohio Termination of Operating Agreement, that happen to be composed in order to meet state and federal specifications.

In case you are currently acquainted with US Legal Forms web site and also have a free account, just log in. Afterward, you are able to acquire the Ohio Termination of Operating Agreement web template.

Should you not have an account and need to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for your right city/area.

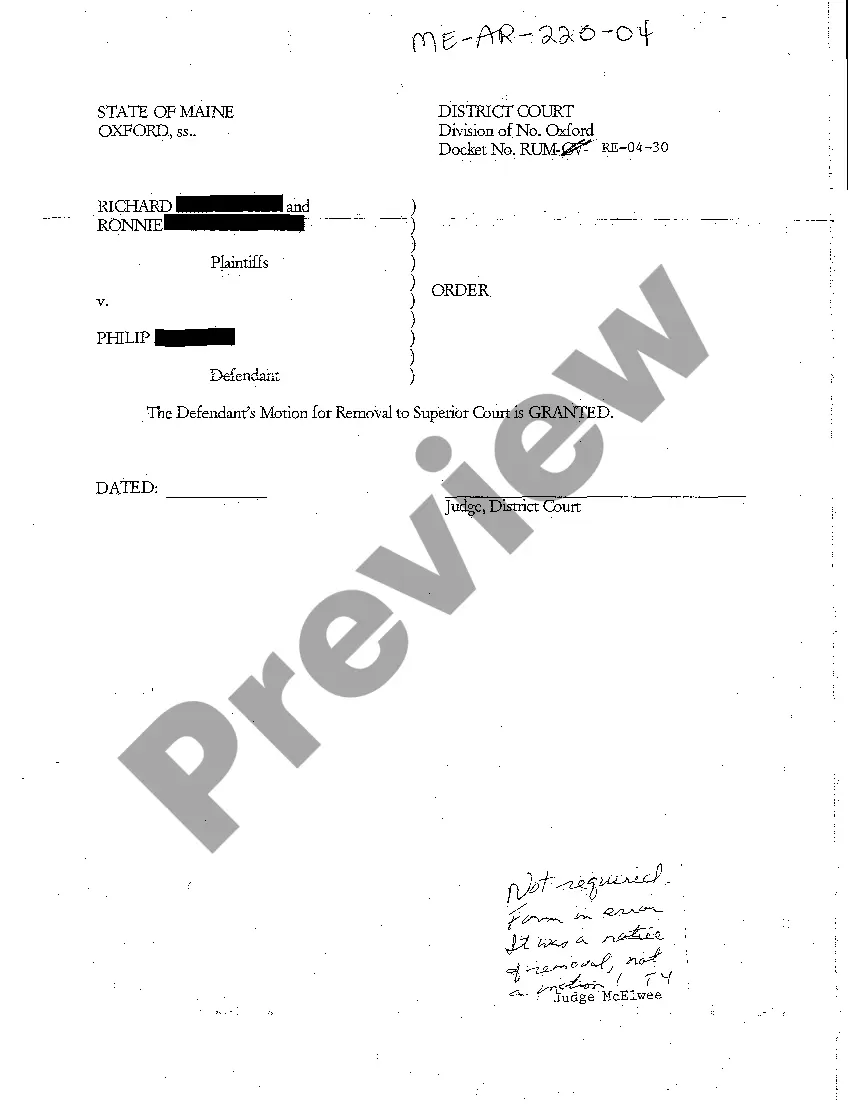

- Utilize the Preview switch to examine the form.

- Browse the information to actually have chosen the appropriate kind.

- When the kind is not what you are looking for, take advantage of the Search discipline to discover the kind that suits you and specifications.

- Whenever you get the right kind, just click Buy now.

- Choose the pricing prepare you need, fill out the specified details to make your bank account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Select a convenient data file formatting and acquire your duplicate.

Discover all the document web templates you might have bought in the My Forms food selection. You may get a additional duplicate of Ohio Termination of Operating Agreement any time, if possible. Just click the necessary kind to acquire or print out the document web template.

Use US Legal Forms, one of the most substantial assortment of legitimate kinds, to save time and stay away from errors. The service provides skillfully manufactured legitimate document web templates which you can use for an array of purposes. Produce a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

How to Dissolve an LLC in Ohio in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

Ohio Revised Code Title 17, § 1706.081: Ohio law does not strictly require an Operating Agreement to form an LLC, but it is highly recommended. This vital document provides the opportunity to layout the LLC's internal operations, member roles, and rules, separating personal and business assets.

§ 4113.15, when an employee is fired, the employer must give a final paycheck to him or her on the next regularly scheduled pay date, or within fifteen (15) days, whichever is earlier.

Section 1706.471 | Effect of dissolution. (A) A dissolved limited liability company continues its existence as a limited liability company but may not carry on any activities except as is appropriate to wind up and liquidate its activities and affairs.

To dissolve an LLC in Ohio, you will need to comply with Ohio's revised code 1706.471. This involves filing a Certificate of Dissolution with the Ohio Secretary of State and a $50 filing fee.

In Texas, an operating agreement isn't required to form a limited liability company (LLC). However, business attorneys, accountants and advisors agree that no LLC should form without one. An LLC operating agreement is a legally binding document that defines critical aspects of the LLC.

The price to start an Ohio LLC is $99. Forming your LLC in Ohio starts with filing Articles of Organization with Ohio's Secretary of State. Regular filings (mail, in person, and online) take about 3-7 days to be processed. Expedited filings are available for additional fees, starting at $100 for 2-day process.

A limited liability company (LLC) is a business entity which combines elements of partnership and corporate structures, and may be formed in Ohio for a profit or nonprofit purpose. An LLC protects the members of the LLC from individual legal liability.