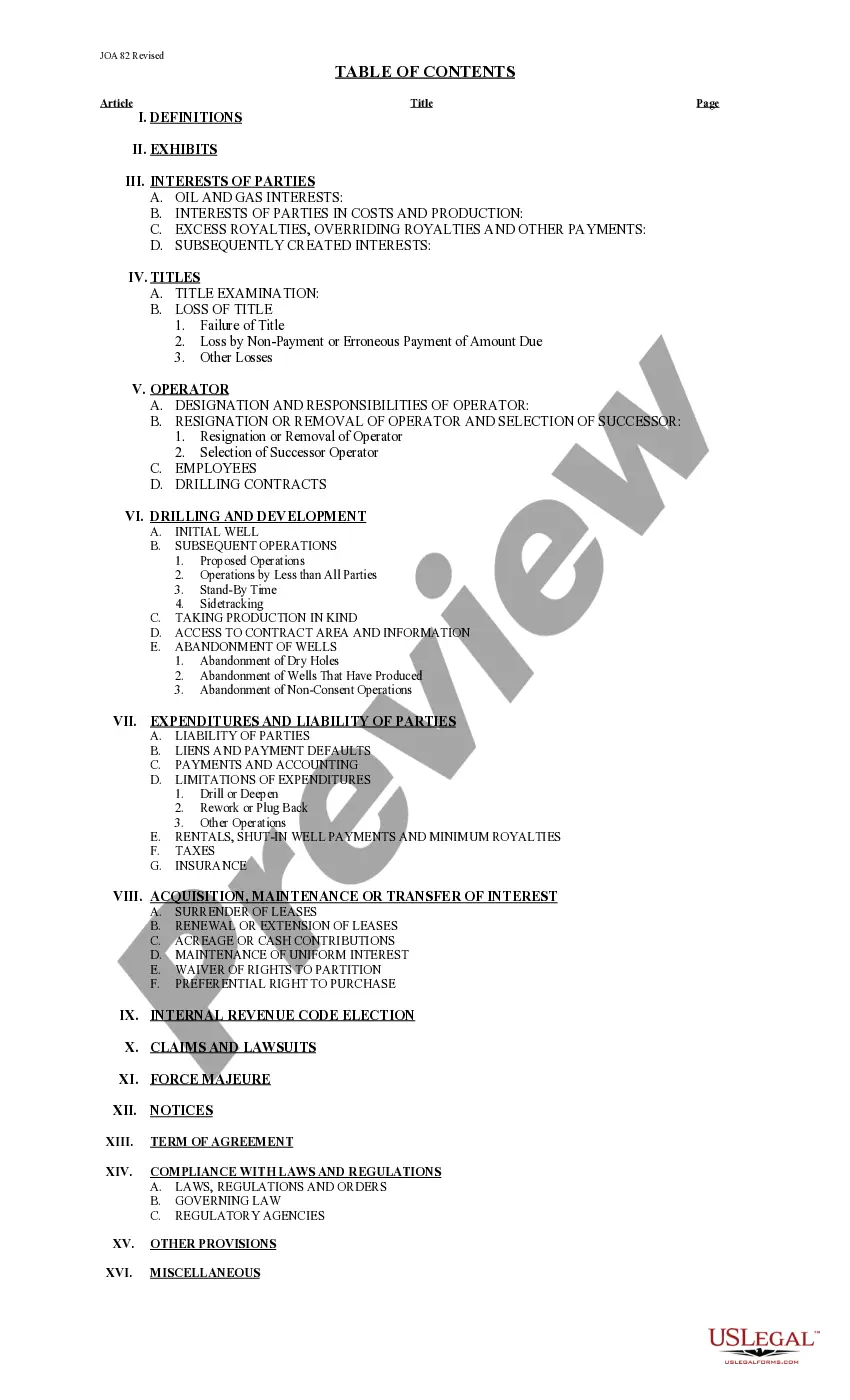

This operating agreement is used when the parties to the Agreement are owners of oil and gas leases and/or oil and gas interests in the land identified in Exhibit A to the agreement, and have reached an agreement to explore and develop these leases and/or oil and gas interests for the production of oil and gas to the extent and as provided for in this Agreement.

Ohio Joint Operating Agreement 82 Revised

Description

How to fill out Joint Operating Agreement 82 Revised?

Choosing the best authorized file format could be a struggle. Of course, there are a lot of web templates available online, but how will you discover the authorized form you will need? Use the US Legal Forms web site. The support offers a large number of web templates, such as the Ohio Joint Operating Agreement 82 Revised, which you can use for business and personal demands. Each of the types are inspected by pros and meet state and federal specifications.

When you are previously registered, log in to your account and click on the Down load option to find the Ohio Joint Operating Agreement 82 Revised. Use your account to search through the authorized types you may have ordered earlier. Proceed to the My Forms tab of the account and get an additional copy of your file you will need.

When you are a whole new end user of US Legal Forms, listed below are straightforward guidelines that you can adhere to:

- First, ensure you have chosen the proper form for the town/region. You can look over the form making use of the Preview option and study the form description to make sure this is basically the right one for you.

- In case the form will not meet your needs, take advantage of the Seach field to obtain the right form.

- Once you are positive that the form is suitable, go through the Purchase now option to find the form.

- Pick the rates strategy you desire and enter the required details. Build your account and pay for an order with your PayPal account or bank card.

- Choose the data file format and down load the authorized file format to your system.

- Comprehensive, change and produce and signal the received Ohio Joint Operating Agreement 82 Revised.

US Legal Forms will be the biggest library of authorized types that you can discover different file web templates. Use the company to down load professionally-manufactured paperwork that adhere to state specifications.

Form popularity

FAQ

Do you need an operating agreement in Ohio? No, it's not legally required in Ohio under § 176.081. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Under the Revised LLC Act, the default fiduciary duties for members (in a member-managed LLC) are the duty of loyalty and care, as well as the duty of good faith and fair dealing. Similarly, by default, managers also have these same duties.

Duties of a fiduciary of an estate plan typically include the following: Identify and provide notice to the beneficiaries and creditors of the estate. Identify and locate the deceased person's assets. Pay taxes and debts of the deceased person and the estate assets.

Do you need an operating agreement in Ohio? No, it's not legally required in Ohio under § 176.081. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Popular options are Wyoming and Delaware. However, we personally recommend Ohio because it's more affordable (there's no Annual Report) and the paperwork is very simple. We don't think the ?reputation? of Delaware is that important, or worth the extra cost. Wyoming LLC Non-Resident costs: State fee is $100.

In some cases, LLC members may decide to participate in the management of their LLC. Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners.