Ohio Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

Finding the right legal file design can be a battle. Needless to say, there are plenty of web templates accessible on the Internet, but how can you find the legal kind you require? Take advantage of the US Legal Forms internet site. The assistance delivers 1000s of web templates, including the Ohio Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, that can be used for company and personal needs. Every one of the forms are inspected by experts and meet state and federal demands.

When you are presently listed, log in for your account and click on the Down load button to get the Ohio Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. Utilize your account to search throughout the legal forms you have acquired formerly. Visit the My Forms tab of your own account and acquire yet another version of your file you require.

When you are a new customer of US Legal Forms, listed here are basic recommendations that you can follow:

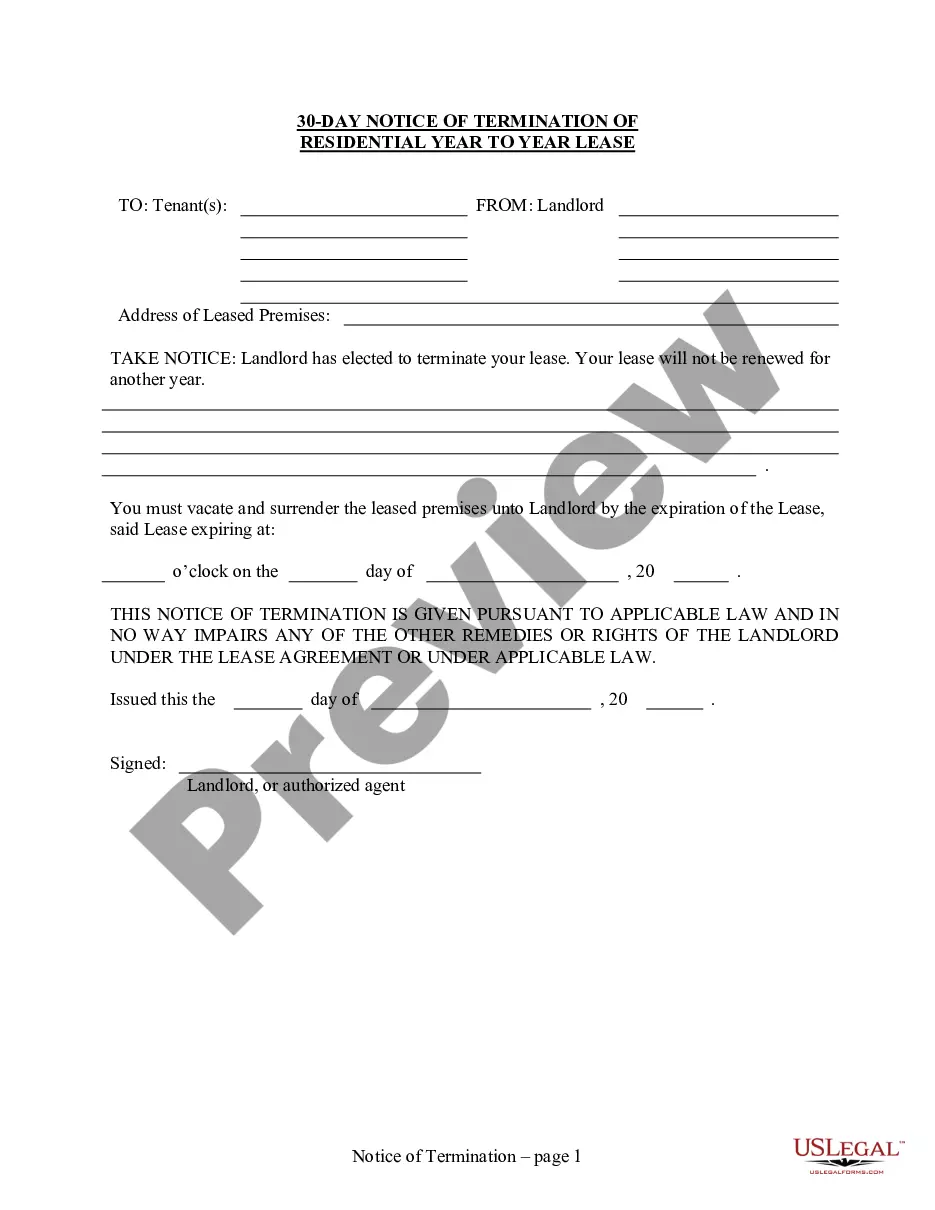

- Very first, ensure you have selected the correct kind to your town/region. You are able to check out the form using the Preview button and read the form explanation to make certain this is basically the right one for you.

- In the event the kind does not meet your needs, make use of the Seach area to discover the correct kind.

- When you are sure that the form is proper, select the Acquire now button to get the kind.

- Select the pricing strategy you would like and enter in the needed information and facts. Create your account and pay for your order with your PayPal account or Visa or Mastercard.

- Opt for the document structure and obtain the legal file design for your device.

- Full, edit and print and signal the received Ohio Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

US Legal Forms may be the biggest local library of legal forms where you can discover a variety of file web templates. Take advantage of the service to obtain expertly-created paperwork that follow status demands.

Form popularity

FAQ

An ORRI is an undivided interest in a mineral lease that gives you the right to a proportional share of the gas and oil that is produced. The overriding royalty interest is carved from the lease or working interest.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...

An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a 'regular' mineral rights owner as they do not have the right to make decisions related to the execution of leases.

Non-operating working interests include overriding royalty interests, production payments, and net profit interests. Unlike royalty interests, non-operating working interest must include a portion of the costs associated with the day-to-day operation of the well.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The term ?non-participating? indicates that the interest owner does not share in the bonus, rentals from a lease, nor the right (or obligation) to make decisions regarding execution of those leases (i.e., no executive rights).

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.