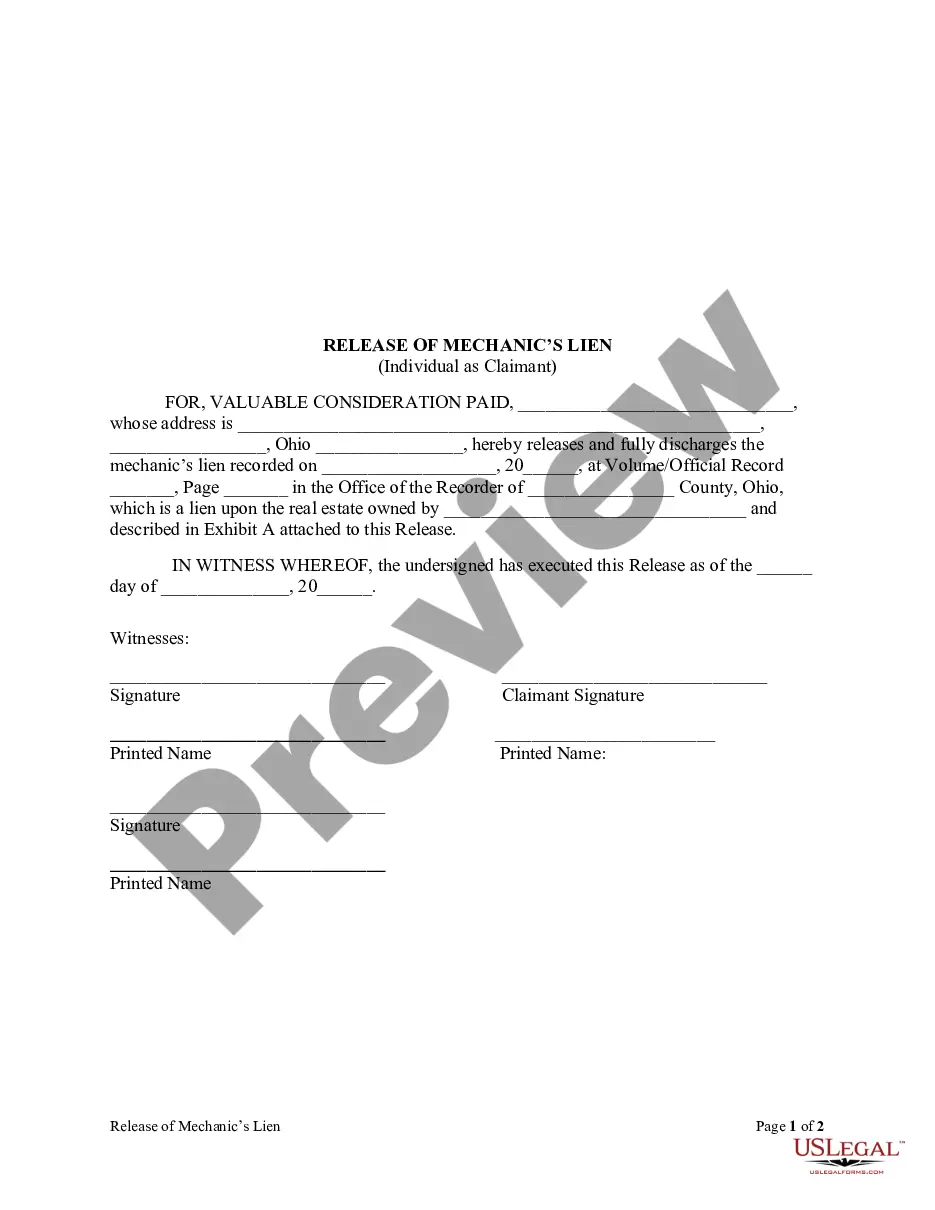

Ohio Release of Judgment Lien - Full Release

Description

How to fill out Release Of Judgment Lien - Full Release?

Have you been in the place in which you need to have documents for either enterprise or specific uses nearly every time? There are a lot of lawful document layouts accessible on the Internet, but finding versions you can rely on isn`t effortless. US Legal Forms offers thousands of form layouts, just like the Ohio Release of Judgment Lien - Full Release, which are written to fulfill state and federal demands.

In case you are previously informed about US Legal Forms website and have a free account, basically log in. Afterward, it is possible to acquire the Ohio Release of Judgment Lien - Full Release template.

Should you not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is to the correct town/state.

- Use the Review button to examine the form.

- Read the explanation to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are looking for, utilize the Research area to find the form that suits you and demands.

- Whenever you obtain the correct form, just click Get now.

- Pick the costs program you desire, complete the specified information and facts to produce your bank account, and purchase the transaction making use of your PayPal or credit card.

- Decide on a handy file structure and acquire your copy.

Get each of the document layouts you have bought in the My Forms food list. You can get a additional copy of Ohio Release of Judgment Lien - Full Release any time, if possible. Just click the needed form to acquire or printing the document template.

Use US Legal Forms, the most extensive assortment of lawful kinds, to conserve some time and avoid mistakes. The support offers expertly produced lawful document layouts which can be used for a variety of uses. Generate a free account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

Once the state liens are paid, you will receive a Lien Satisfaction Notice from the Ohio Attorney General's office. To release the lien, you are to bring the notice to the Clerk's office.

Manual Lien Release To remove the lien from the BMV records, you must take the title to any County Clerk of Courts Title Office and apply for a title. The County Clerk of Courts Title Office will issue you a new paper title.

If an execution sale does not take place within a period of five years (where the plaintiff is someone other than the state) or between 10 and 15 years where the plaintiff is the state, the underlying judgment becomes dormant.

For a Lien Released Manually Bring the title to any County Clerk of Courts Title Office. Apply for a title and pay for title fees.

To properly release the state tax lien, the debtor must file this document in the Clerk of Courts' office along with the appropriate fees and all outstanding court costs. The Clerk accepts cash, check, money order, American Express, Discover or MasterCard.

In order to release a lien, payment including court costs must be paid in full. The cost of releasing Ohio Department of Taxation, Bureau of Workers Compensation, Child Support, and City of Akron Liens is $60.50.

Tax lien: The statute of limitations for a tax lien in Ohio is 15 years from the date the tax liability was assessed. This means that the government has 15 years to collect the taxes owed before the lien expires. Judgment lien: In Ohio, a judgment lien can be valid for up to 5 years.

If you win a judgment and the other party does not pay, you may start collection proceedings. Certain methods for collecting judgments such as bank and earnings garnishments, liens and attachments are permitted under the law. Filings on these actions can be made in the Clerk's Office Civil Division.