Ohio Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Are you in a scenario where you will require documents for both business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating versions you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Ohio Statement to Add to Credit Report, which can be tailored to meet state and federal requirements.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Statement to Add to Credit Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

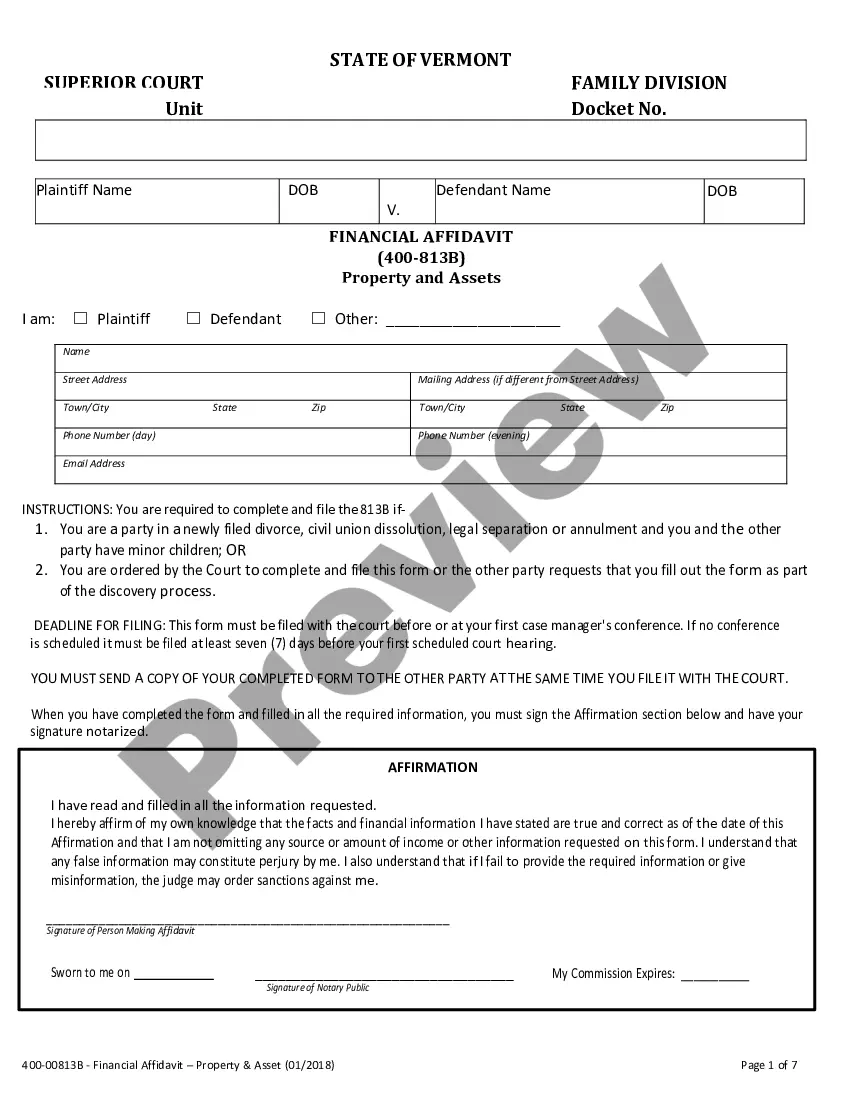

- Use the Preview button to review the document.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you seek, utilize the Lookup field to find the form that meets your needs and requirements.

- When you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Ohio Statement to Add to Credit Report anytime if needed. Just click the required form to download or print the document template.

Form popularity

FAQ

To increase your credit score by 100 points in 30 days, start by reviewing your credit report for errors. Dispute any inaccuracies you find, as correcting these can improve your score. Additionally, consider using an Ohio Statement to Add to Credit Report, which can help highlight positive payment history and accounts. Lastly, reduce your credit utilization by paying down existing debts, as this can significantly boost your score.

Building your credit from 500 to 700 can take time, often several months to a few years, depending on your financial habits. Consistently making on-time payments, reducing debt, and managing credit responsibly will help improve your score. Additionally, consider adding an Ohio Statement to Add to Credit Report to clarify any past issues. With the right strategies, you can enhance your credit profile and achieve your goal.

To add a statement to your credit report, you need to contact the credit reporting agencies directly. You can provide them with your statement in writing, explaining any discrepancies or context about your credit history. This is especially useful when you want to clarify negative information. Using our platform at US Legal Forms can guide you through the process of drafting an effective Ohio Statement to Add to Credit Report.

Yes, putting a freeze on your credit can be a wise decision, especially if you are concerned about identity theft. A credit freeze restricts access to your credit report, making it harder for unauthorized individuals to open accounts in your name. While it does not affect your credit score, it provides peace of mind. If you want to safeguard your financial information, consider an Ohio Statement to Add to Credit Report as part of your strategy.

To get an account added to your credit report, you must first ensure the account issuer reports to the credit bureaus. You can contact the creditor directly and request them to submit your account information. If you need assistance, consider using services like USLegalForms, which can help streamline the process and provide necessary documentation. Remember, having an Ohio Statement to Add to Credit Report can strengthen your request and improve your credit profile.

Raising your credit score by 200 points in 30 days is challenging but achievable with strategic actions. Focus on paying down high credit card balances, making all payments on time, and disputing any errors on your report. Additionally, consider using the Ohio Statement to Add to Credit Report to clarify any recent issues. These steps can create a positive impact on your credit score in a short timeframe.

To add a statement to your credit report, you typically need to contact the credit bureau and provide your statement in writing. The Ohio Statement to Add to Credit Report can be a valuable tool for you in this process. Ensure your statement is concise and directly addresses any specific concerns. Platforms like uslegalforms can assist you in drafting and submitting your statement properly.

Achieving an 800 credit score in 45 days may be ambitious but not impossible. Focus on reducing your credit utilization, making timely payments, and disputing any inaccuracies. Additionally, consider adding an Ohio Statement to Add to Credit Report to explain any recent financial changes or challenges. These actions can help boost your score significantly in a short time.

Yes, you can add a statement to your credit report. The Ohio Statement to Add to Credit Report gives you the opportunity to share important information that may not be reflected in your credit history. This can be particularly useful if you are disputing an entry or if you want to explain a negative mark. Be sure to draft a clear and concise statement for the best impact.

Yes, you can include a statement on your credit report, but it is typically limited to 100 words. This Ohio Statement to Add to Credit Report allows you to express your viewpoint or clarify any discrepancies. By using this option, you can provide context that may help lenders understand your credit situation better. Remember, clarity and brevity are key to communicating effectively.