Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

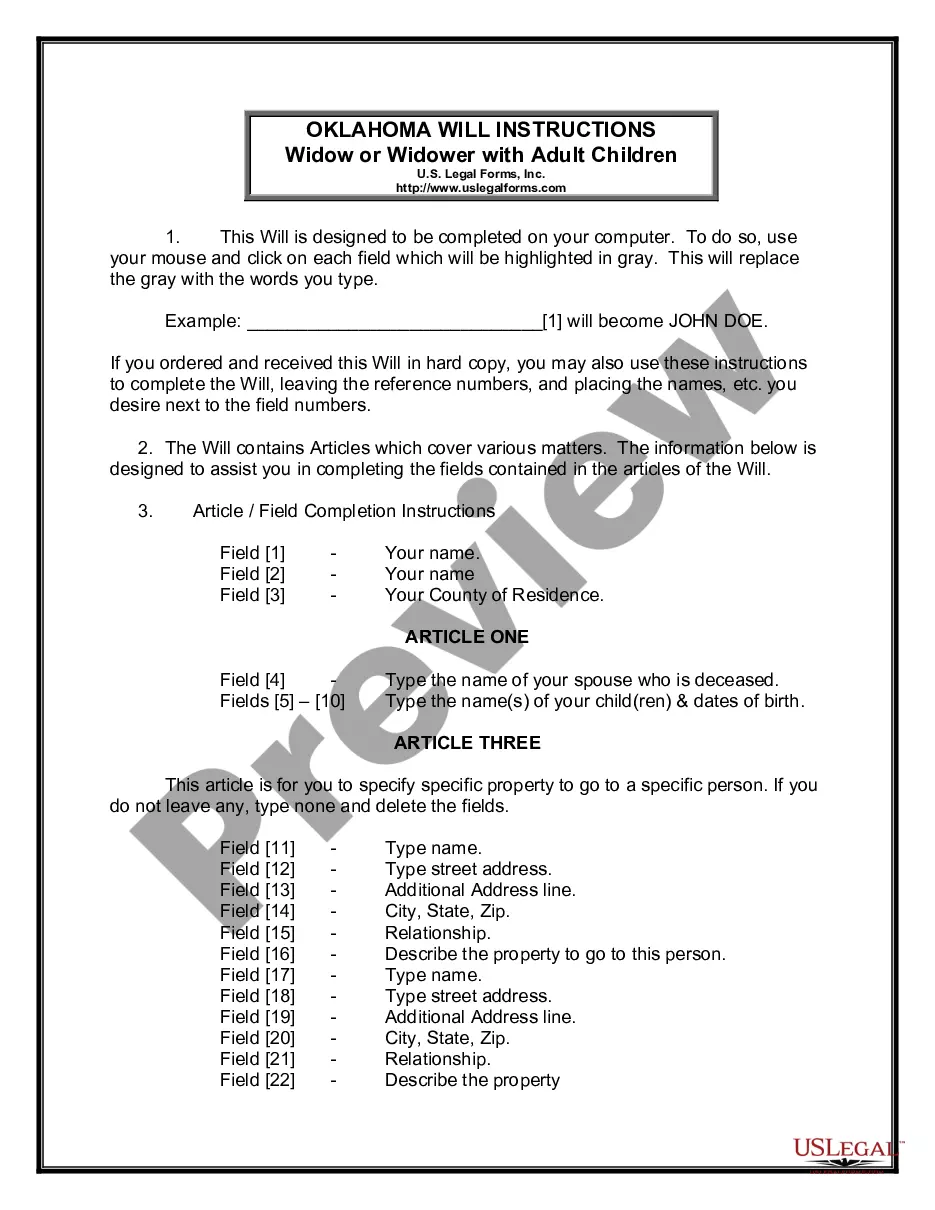

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most vital collections of legal documents in the USA - offers a variety of legal template formats that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest forms such as the Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor in just a few seconds.

Review the form description to ensure it meets your requirements.

If the form does not fulfill your needs, use the Search box at the top of the page to find the one that does.

- If you have a monthly subscription, Log In to download the Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor from your US Legal Forms library.

- The Download option will be available for every form you review.

- You have access to all previously acquired forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your area/county.

- Choose the Preview option to review the content of the form.

Form popularity

FAQ

To hire an independent contractor, you will need a signed agreement specifying the work and payment details. You may also require a W-9 form for tax purposes and to track payments made. Using an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor ensures you cover all necessary documentation in one cohesive agreement.

Creating an independent contractor agreement involves outlining the project's scope, payment terms, and deadlines. You'll want to include specifics about services, confidentiality, and termination conditions. Leveraging templates for an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor can make this process easier and more efficient.

When employing an independent contractor, you need to have a clear contract or agreement in place. This agreement should specify the scope of work, payment terms, and deadlines. Utilizing an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor can streamline this process and ensure all necessary documentation is handled correctly.

Independent contractors must meet certain legal requirements, including compliance with tax regulations and proper licensing where applicable. They should not be treated like employees, which means different benefits and protections apply. Signing an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor can solidify this understanding and outline your responsibilities.

In Ohio, self-employed individuals are generally not required to carry workers' compensation insurance. However, if you employ others, even on a contract basis, you may need coverage. Understanding your obligations under the Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor can help clarify any necessary protections.

An independent contractor commonly fills out a W-9 form to provide their taxpayer information. Additionally, you may need to complete the 1099-MISC form for reporting payments made. It's crucial to keep your records organized, especially when working under an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor.

Choosing between payroll and 1099 status depends on your personal and professional goals. Being on payroll provides stability and access to benefits like health insurance and retirement plans, while a 1099 status offers greater independence and the freedom to choose your clients. The Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor clearly defines your working conditions, ensuring you have the tools you need to make the best choice for your circumstances. Ultimately, consider your lifestyle and financial needs when making this decision.

Independent contractors are typically not considered employees and, therefore, are not on payroll in the traditional sense. Instead, they receive payments through invoices or agreements like the Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor. This type of arrangement allows for more flexibility in how you earn income and manage your taxes. It's important to keep records for accurate reporting and to maintain your self-employed status.

Yes, as a self-employed individual, you can have a contract. In fact, an Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor is essential for outlining the terms of your working relationship. This contract helps clarify expectations, payment terms, and the scope of your work, ensuring both parties understand their responsibilities. Using a well-crafted agreement minimizes misunderstandings and protects your interests.

An independent contractor typically needs to fill out a W-9 form, which provides their Taxpayer Identification Number to the hiring entity. Additionally, depending on the state, there may be other forms relevant to the agreement or tax reporting. The Ohio Payroll Specialist Agreement - Self-Employed Independent Contractor can help clarify necessary forms and compliance requirements, ensuring you don’t overlook any vital documentation.