Ohio Self-Employed Referee Or Umpire Employment Contract

Description

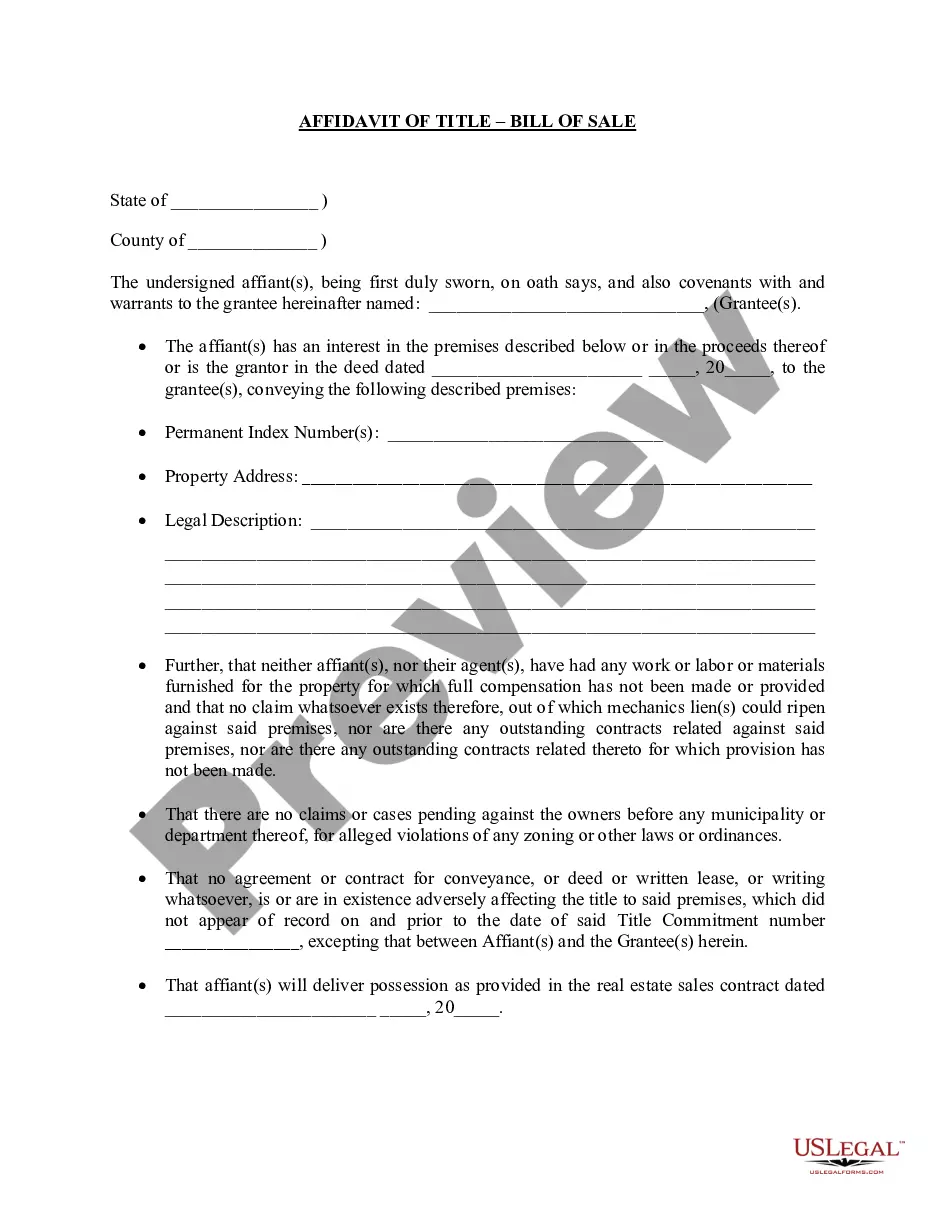

How to fill out Self-Employed Referee Or Umpire Employment Contract?

US Legal Forms - one of the most important collections of legal documents in the USA - provides a selection of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Ohio Self-Employed Referee Or Umpire Employment Contract in just minutes.

If you have a subscription, Log In and obtain the Ohio Self-Employed Referee Or Umpire Employment Contract from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you begin: Ensure you have selected the correct form for your city/state. Click the Preview button to examine the contents of the form. Review the form details to confirm that you have selected the appropriate form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to create an account. Process the purchase. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Ohio Self-Employed Referee Or Umpire Employment Contract. Each template you added to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you want. Gain access to the Ohio Self-Employed Referee Or Umpire Employment Contract with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In Ohio, whether you need a license as an independent contractor varies based on the type of work you perform. For someone working under an Ohio Self-Employed Referee Or Umpire Employment Contract, specific licensing or certifications may be necessary, especially for officiating sports. Always check local regulations and requirements to ensure compliance. The uslegalforms platform can assist you in understanding any licensing nuances related to your employment.

Self-employed individuals in Ohio can access unemployment benefits under specific circumstances. For example, if you have a valid Ohio Self-Employed Referee Or Umpire Employment Contract, and you experience a significant loss of income due to a qualifying event, you may qualify for benefits. It’s essential to document your income and employment status accurately. To navigate the application process, consider using resources like the uslegalforms platform for guidance.

Generally, 1099 employees, classified as independent contractors in Ohio, do not qualify for traditional unemployment benefits. This is because they are not considered employees under state law, limiting their access to those benefits. However, if you have an Ohio Self-Employed Referee Or Umpire Employment Contract, you may explore options such as pandemic unemployment assistance during certain circumstances. Always check with local resources for the most current information and assistance.

In Ohio, the main difference between an employee and an independent contractor lies in the level of control and independence. Employees work under the direction of their employers, who dictate the hours, tasks, and work methods. In contrast, independent contractors, like those creating an Ohio Self-Employed Referee Or Umpire Employment Contract, enjoy more autonomy in how they complete their work. This distinction impacts tax obligations and benefits eligibility.

Yes, referees are typically considered self-employed, especially when they manage their own officiating contracts. They have the autonomy to accept jobs from various organizations and can establish their own work practices. Utilizing an Ohio Self-Employed Referee Or Umpire Employment Contract can provide clarity in these arrangements and protect their interests.

Being self-employed means you run your own business and earn income without being an employee of someone else. For referees, this might include officiating sports events, billing clients directly, and managing their own schedule. An Ohio Self-Employed Referee Or Umpire Employment Contract can serve as a valuable asset in outlining the terms of your self-employment.

As a referee, you can write off various expenses on your taxes to maximize your deductions. Common write-offs include travel costs to games, uniform purchases, and training expenses. Keeping track of these expenditures is crucial, and using an Ohio Self-Employed Referee Or Umpire Employment Contract can help streamline your financial records.

Yes, a referee can be self-employed, depending on how they operate in their field. They often work under their own terms and can set their own schedule and rates. This flexibility allows referees to engage in multiple events and contracts, making it essential to manage an Ohio Self-Employed Referee Or Umpire Employment Contract.

Yes, umpires are typically classified as independent contractors. They often engage in an Ohio Self-Employed Referee Or Umpire Employment Contract with the leagues they officiate for. This allows umpires to manage their work independently while ensuring that they meet specific criteria and obligations outlined in their contracts.

An independent contractor is someone who provides services to another entity while retaining control over how those services are performed. Athletes, including referees and umpires, often fit this definition as they operate under an Ohio Self-Employed Referee Or Umpire Employment Contract. This contract outlines the nature of their work while affirming their status as independent workers.