Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

Are you in a situation where you require documents for either business or personal purposes almost every time.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of template options, including the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor, designed to meet state and federal standards.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the template you need and ensure it is for the correct area/county.

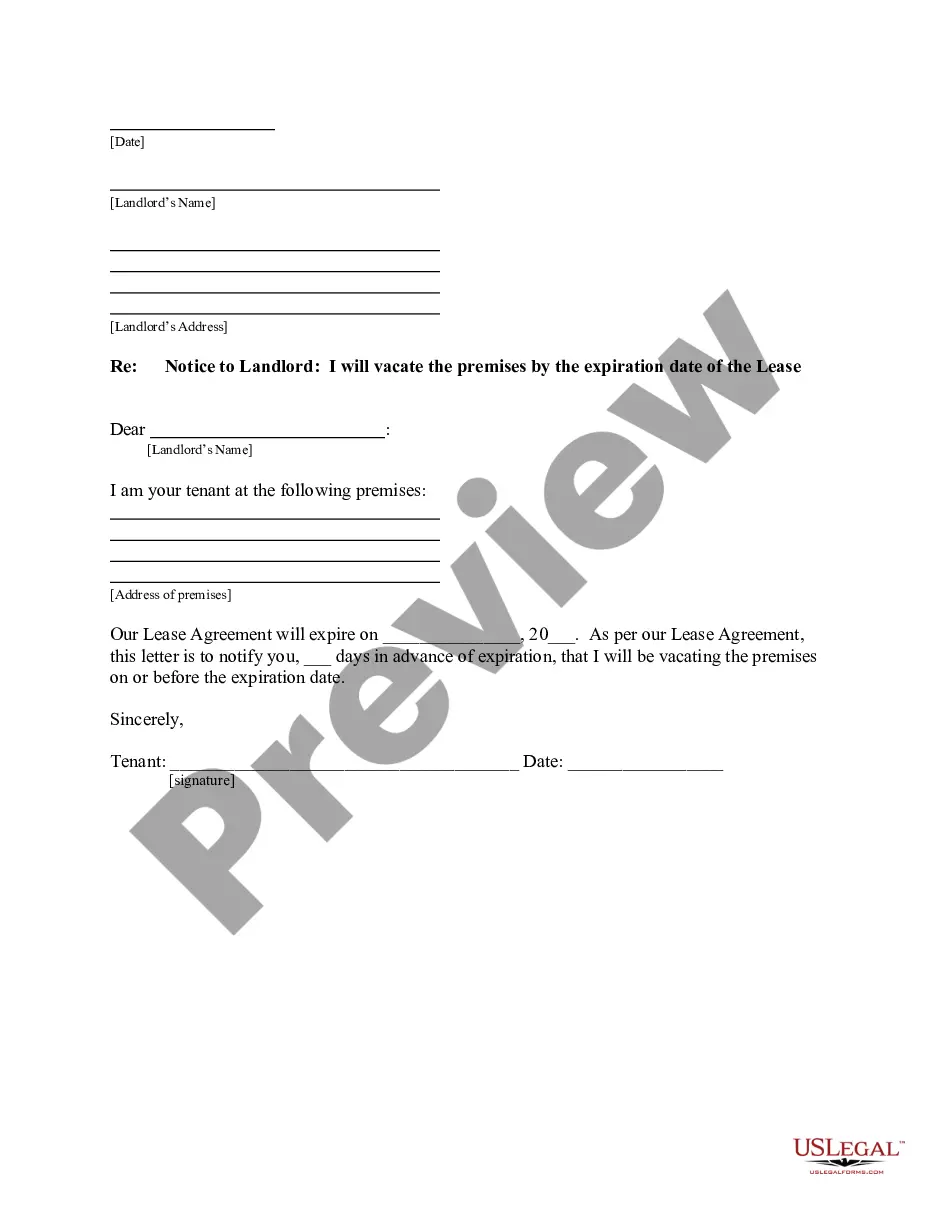

- Use the Review button to examine the document.

- Check the description to ensure you have selected the right template.

- If the template is not what you are looking for, use the Search field to find the document that meets your needs and specifications.

- Once you locate the appropriate template, click on Acquire now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for your order with your PayPal or credit card.

- Choose a convenient file format and download your version.

- Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor at any time if needed. Just navigate to the desired template to download or print the document.

- Utilize US Legal Forms, the largest collection of legal templates, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

Form popularity

FAQ

Independent contractors in Ohio must be mindful of their tax obligations. You will be responsible for reporting and paying both state and federal taxes, including self-employment tax. It is essential to keep accurate records of your earnings related to your Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor. Consulting with a tax professional can also help you navigate deductions and ensure compliance with all tax laws.

In Ohio, the necessity of a license for independent contractors depends on the specific type of work being performed. Generally, many fields do not require a special license, but certain professions may have specific licensing requirements. For those in the translation and interpretation field, utilizing the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor ensures you meet all contractual obligations even if a formal license is not needed. To be safe, always check local regulations for any requirements related to your specific services.

Yes, an interpreter can operate as an independent contractor in Ohio. Many interpreters choose this path to enjoy the flexibility of setting their own schedules and selecting their clients. By utilizing an Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor, they can outline their roles clearly, which helps establish professional relationships and expectations. This framework not only benefits the interpreter but also provides clarity for clients.

To work as an independent contractor in Ohio, you must meet certain legal requirements. First, you should have a clear agreement with your clients, such as the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor, detailing the project's scope and payment terms. Additionally, you should ensure compliance with tax regulations and maintain proper business licenses. Lastly, familiarity with relevant industry regulations can help you operate smoothly.

To write an Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor, start by outlining the key components. Include the names of both parties, the services to be provided, compensation details, and any deadlines. It's essential to specify the independent nature of the contractor's work to clarify that they are not an employee. Using a platform like USLegalForms can simplify this process, providing templates that ensure legal compliance and clarity.

Creating an independent contractor agreement is essential for establishing clear terms of engagement. Begin by defining the parties involved, specifying your role as a translator or interpreter and the details of the job. Next, outline the services to be provided, payment terms, and any confidentiality clauses relevant to your work. Utilizing a platform like USLegalForms can simplify the process, helping you generate a solid Ohio Translator and Interpreter Agreement - Self-Employed Independent Contractor that meets legal standards.

Yes, you can be a freelance translator as long as you meet the necessary qualifications and requirements. This allows you to work independently, and you can use the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor to outline your service terms. Many freelance translators thrive by offering specialized language services to clients, giving you the freedom to set your own rates and hours. Utilizing platforms like USLegalForms can help simplify your contracting process.

To fill out an independent contractor agreement, you should start by providing your personal information and that of the client. Specify the services you will offer and the payment terms. It's important to reference the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor as it details the responsibilities of both parties. Review, sign, and store the agreement for future reference.

Filling out an independent contractor form starts with gathering accurate information about your work. Make sure to include your name, address, and contact details. Then, clearly outline the scope of services you will provide, referencing the Ohio Translator And Interpreter Agreement - Self-Employed Independent Contractor for additional guidance. Finally, sign and date the form to make it official.