Ohio Lab Worker Employment Contract - Self-Employed

Description

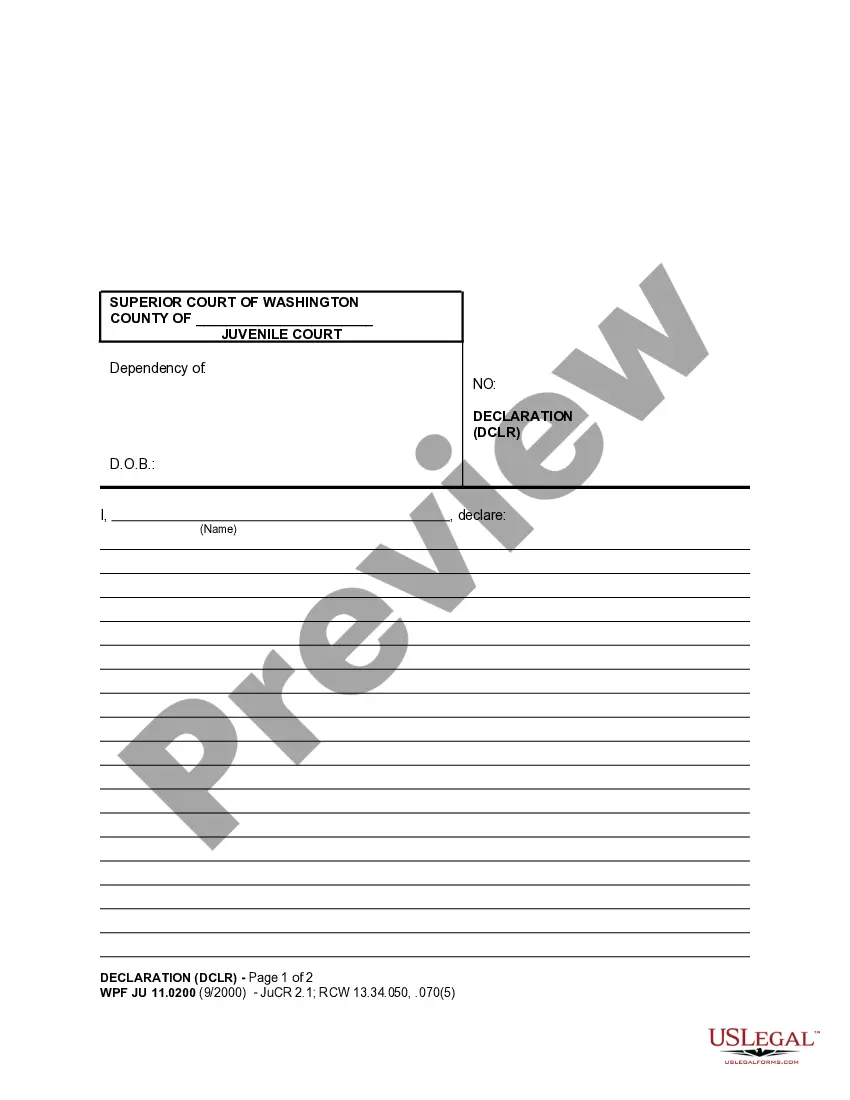

How to fill out Lab Worker Employment Contract - Self-Employed?

You might spend hours online attempting to locate the valid document template that meets the federal and state standards you require. US Legal Forms offers a multitude of valid forms that can be reviewed by specialists.

You can obtain or create the Ohio Lab Worker Employment Contract - Self-Employed from my service. If you have a US Legal Forms account, you can Log In and click the Download button. Afterward, you can complete, modify, print, or sign the Ohio Lab Worker Employment Contract - Self-Employed. Each valid document template you purchase is yours permanently.

To obtain another copy of the purchased form, navigate to the My documents section and click the respective button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have selected the right form. If available, utilize the Review button to preview the document template simultaneously.

- If you wish to obtain another version of the form, use the Search area to find the template that meets your needs and specifications.

- Once you have identified the template you desire, click Acquire now to continue.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the valid form.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, alter, and sign and print the Ohio Lab Worker Employment Contract - Self-Employed.

- Download and print numerous document templates using the US Legal Forms site, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Independent contractors in Ohio are typically not required to carry workers' compensation insurance. However, it's important to evaluate the specific risks involved with your work. If you are working under an Ohio Lab Worker Employment Contract - Self-Employed, consider discussing insurance options to protect yourself against potential work-related injuries.

Yes, all 1099 employees are classified as self-employed. They receive a 1099 form for tax purposes, indicating that they are not under standard employment agreements. Often working under contracts like an Ohio Lab Worker Employment Contract - Self-Employed, these individuals manage their own taxes and benefits.

Yes, a self-employed individual can certainly have a contract. In fact, an Ohio Lab Worker Employment Contract - Self-Employed is often essential for formalizing the terms of service. This contract protects both parties and clarifies expectations regarding payments and responsibilities.

While 'contract' and 'self-employed' are closely related, they are not exactly the same. Contract workers operate based on agreements, such as an Ohio Lab Worker Employment Contract - Self-Employed, which defines their relationship with clients. Self-employment encompasses a broader range of activities, including freelancing and consulting.

Contract work can be classified as a form of employment, albeit a different type than traditional jobs. When you engage in contract work under an Ohio Lab Worker Employment Contract - Self-Employed, you maintain the right to set your own schedule and work environment. This unique structure provides both advantages and challenges compared to standard employment.

Absolutely, contract workers are indeed considered self-employed. They enter contracts and provide services independently, often governed by an Ohio Lab Worker Employment Contract - Self-Employed. This distinction allows them the freedom to choose their projects and control their workload.

In Ohio, not all independent contractors require a specific license to operate. However, it’s vital to check local regulations relevant to your specific field. An Ohio Lab Worker Employment Contract - Self-Employed can help clarify any additional requirements you may need to meet.

Yes, contract employees are generally considered self-employed. They often operate under an Ohio Lab Worker Employment Contract - Self-Employed, allowing them more flexibility in their work. This means they are responsible for managing their own taxes and benefits, in contrast to traditional employees.

In some circumstances, self-employed individuals in Ohio may qualify for unemployment benefits. The eligibility largely depends on your contributions to state unemployment insurance and the nature of your work. Using tools like an Ohio Lab Worker Employment Contract - Self-Employed can help you understand your rights and obligations regarding unemployment claims.

While it may seem unusual, creating a private contract with yourself can clarify your personal business arrangements. An Ohio Lab Worker Employment Contract - Self-Employed can guide this process and set clear terms for your business operations. Use it as a tool to stay organized and accountable in your self-employment journey.