Ohio Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

You might spend numerous hours online attempting to locate the official document template that meets the federal and state requirements you require.

US Legal Forms offers a vast array of official forms that are evaluated by experts.

You can obtain or create the Ohio Oil Cleanup Services Contract - Self-Employed from their service.

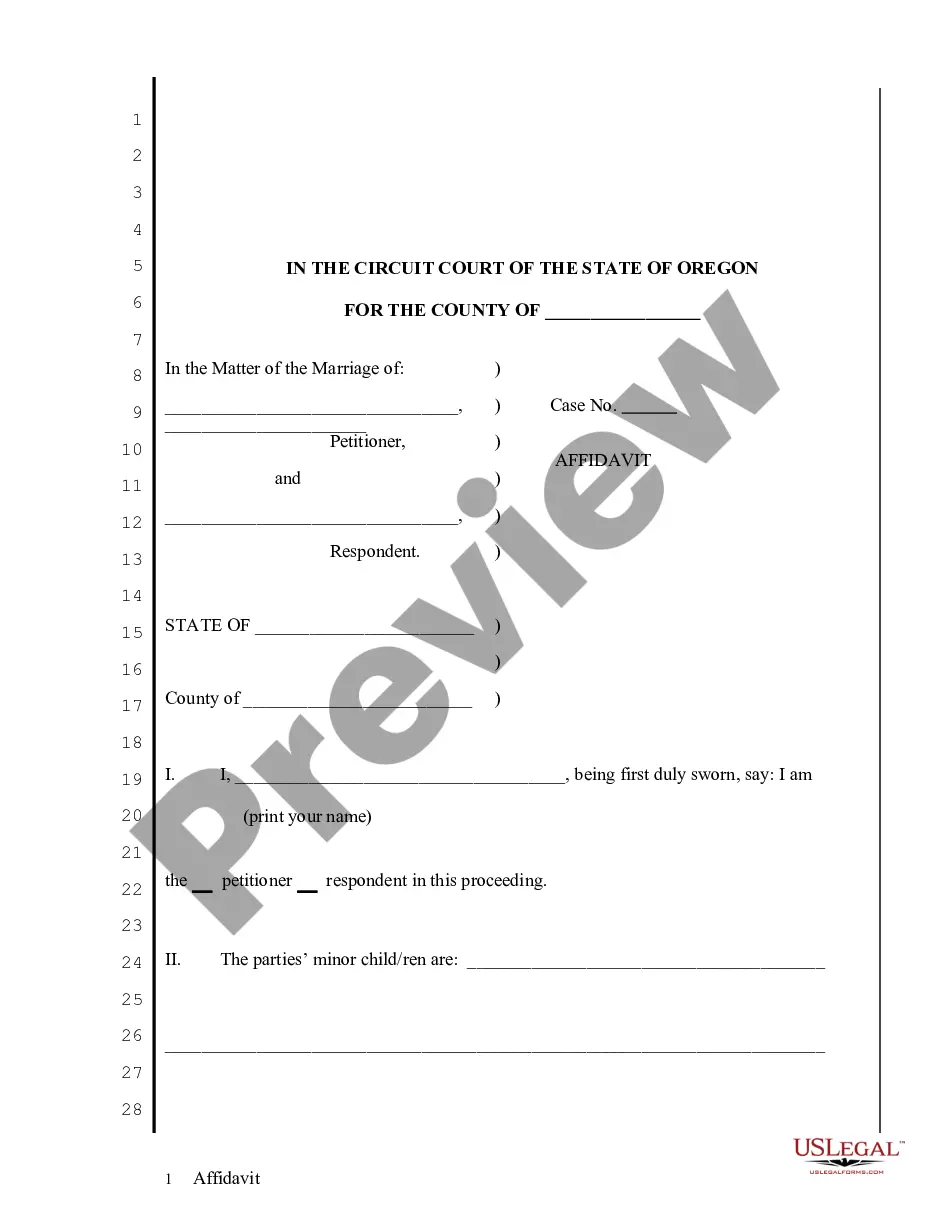

If available, use the Preview button to also look at the document template. If you wish to find another version of the form, utilize the Search field to locate the template that meets your needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Ohio Oil Cleanup Services Contract - Self-Employed.

- Each official document template you obtain is yours permanently.

- To access another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/region you choose.

- Review the form summary to confirm you have selected the appropriate form.

Form popularity

FAQ

House cleaning can often be classified as a form of janitorial service, depending on the scope of work. However, the tax implications and legal requirements may differ. For your Ohio Oil Cleanup Services Contract - Self-Employed, clarifying the classification of your services can streamline operations and compliance with state regulations.

Yes, Ohio imposes sales tax on certain cleaning services. If your services include cleaning that improves or alters property, there is likely a sales tax applicable. It’s crucial to be aware of these details when managing your finances under the Ohio Oil Cleanup Services Contract - Self-Employed to avoid unexpected costs.

Yes, self-employment income is taxable in Ohio just like any other form of income. If you’re making a living under the Ohio Oil Cleanup Services Contract - Self-Employed, you are responsible for reporting your income and paying the applicable taxes. Keep accurate records of your earnings to ensure proper tax filings and avoid penalties.

In Ohio, whether cleaning fees are taxable depends on the services provided. If the fees are associated with items or equipment that provide a benefit, they may incur sales tax. When considering your Ohio Oil Cleanup Services Contract - Self-Employed, be clear about which aspects of your service may attract taxes to maintain compliance.

Cleaning services in Ohio can be subject to sales tax if they involve tangible personal property. For those operating under the Ohio Oil Cleanup Services Contract - Self-Employed, understanding which services are taxable can help in proper billing and compliance. Thus, it is advisable to stay informed about the changing tax laws in the state.

Ohio Revised Code 5301.332 pertains to the recording of certain types of contracts and claims regarding real property. For contractors working under the Ohio Oil Cleanup Services Contract - Self-Employed, awareness of this statute can aid in legal compliance and property documentation. Make sure to review this code to protect your rights and clarify your standing.

In Ohio, maintenance services may be taxable depending on the nature of the service. If your service involves tangible personal property or any improvements to real property, it could fall under sales tax regulations. It's essential to understand these specifics, especially when navigating the Ohio Oil Cleanup Services Contract - Self-Employed.

In Ohio, an operating agreement is not legally required for all businesses; however, it is highly recommended for those who are self-employed. This document outlines the structure and management of your business, which is vital for Ohio Oil Cleanup Services Contract - Self-Employed. Having a clear agreement can help you avoid misunderstandings and establish operational guidelines.

If you witness or experience an oil spill in Ohio, it is crucial to act swiftly and report it to the appropriate authorities. You can contact the Ohio Environmental Protection Agency (EPA) or local emergency services to initiate the reporting process. Providing specific details about the location and nature of the spill can help ensure a prompt response. Utilizing resources like the US Legal Forms platform can guide you through the necessary steps and documentation required for effective reporting.