Ohio Payroll Deduction Authorization Form for Optional Matters - Employee

Description

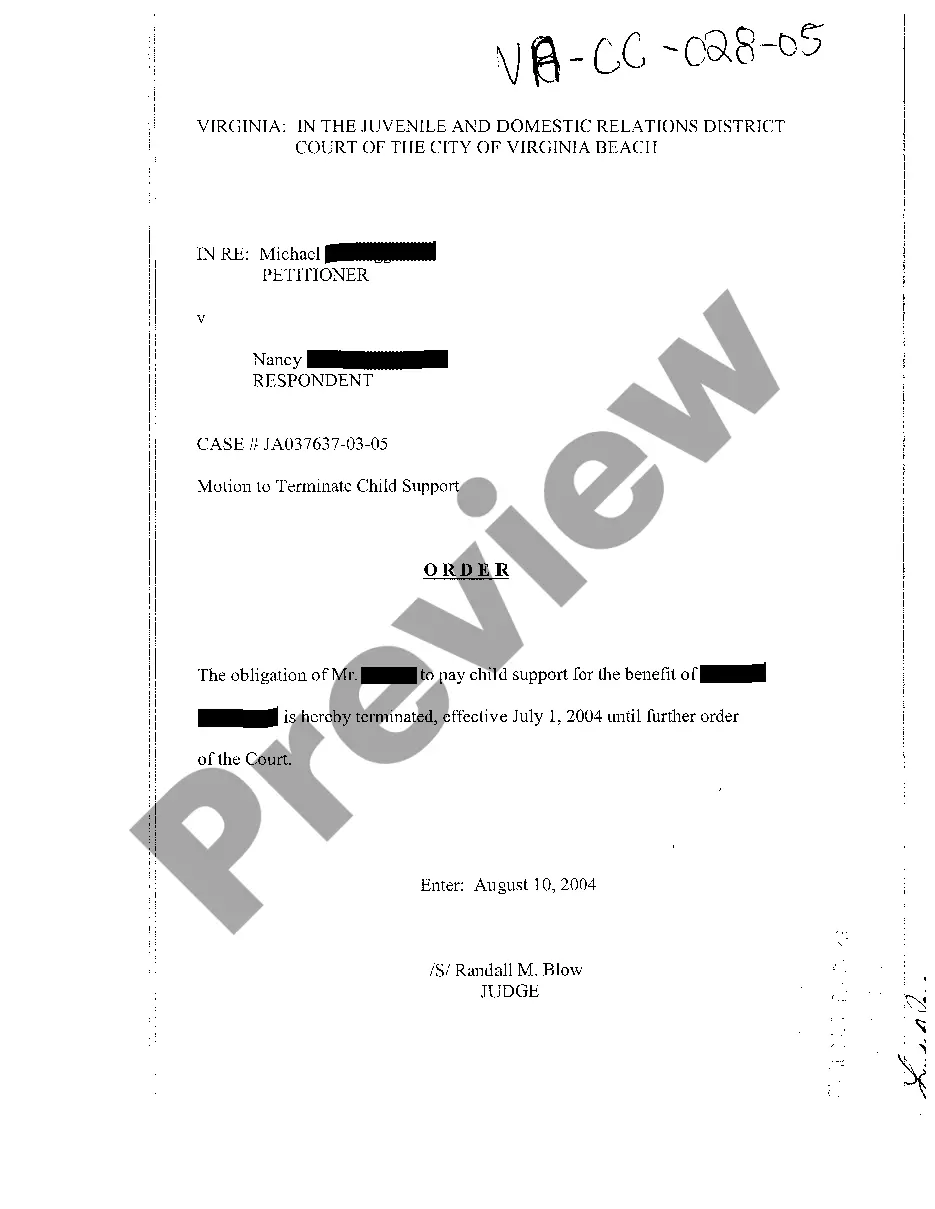

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

US Legal Forms - one of the most extensive repositories of legal documents in the United States - provides a broad selection of legal document templates that you can download or generate.

By utilizing the website, you will find numerous documents for business and personal use, categorized by types, states, or keywords. You can obtain the latest versions of documents such as the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee in mere moments.

If you currently hold a monthly subscription, Log In and retrieve the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded documents in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device.Edit. Fill, modify, and print and sign the downloaded Ohio Payroll Deduction Authorization Form for Optional Matters - Employee. Each template added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form’s content.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, choose your preferred pricing plan and provide your details to register for the account.

Form popularity

FAQ

The Ohio 942 form is used for reporting income tax withheld from employees' paychecks. This form ensures that employers comply with state tax laws and accurately report their withholding amounts. When completing the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, it is beneficial to understand how your optional deductions may influence the reporting on the Ohio 942 form, ensuring clarity and compliance.

Being exempt from Ohio withholding means that an employee does not have state income tax withheld from their paycheck. This status can apply to individuals who meet specific criteria outlined by tax regulations. When filling out the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, you can declare your exemption status, ensuring that your payroll accurately reflects your tax obligations.

An example of an optional payroll deduction is a contribution to a 401(k) retirement plan. Employees can opt to set aside a portion of their earnings for future retirement needs. It is essential to use the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee to declare your participation in such programs, allowing you to save securely for the future.

Optional deductions are amounts subtracted from an employee's paycheck that the employee chooses to enroll in voluntarily. These deductions can cover various benefits, such as life insurance, disability insurance, or contributions to savings plans. When you complete the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, you can specify which optional deductions you prefer, ensuring that your financial needs are met.

Optional deductions include contributions to retirement accounts, health savings accounts, and voluntary insurance premiums. Each of these deductions is chosen by the employee and not mandated by law. Understanding these options is important when filling out the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, as it helps you take control of your deductions.

Payroll deduction refers to the process where an employer automatically removes specific amounts from an employee's paycheck to cover various expenses. This could include taxes, benefits, or voluntary contributions. Understanding how to navigate this process through the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee can help you stay organized and informed about your finances.

A payroll deduction authorization form is a key document that employees use to specify the deductions they would like to authorize. This form includes information about the types and amounts of deductions, helping to facilitate accurate payroll processing. By completing the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, you take control of your payroll deductions with confidence.

A payroll deduction agreement is a formal document that stipulates the terms under which deductions will be made from an employee's salary. This agreement protects both the employee's wishes and the employer's compliance practices. Utilizing the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee helps ensure that all parties understand their roles in this process.

A wage authorization form is a document that employees submit to approve deductions from their wages. It outlines details like the amount and type of deduction, ensuring clarity between the employer and employee. Using the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee makes it easy to formalize these agreements and prevents any misunderstandings.

Payroll deduction authorization means an employee gives permission for specific amounts to be removed from their paychecks. This process can be applied to various deductions, such as retirement contributions or insurance payments. By completing the Ohio Payroll Deduction Authorization Form for Optional Matters - Employee, workers can manage their deductions effectively and maintain financial control.