Ohio Restated Limited Liability Company Agreement of LLC

Description

How to fill out Restated Limited Liability Company Agreement Of LLC?

Discovering the right legitimate papers design might be a have difficulties. Of course, there are plenty of web templates accessible on the Internet, but how do you discover the legitimate develop you require? Make use of the US Legal Forms website. The services delivers a large number of web templates, including the Ohio Restated Limited Liability Company Agreement of LLC, that you can use for company and private needs. All of the varieties are inspected by pros and meet up with state and federal requirements.

When you are currently registered, log in to the profile and click the Down load button to have the Ohio Restated Limited Liability Company Agreement of LLC. Utilize your profile to appear from the legitimate varieties you may have acquired in the past. Visit the My Forms tab of your profile and get yet another version from the papers you require.

When you are a whole new customer of US Legal Forms, listed here are basic instructions so that you can adhere to:

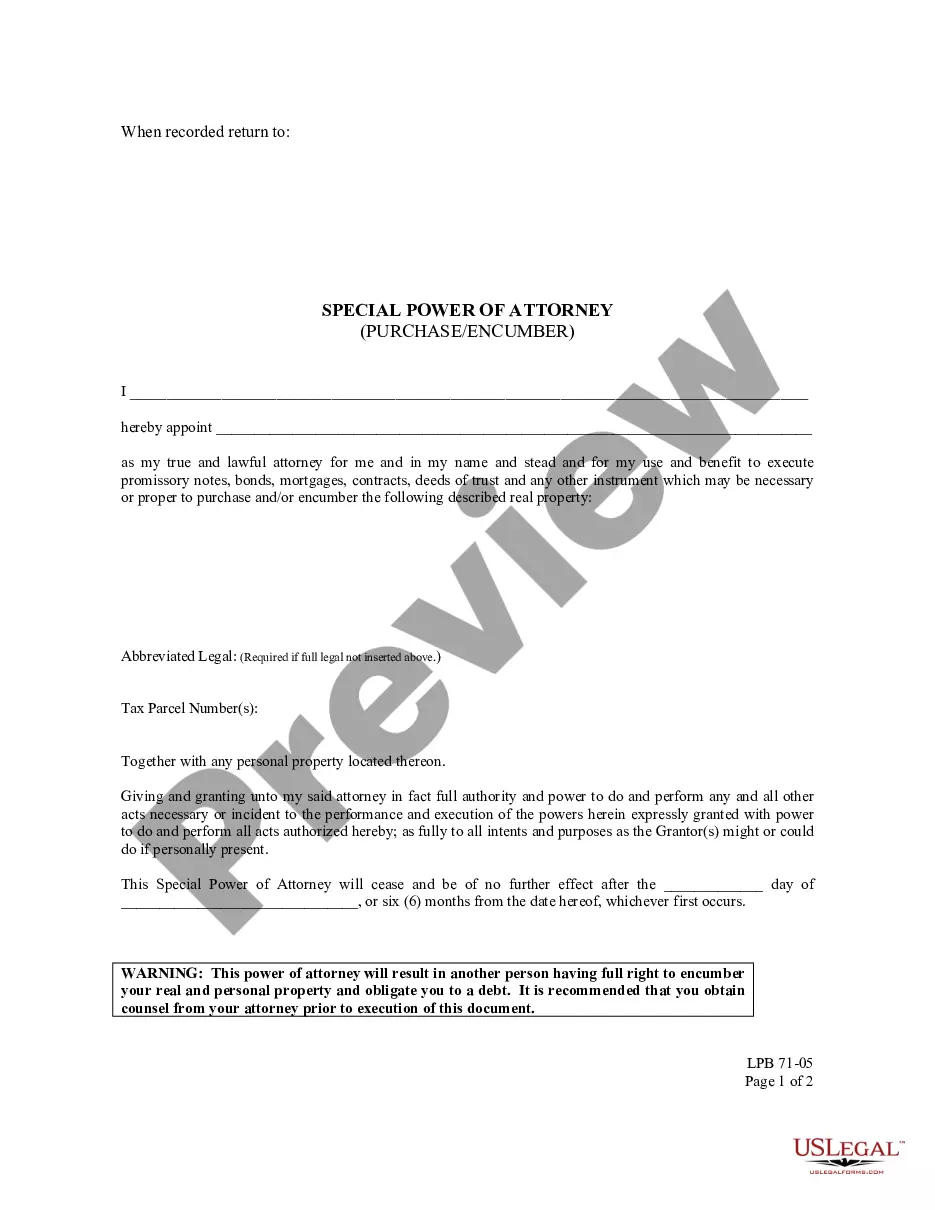

- Initial, be sure you have chosen the right develop for the area/county. It is possible to look through the form utilizing the Review button and study the form description to ensure it will be the right one for you.

- If the develop fails to meet up with your needs, make use of the Seach discipline to get the correct develop.

- When you are positive that the form is acceptable, go through the Buy now button to have the develop.

- Select the prices plan you want and type in the needed details. Make your profile and pay for the transaction utilizing your PayPal profile or credit card.

- Choose the file structure and download the legitimate papers design to the gadget.

- Total, revise and print and signal the received Ohio Restated Limited Liability Company Agreement of LLC.

US Legal Forms is definitely the greatest local library of legitimate varieties in which you can discover numerous papers web templates. Make use of the company to download expertly-manufactured papers that adhere to status requirements.

Form popularity

FAQ

To close an LLC in Ohio, you must undertake several steps. Close the LLC's Tax Accounts. All active LLCs have tax accounts with different departments under the state government. ... File Articles of Dissolution. ... Time Needed to Legally Dissolve an LLC. ... State Fees. ... Paying Bills. ... Filing Requirements.

To make amendments to your limited liability company in Ohio, you must provide the completed Domestic Limited Liability Company Certificate of Amendment or Restatement form (543a) to the Secretary of State by mail or in person.

No, it's not legally required in Ohio under § 176.081. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

5, "Notification of issolution or Surrender," is prescribed by the tax commissioner for the purpose of obtaining a certificate of tax clearance indicating that the taxes administered by the tax commissioner have been paid or an adequate guarantee that such taxes will be paid has been received by the department, and ...

No, there's no annual fee for an LLC in Ohio. Unlike the majority of the states, the government also doesn't require any annual report fee. However, you are expected to pay taxes such as commercial activity tax, withholding tax if you're paying employees, or sales and use tax if you're selling products.

In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Corporate taxpayers are required to file form D5 ?Notification of Dissolution or Surrender? with the Ohio Department of Taxation once a final return and payment are made.

How to Dissolve an LLC in Ohio in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

Is there a filing fee to dissolve or cancel a Ohio LLC? To dissolve your Limited Liability Company in Ohio, a filing fee of $50 is required. Checks should be made payable to ?Secretary of State.?