Ohio Accredited Investor Suitability

Description

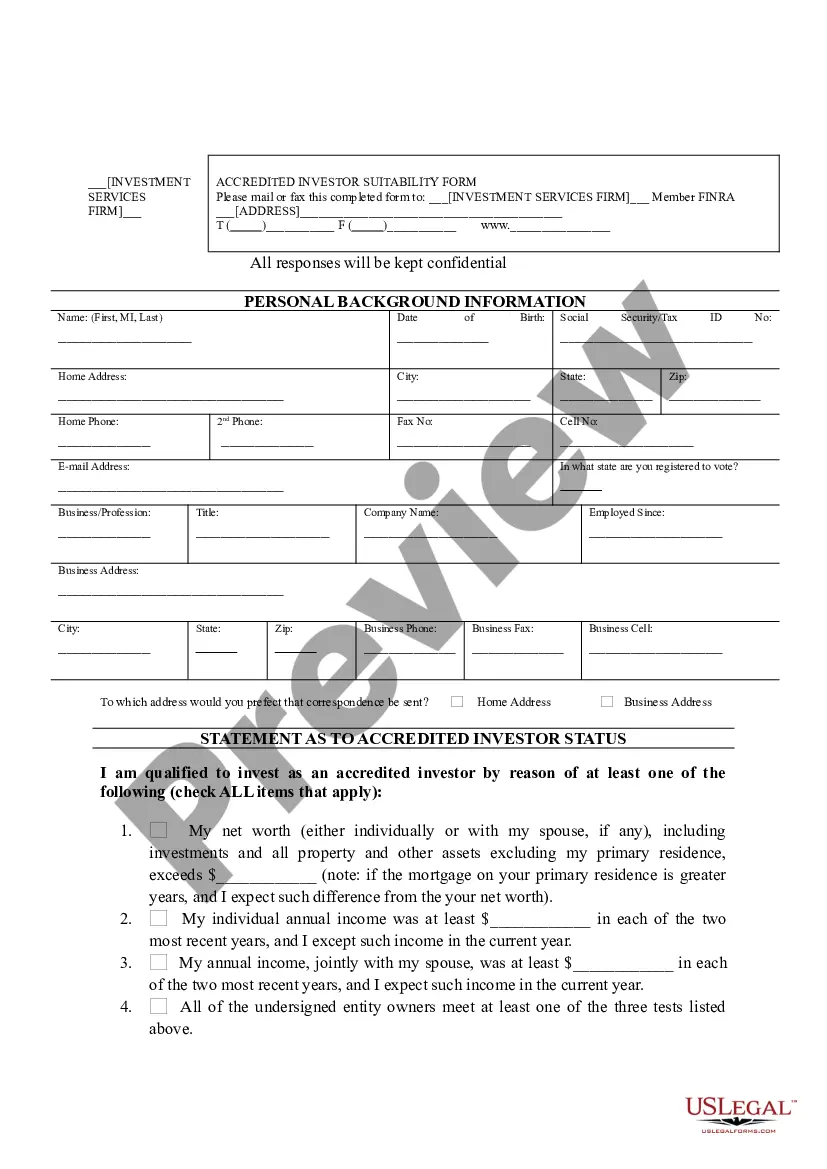

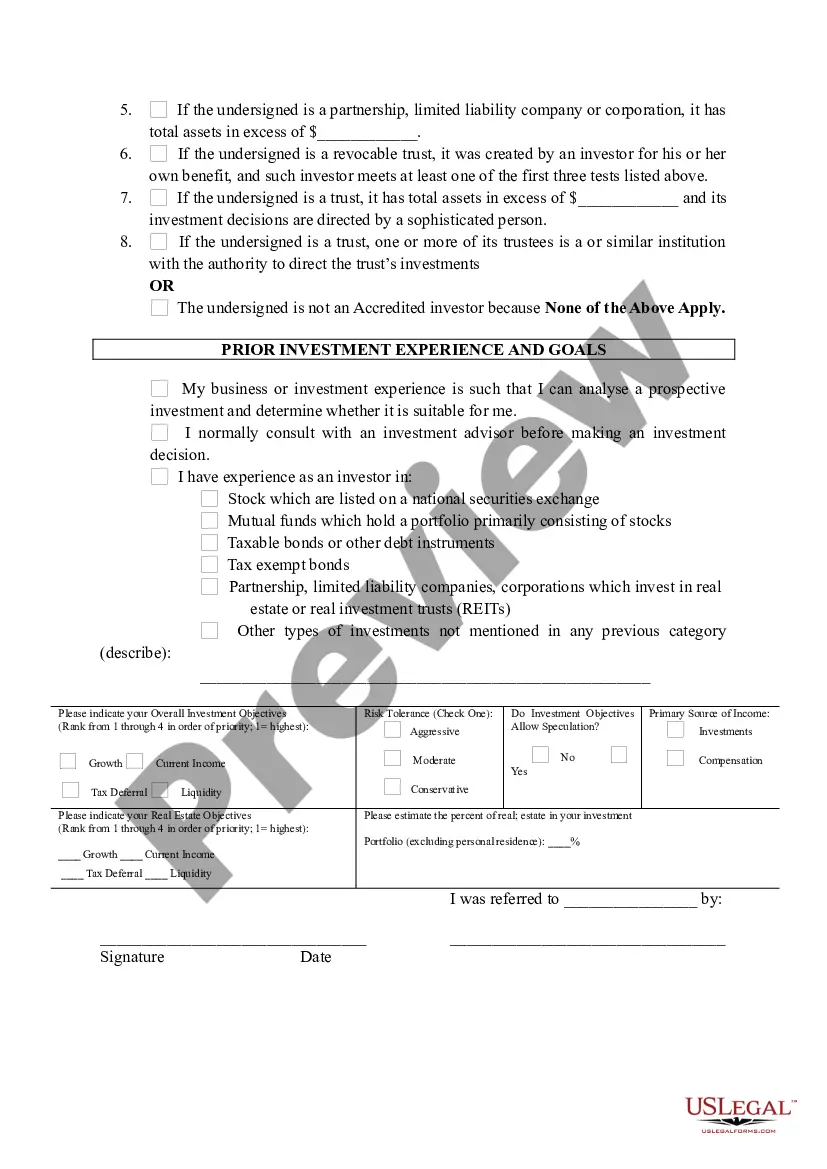

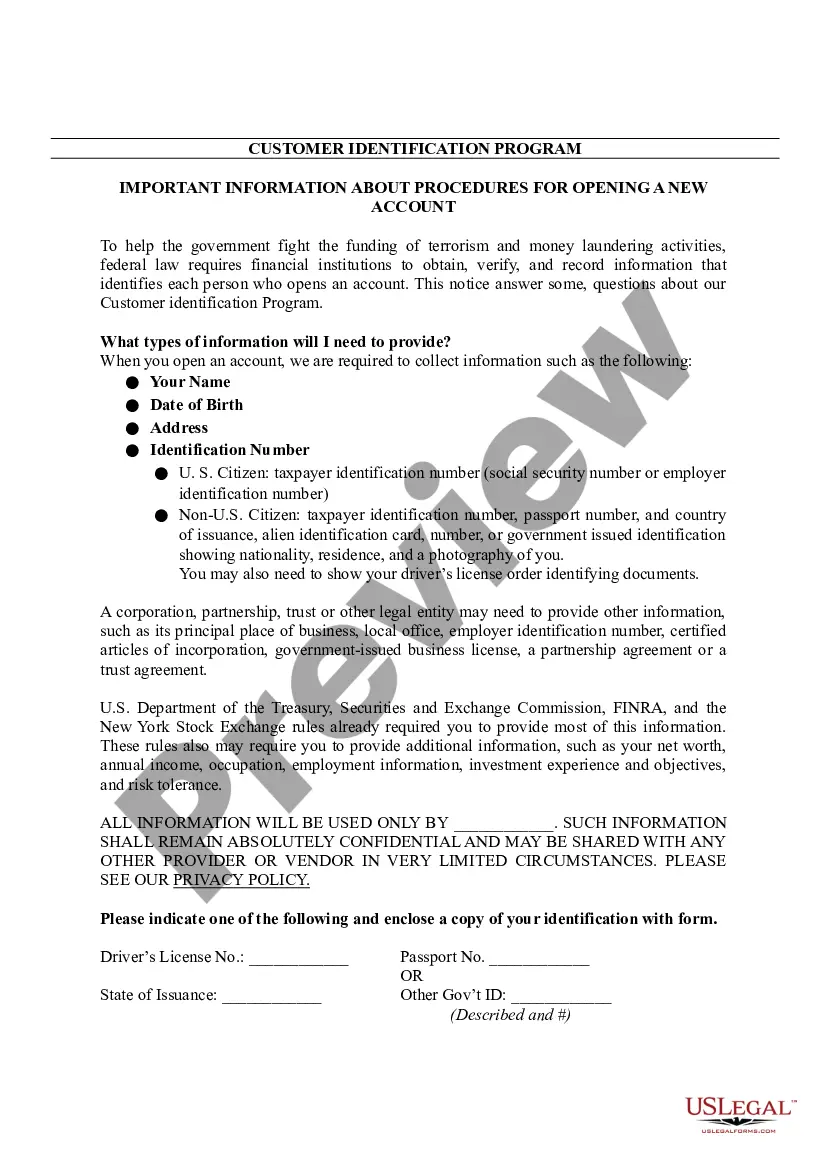

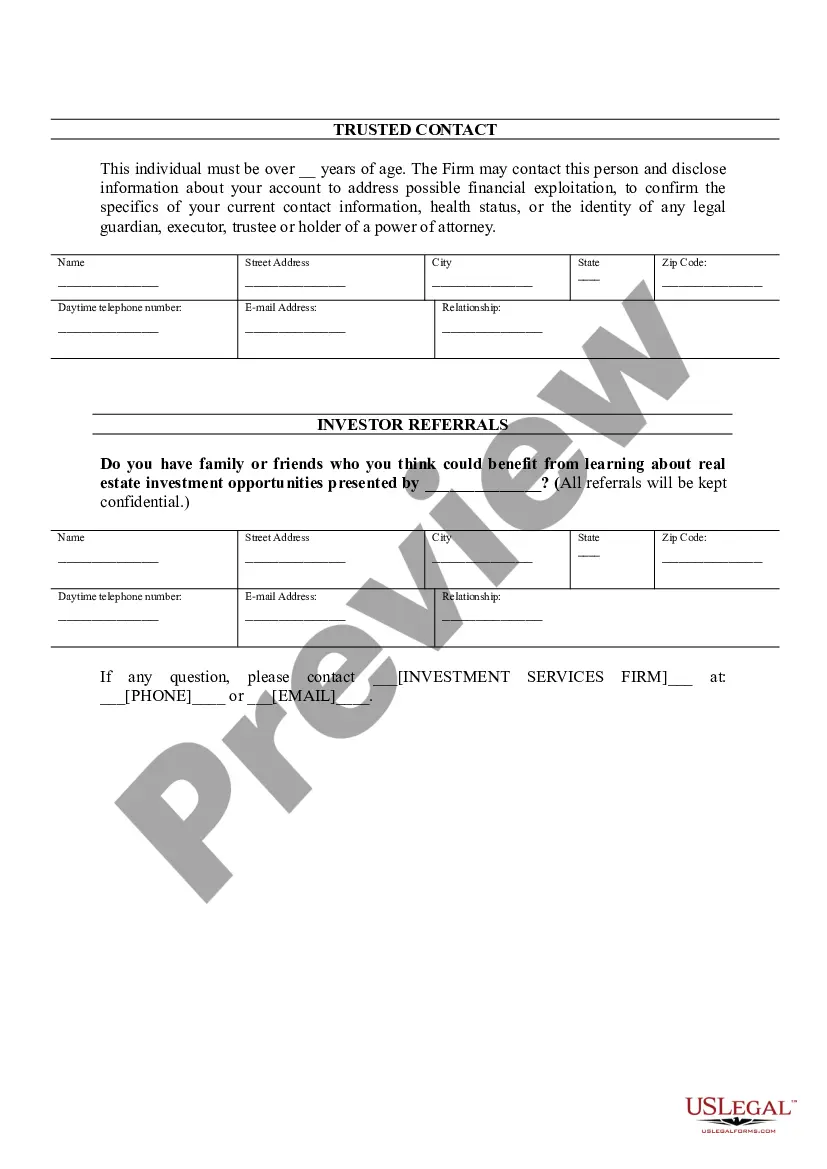

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

Have you been inside a situation where you will need documents for possibly enterprise or specific reasons just about every day? There are a variety of authorized file web templates available online, but discovering kinds you can rely isn`t straightforward. US Legal Forms gives 1000s of type web templates, such as the Ohio Accredited Investor Suitability, which can be written to satisfy federal and state needs.

In case you are already acquainted with US Legal Forms website and get a free account, simply log in. After that, you are able to download the Ohio Accredited Investor Suitability web template.

If you do not provide an profile and wish to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and ensure it is for your appropriate town/region.

- Take advantage of the Review button to examine the shape.

- See the explanation to ensure that you have selected the proper type.

- In case the type isn`t what you`re looking for, take advantage of the Search area to discover the type that meets your needs and needs.

- Whenever you get the appropriate type, just click Buy now.

- Opt for the prices plan you need, fill out the necessary information and facts to make your account, and buy the order making use of your PayPal or credit card.

- Select a convenient paper structure and download your backup.

Discover all the file web templates you have bought in the My Forms menus. You can get a extra backup of Ohio Accredited Investor Suitability anytime, if needed. Just click the essential type to download or produce the file web template.

Use US Legal Forms, one of the most considerable assortment of authorized kinds, to conserve some time and steer clear of mistakes. The service gives professionally produced authorized file web templates that can be used for a variety of reasons. Make a free account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Not all states license investment adviser representatives, but most of those that do require that the individual pass the Series 65 exam (or an equivalent), file an application, pay a fee, and comply with other requirements such as undergoing a background check.

If an IA is a sole proprietorship, the proprietor is not required to pay an IAR registration fee or file a Form U4. However, the proprietor must have passed the Series 65 examination or the Series 7 and 66 examinations since 2000, or the proprietor must possess one of the 5 recognized professional designations.

Who Needs a Series 65 License? Securities industry professionals seeking to charge a fee to provide investment advice as an investment adviser representative (IAR) are required by most state securities administrators to pass the Uniform Investment Adviser Law Exam, more commonly known as the Series 65 exam.

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

Certified Financial Planner (CFP) ? Hold a bachelor's degree, plus 3 years experience. Personal Financial Specialist (PFS) ? Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

The Series 63 (formally known as the Uniform Securities Agent State Law Examination) is a registered exam that is required of all potential registered representatives in most of the U.S. states. However, Colorado, District of Columbia, Florida, Louisiana, Maryland, Ohio, and Puerto Rico do not require the Series 63.

Applications for licensure must be submitted electronically using the IARD system. Items to be filed on IARD include Form ADV Parts 1A and 1B, Parts 2A and 2B, and wrap fee brochure, if applicable. These documents make up your firm's application.