Ohio Option Agreement

Description

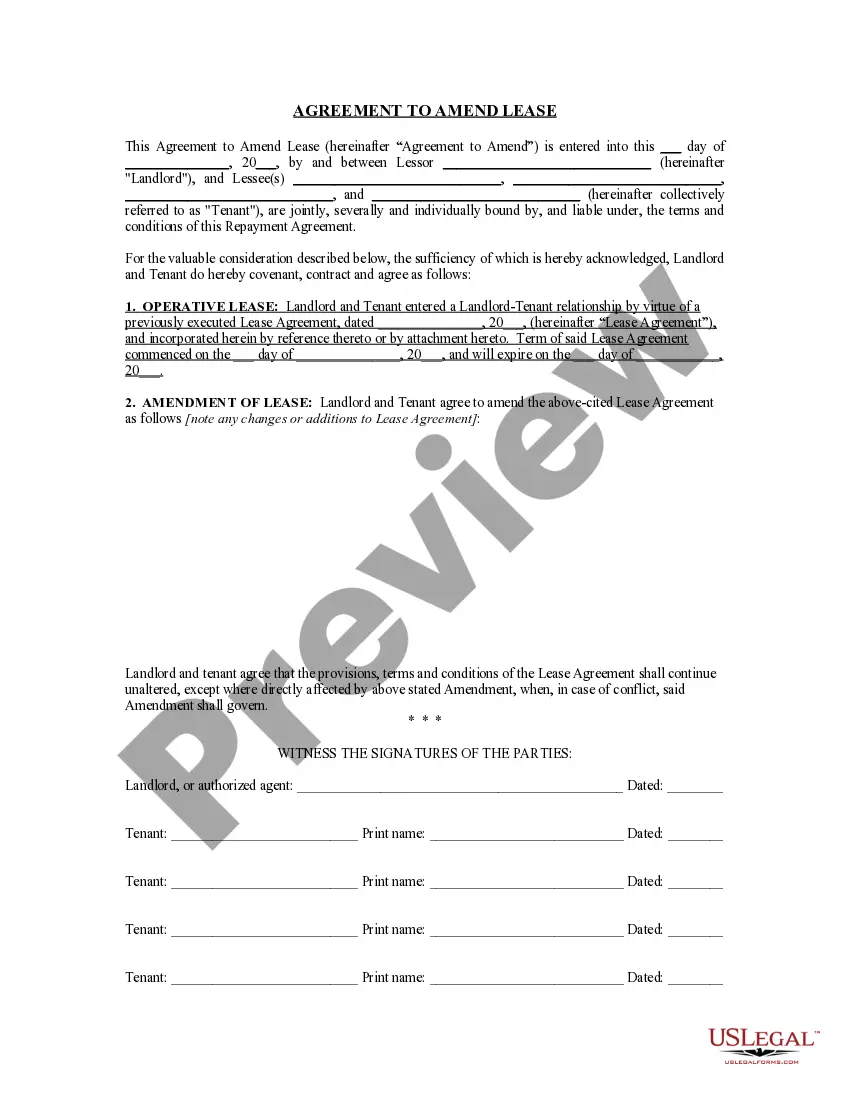

How to fill out Option Agreement?

You can devote hours on the Internet looking for the lawful document format that meets the federal and state requirements you need. US Legal Forms gives a huge number of lawful varieties which are analyzed by professionals. It is possible to download or print out the Ohio Option Agreement from our service.

If you already possess a US Legal Forms profile, you can log in and click on the Obtain button. Next, you can full, modify, print out, or sign the Ohio Option Agreement. Every lawful document format you purchase is your own for a long time. To acquire one more version of the obtained type, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms web site the very first time, follow the straightforward recommendations beneath:

- First, make certain you have chosen the correct document format for that state/metropolis of your choice. Look at the type outline to make sure you have selected the proper type. If readily available, use the Review button to check through the document format too.

- In order to find one more model of the type, use the Research industry to find the format that fits your needs and requirements.

- Upon having found the format you need, click Get now to carry on.

- Find the costs strategy you need, type your qualifications, and register for a free account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal profile to cover the lawful type.

- Find the formatting of the document and download it for your system.

- Make adjustments for your document if necessary. You can full, modify and sign and print out Ohio Option Agreement.

Obtain and print out a huge number of document templates making use of the US Legal Forms Internet site, that offers the largest collection of lawful varieties. Use specialist and condition-particular templates to take on your small business or individual demands.

Form popularity

FAQ

An Ohio rent-to-own agreement is a real estate document that combines a residential lease with a purchase agreement, giving tenants the prospect of buying the property at a designated period during or after the rental term.

Options are quoted in the price per share of stock, rather than the price to own an actual contract. For instance, the last quoted price on an option may be $1.25. To buy that contract, it would cost 100 shares per contract * 1 contract * $1.25, or $125.

An option agreement sets out a definitive timescale - and can also provide for an up-front payment as an incentive to the owner to create the opportunity. Your community body requires time to put together a funding package for a property acquisition and/or its subsequent development .

The amount of days we normally see for the option period is 7-10 days from the day the contract is fully signed by both parties. And the fee ranges anywhere from $150-300.

An option agreement is a contract between the owner of a property and a potential buyer, giving the buyer the right to serve notice upon the seller to sell the property either at an agreed price or at its market value. Often, the purchaser will pay the seller a fee for entering into an option agreement.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

An options contract is an agreement between two parties to facilitate a potential transaction involving an asset at a preset price and date. Call options can be purchased as a leveraged bet on the appreciation of an asset, while put options are purchased to profit from price declines.

An options contract is an agreement between two parties to facilitate a potential transaction on an underlying security at a preset price, referred to as the strike price, prior to or on the expiration date.