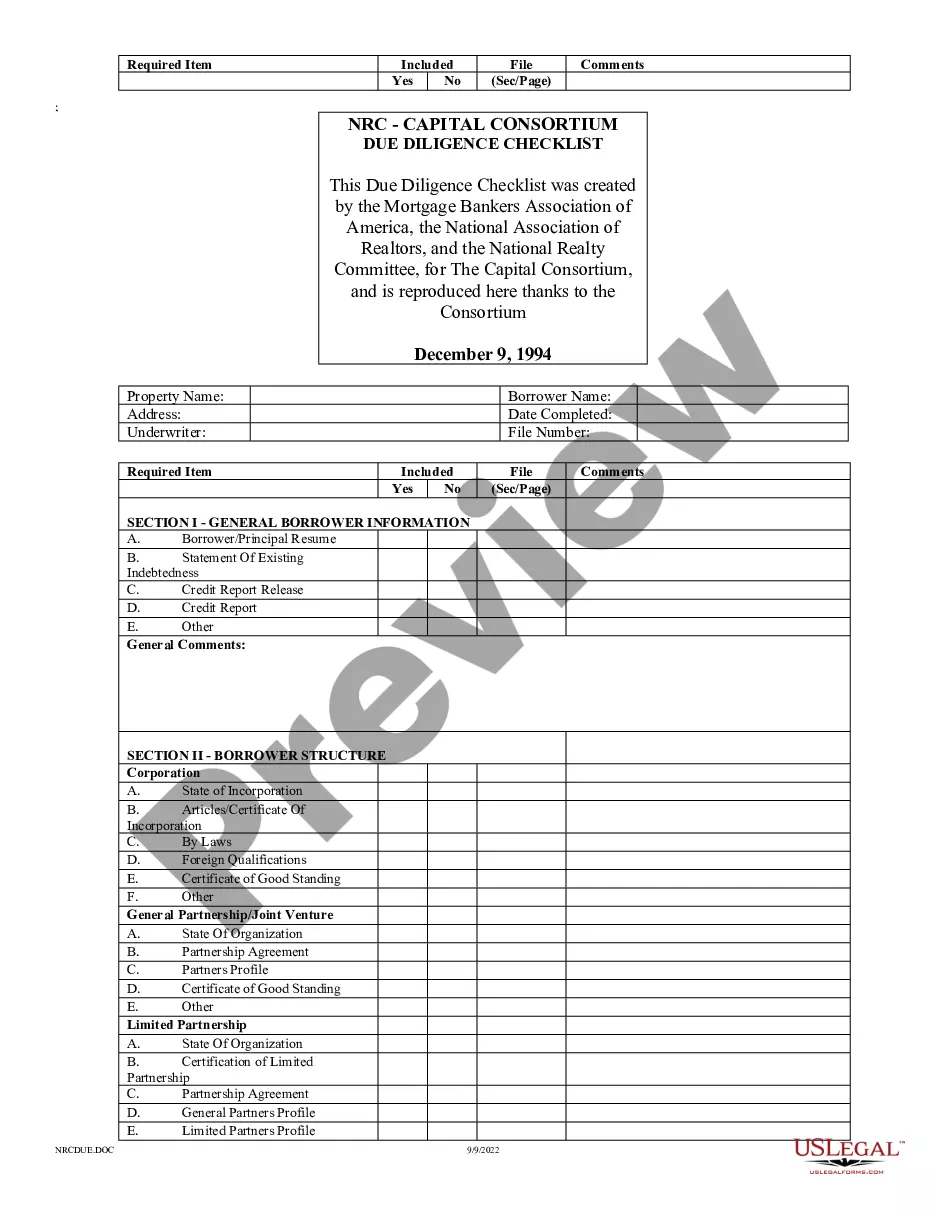

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

Ohio Capital Consortium Due Diligence Checklist

Description

How to fill out Capital Consortium Due Diligence Checklist?

It is possible to commit several hours on the Internet trying to find the legitimate record design that fits the federal and state requirements you will need. US Legal Forms gives thousands of legitimate kinds that happen to be analyzed by pros. You can easily down load or printing the Ohio Capital Consortium Due Diligence Checklist from the assistance.

If you currently have a US Legal Forms profile, you can log in and then click the Down load button. Next, you can full, modify, printing, or signal the Ohio Capital Consortium Due Diligence Checklist. Each legitimate record design you purchase is yours permanently. To acquire an additional copy of any bought kind, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site the first time, stick to the simple guidelines beneath:

- Initially, make certain you have chosen the right record design for the area/metropolis that you pick. Look at the kind explanation to make sure you have picked out the right kind. If available, utilize the Review button to look from the record design at the same time.

- In order to discover an additional model in the kind, utilize the Research discipline to discover the design that fits your needs and requirements.

- When you have located the design you would like, click Get now to continue.

- Select the pricing program you would like, enter your qualifications, and sign up for your account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal profile to fund the legitimate kind.

- Select the formatting in the record and down load it to your gadget.

- Make alterations to your record if possible. It is possible to full, modify and signal and printing Ohio Capital Consortium Due Diligence Checklist.

Down load and printing thousands of record templates using the US Legal Forms Internet site, that offers the greatest assortment of legitimate kinds. Use expert and state-particular templates to handle your company or person requirements.

Form popularity

FAQ

2. Financial Due Diligence Documents Up to date tax returns documents. Audited financial statements (at least 3 years) Auditor's correspondence for last five years. Copies of all loans and credit agreements. Details of company investments (bonds, marketable securities, etc.) Capital structure.

The career path of a financial analyst working in due diligence usually begins with a few years of experience in the financial sector. Data analysis and accounting are some of the most common areas that future analysts embark on before entering financial due diligence.

There are many possible examples of due diligence. Some common examples include investigating the financials of a company before making an investment, researching a person's background before hiring them, or reviewing environmental impact reports before committing to a construction project.

A due diligence report should capture these key elements. Executive summary, company overview, purpose, due diligence (financial, legal, operational, commercial, market, environmental and regulatory), insurance and risk management, growth prospects and recommendations.

The most common are: economic, technical and organizational due diligence checks. checks of managers and staff. legal and tax checks. operational due diligence (ODD) to assess the risks and appreciation potential of the target object.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

Below is a basic outline of the financial due diligence checklist: Income statements (past five years) showing income and expenditure, profit and loss. Balance sheets (past five years) showing company assets and liabilities. Cash flow statements (past five years) showing all cash inflows and cash outflows.

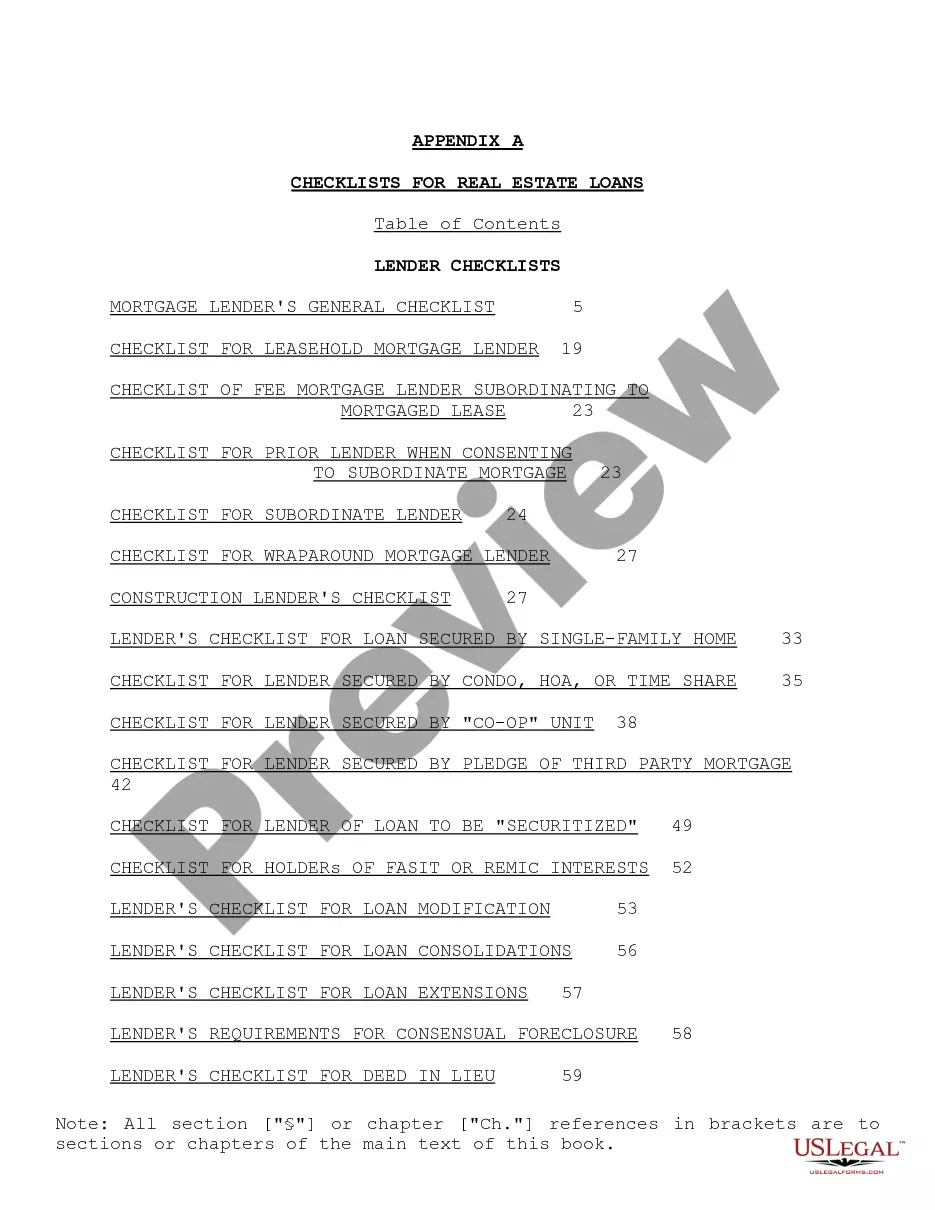

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.