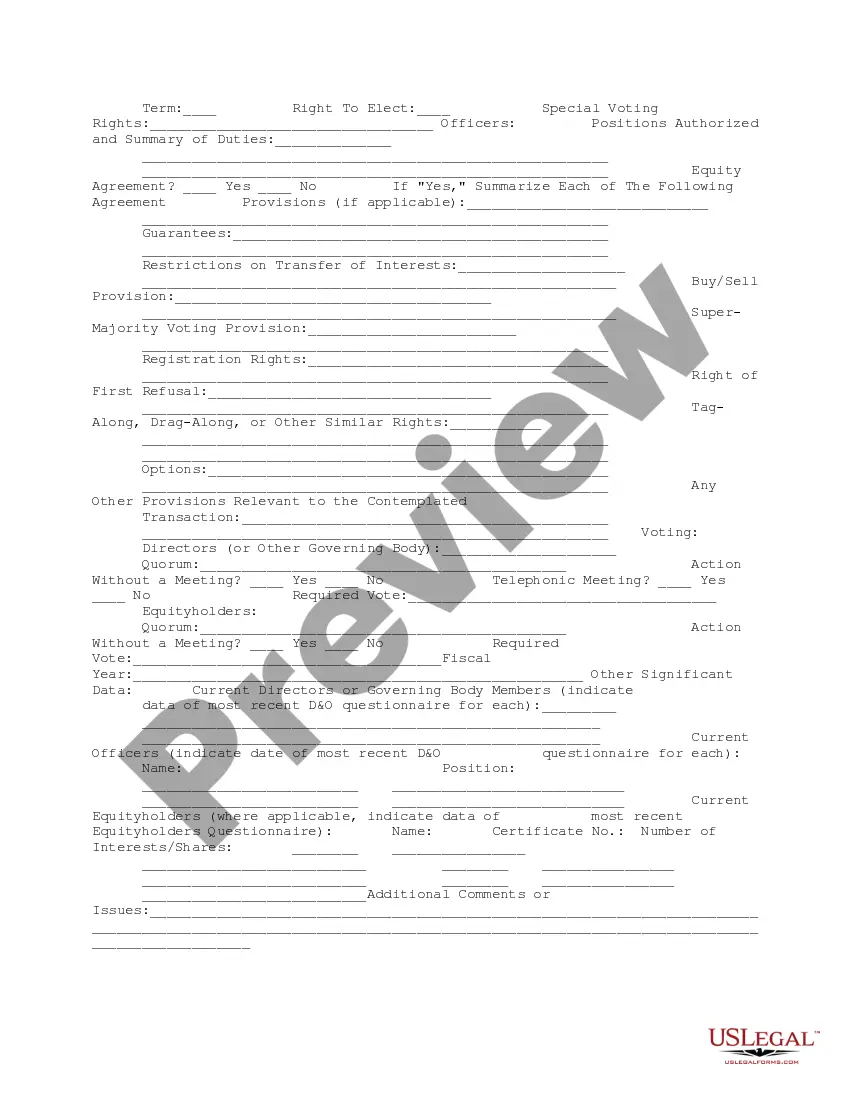

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Ohio Company Data Summary

Description

How to fill out Company Data Summary?

You may spend multiple hours online searching for the valid document template that meets the state and federal stipulations you require.

US Legal Forms offers a vast collection of valid forms that have been vetted by professionals.

You can download or print the Ohio Company Data Summary from my service.

- If you already have a US Legal Forms account, you can Log In and then press the Download button.

- Then, you can complete, modify, print, or sign the Ohio Company Data Summary.

- Every valid document template you acquire becomes yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your desired state/city. Check the form description to confirm you have chosen the right one.

- If available, utilize the Review button to consult the document template as well.

- To get another version of the form, use the Search field to find the template that fits your needs and requirements.

- Once you have located the template you want, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the valid form.

- Select the format of the document and download it to your device.

- Make modifications to the document if necessary. You can complete, modify, sign, and print the Ohio Company Data Summary.

- Download and print a wide variety of document templates using the US Legal Forms website, which offers the largest selection of valid forms.

- Utilize professional and state-specific templates to address your business or personal requirements.

Form popularity

FAQ

Annual records in Ohio typically include information about your business's financial performance, management structure, and ownership. Essential documents might consist of tax returns, financial statements, and any amendments to your Articles of Organization. Keeping a detailed Ohio Company Data Summary helps ensure compliance with state laws and supports secure business operations. For further assistance in managing your records, take advantage of the helpful tools available on the USLegalForms platform.

No, you do not need to renew your LLC every year in Ohio. However, you should keep your Ohio Company Data Summary updated with any changes in your business structure or contact information. Staying in good standing with the state requires paying your taxes and filing any necessary documents when changes occur. For a smoother experience, consider exploring USLegalForms, which can help guide you through Ohio's compliance processes.

As mentioned earlier, Ohio does not mandate annual reports for LLCs. This benefit allows you to focus on your business activities without the worry of annual filings. However, keeping your Ohio Company Data Summary current is essential for legal and operational effectiveness. Utilize the resources available on the USLegalForms platform to help you maintain accurate records.

Ohio's adjusted gross income includes various sources of income, such as wages, dividends, interest, and rental income. Deductions like business losses and contributions to retirement accounts also adjust your income. Understanding these components is crucial for accurately completing your tax returns. For additional assistance, refer to the USLegalForms platform, which offers guidance for compiling your Ohio Company Data Summary.

In Ohio, LLCs are not required to file annual reports. However, it is important to keep your Ohio Company Data Summary up-to-date with the Secretary of State. This summary contains essential information such as management structure and registered agent details. Regularly reviewing this data ensures compliance and transparency in your business operations.

You can file your Ohio IT3 forms online through the Ohio Department of Taxation's website. This convenient option allows you to submit your information securely and receive confirmation of your filing. Additionally, you can also mail the form to the appropriate address listed on the form itself. For easy access to comprehensive instructions and resources, consider visiting the USLegalForms platform, which provides valuable insights on managing your Ohio Company Data Summary.

Yes, it is possible to look up someone's criminal record in Ohio. The state provides access to these records in adherence to public information laws. When navigating these records, the Ohio Company Data Summary can help clarify any business-related inquiries and highlight relevant details you might need in your research.

Ohio is a state rich in history, culture, and economic opportunities. Its diverse business environment and proactive regulations make it an attractive destination for entrepreneurs. For anyone exploring the state’s business landscape, the Ohio Company Data Summary offers quick access to vital information regarding companies operating within its borders.

The Ohio database is publicly available, allowing individuals to access various records and business information. This accessibility promotes transparency and enables you to conduct thorough research. With platforms like uslegalforms, accessing the Ohio Company Data Summary becomes a streamlined process, empowering you to find the data you need effortlessly.

Yes, Ohio mandates that Limited Liability Companies (LLCs) submit an annual report. This requirement ensures that the state has updated information about the LLC's operations and contact details. When you review the Ohio Company Data Summary, this information is crucial for verifying compliance and maintaining good standing in the state.