This form is a memorandum summarizes the results of a due diligence investigation relating to the possible acquisition of a company.

Ohio Executive Summary of Preliminary Due Diligence Findings

Description

How to fill out Executive Summary Of Preliminary Due Diligence Findings?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates you can download or create.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents like the Ohio Executive Summary of Preliminary Due Diligence Findings within moments.

If you already have an account, Log In and download the Ohio Executive Summary of Preliminary Due Diligence Findings from the US Legal Forms library. The Download button will appear on every document you view. You can find all previously saved forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the saved Ohio Executive Summary of Preliminary Due Diligence Findings.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Ohio Executive Summary of Preliminary Due Diligence Findings with US Legal Forms, the most extensive library of legal document templates. Take advantage of thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

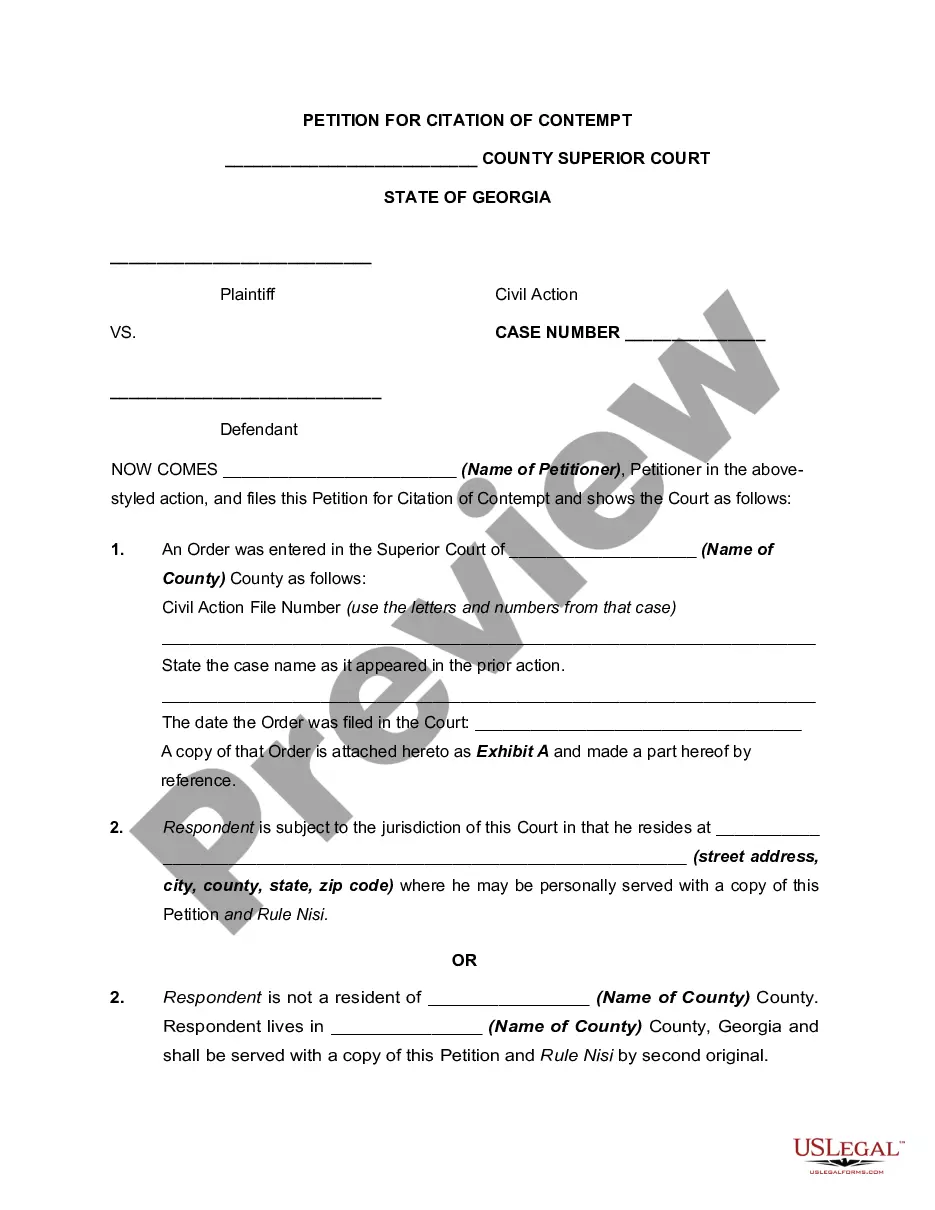

- Ensure you have selected the correct form for your city/state. Click the Preview button to view the content of the form. Review the form summary to confirm that you have chosen the right document.

- If the form doesn’t meet your requirements, use the Search bar at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Yes, Ohio has established practices for due diligence, often influenced by state laws and regulations. Due diligence is vital for businesses operating in Ohio to ensure compliance with local laws and to identify potential risks. Utilizing the Ohio Executive Summary of Preliminary Due Diligence Findings can enhance your understanding and management of these risks effectively. Consider using the uslegalforms platform to access valuable resources and templates that streamline the due diligence process.

Creating a due diligence report involves several systematic steps. First, gather all pertinent information about the company, including financials, legal documentation, and regulatory compliance. Next, analyze the data and summarize your findings clearly and concisely. The Ohio Executive Summary of Preliminary Due Diligence Findings should capture the essential insights, highlighting any potential issues that may arise during the process.

A legal due diligence executive summary outlines the key findings of a thorough investigation into a company's legal standing. This summary provides insights into potential risks and compliance issues that may affect the business. The Ohio Executive Summary of Preliminary Due Diligence Findings plays a crucial role in helping stakeholders make informed decisions. Understanding this document can significantly impact your strategy in Ohio.

A due diligence report is sent as an internal memo to members of the executive team who are evaluating the transaction and is a requirement for closing the deal. Download templates, read examples and learn about how deals are structured.

Listed are general due diligence process steps.Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind:Write for the target audience.Focus on the report objectives.Limit the report to information that has material impact to your company.Structure the information to be used as valuable reference material later.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

Organization and Good Standing of CompanyThe Articles of Incorporation and any amendments.A list of company bylaws and amendments.A list of company assumed names.A list of all states or countries where the company does business, has employees, or owns/leases an asset.Annual reports for the last three years.More items...

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.