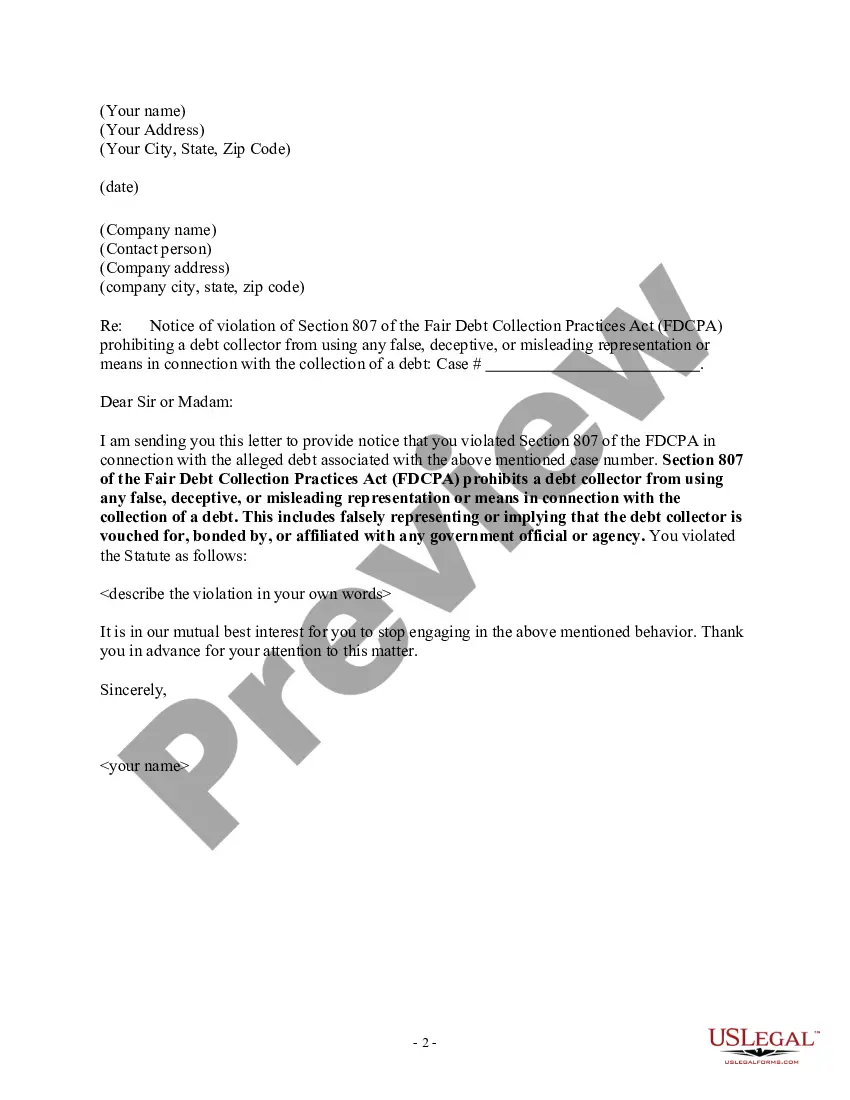

Ohio Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

US Legal Forms - among the most important collections of legal documents in the USA - provides a broad selection of legal form templates that you can download or create.

By using the website, you can discover thousands of forms for both business and personal needs, sorted by types, states, or keywords. You can find the latest versions of forms such as the Ohio Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in just seconds.

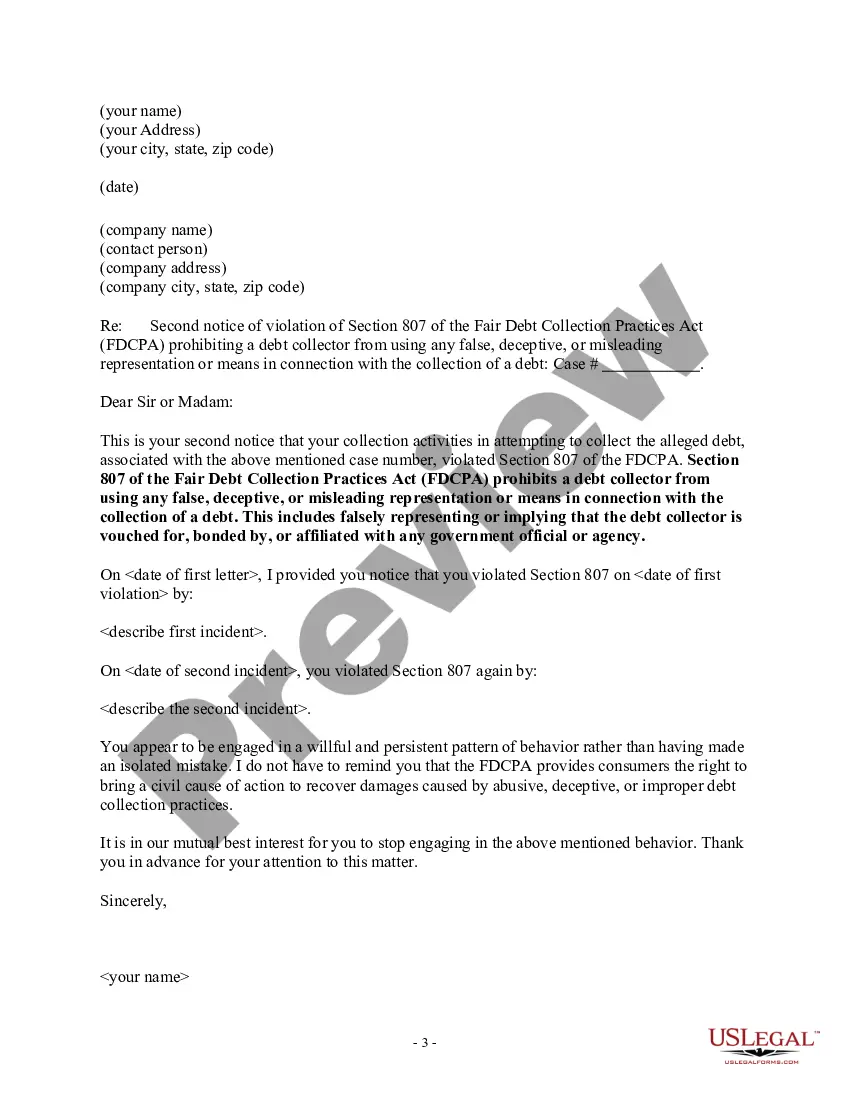

If you have an account, Log In and download the Ohio Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Ohio Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. Every template you add to your account does not expire and is yours forever. So, if you wish to download or produce another copy, simply go to the My documents section and click on the form you want.

Access the Ohio Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your state/region.

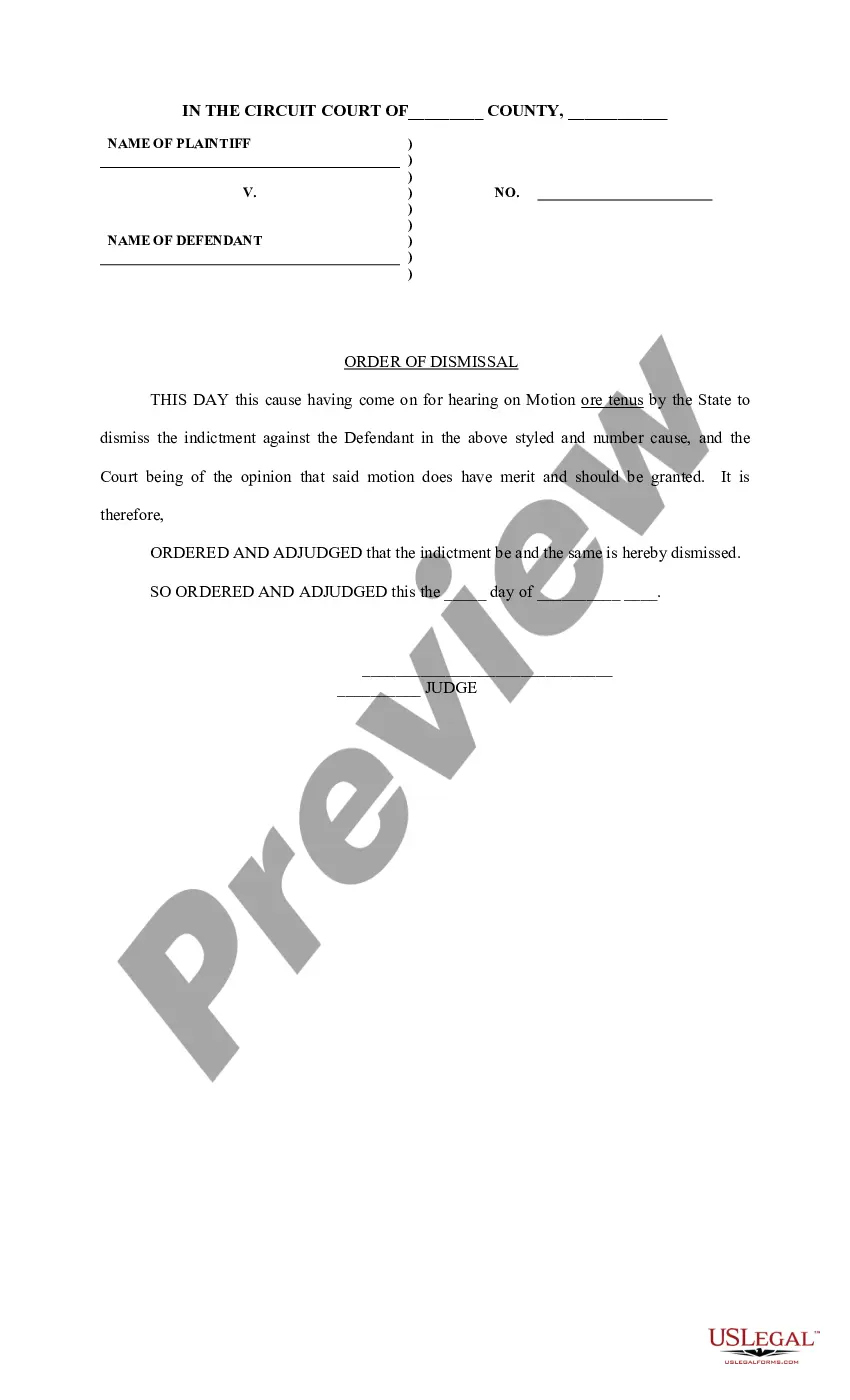

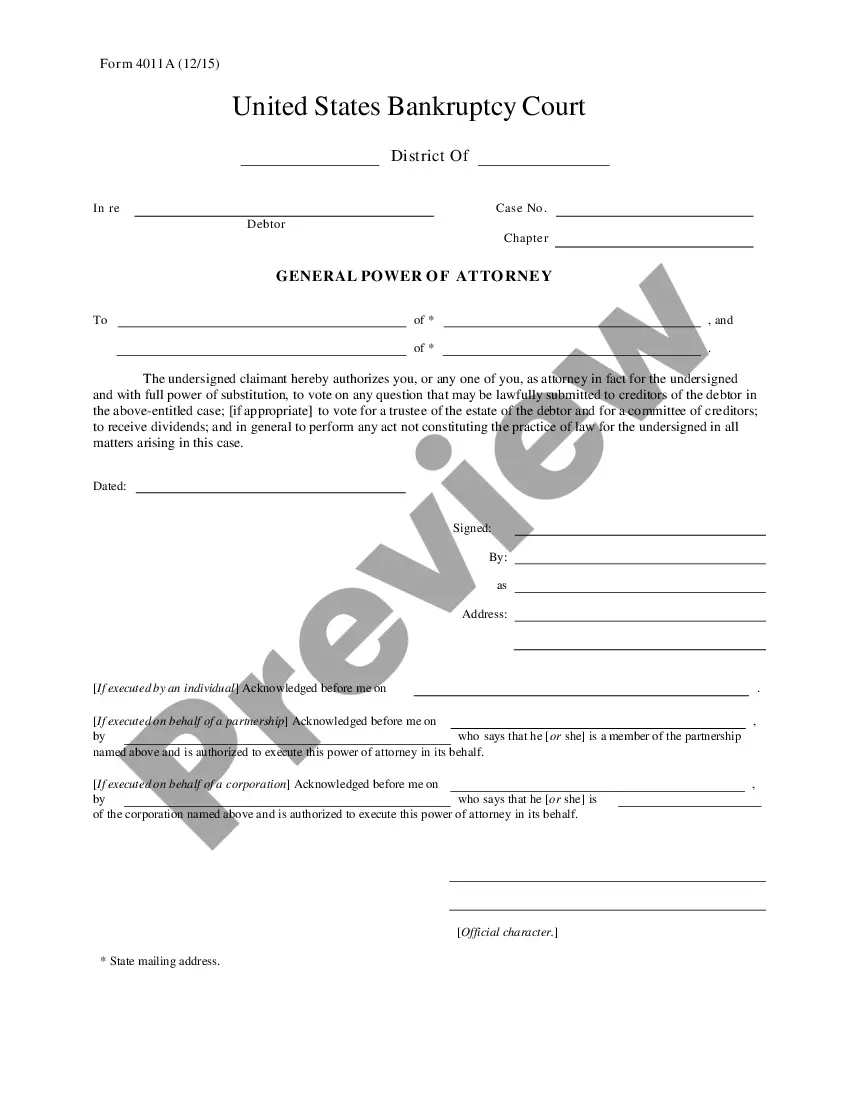

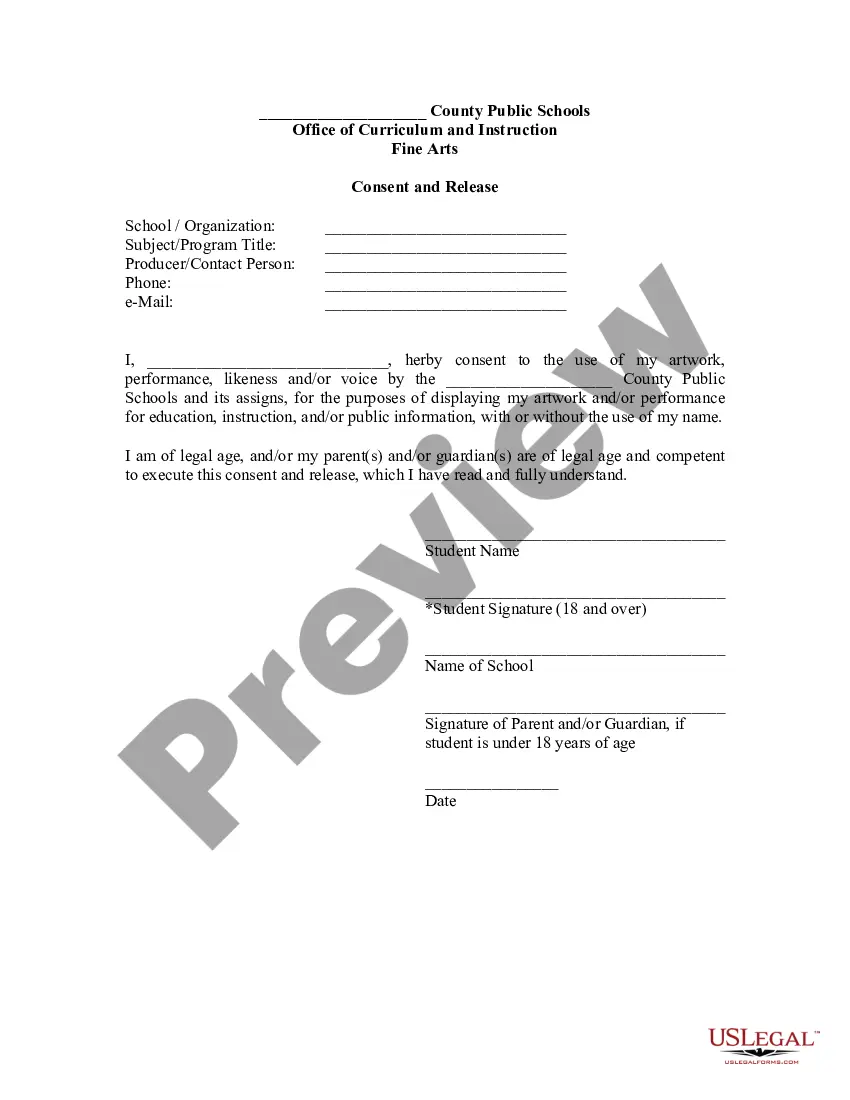

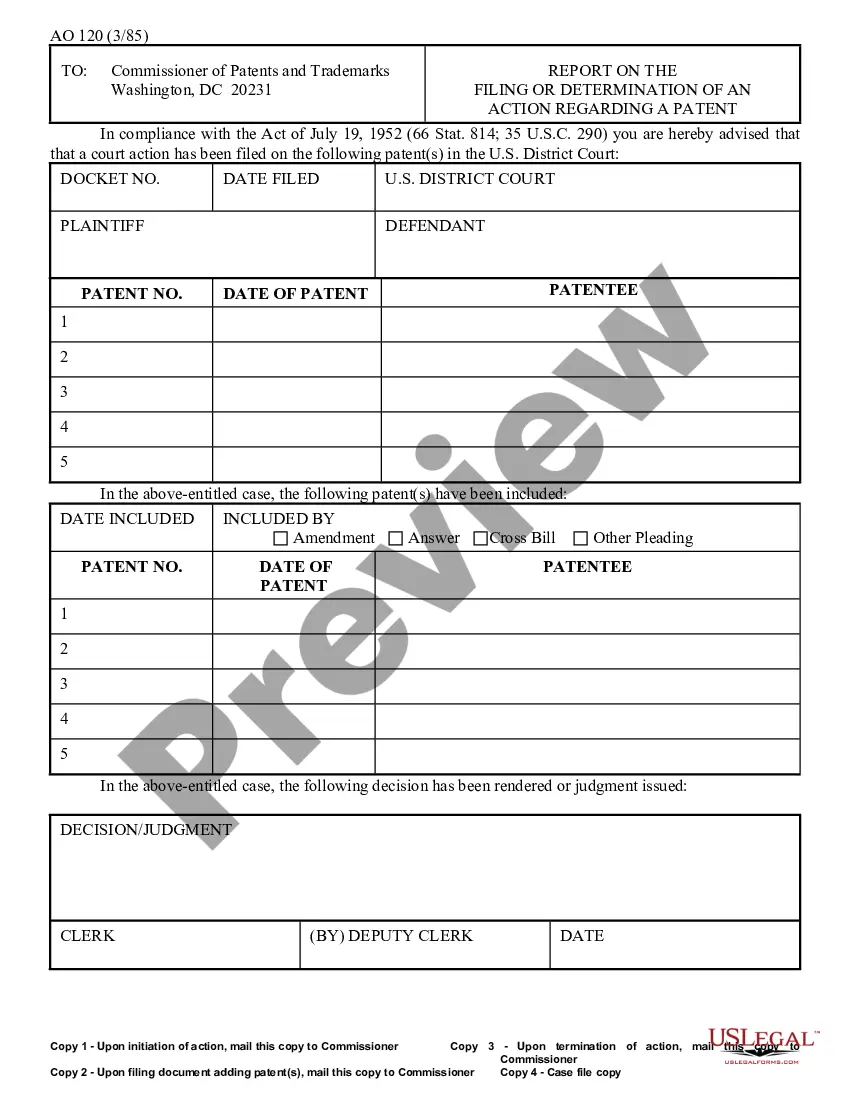

- Click the Review button to examine the form’s contents.

- Read the form description to confirm that you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are content with the form, confirm your choice by clicking the Purchase now button.

- Next, select the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

If you believe a debt collector has violated the federal Fair Debt Collection Practices Act or Ohio Consumer Sales Practices Act, you may sue the collector in federal or state court within one year from the date the violation occurred.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Statute of Limitations in Ohio Ohio's statute of limitations is six years no matter the type of debt. And the six years is counted from the date a debt became overdue or when you last made a payment, whichever was more recent. If the timeframe is more than six years, a creditor cannot sue to collect the debt.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old. When the debt is based on a verbal agreement, that time is reduced to two years.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.