Ohio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

US Legal Forms - among the biggest libraries of legal forms in the USA - offers an array of legal papers web templates you can acquire or print. Using the internet site, you may get thousands of forms for company and specific uses, categorized by categories, says, or key phrases.You can get the most up-to-date versions of forms much like the Ohio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights within minutes.

If you already possess a monthly subscription, log in and acquire Ohio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights from the US Legal Forms library. The Obtain button can look on every single type you perspective. You have accessibility to all earlier delivered electronically forms from the My Forms tab of the account.

If you wish to use US Legal Forms initially, allow me to share easy guidelines to obtain started out:

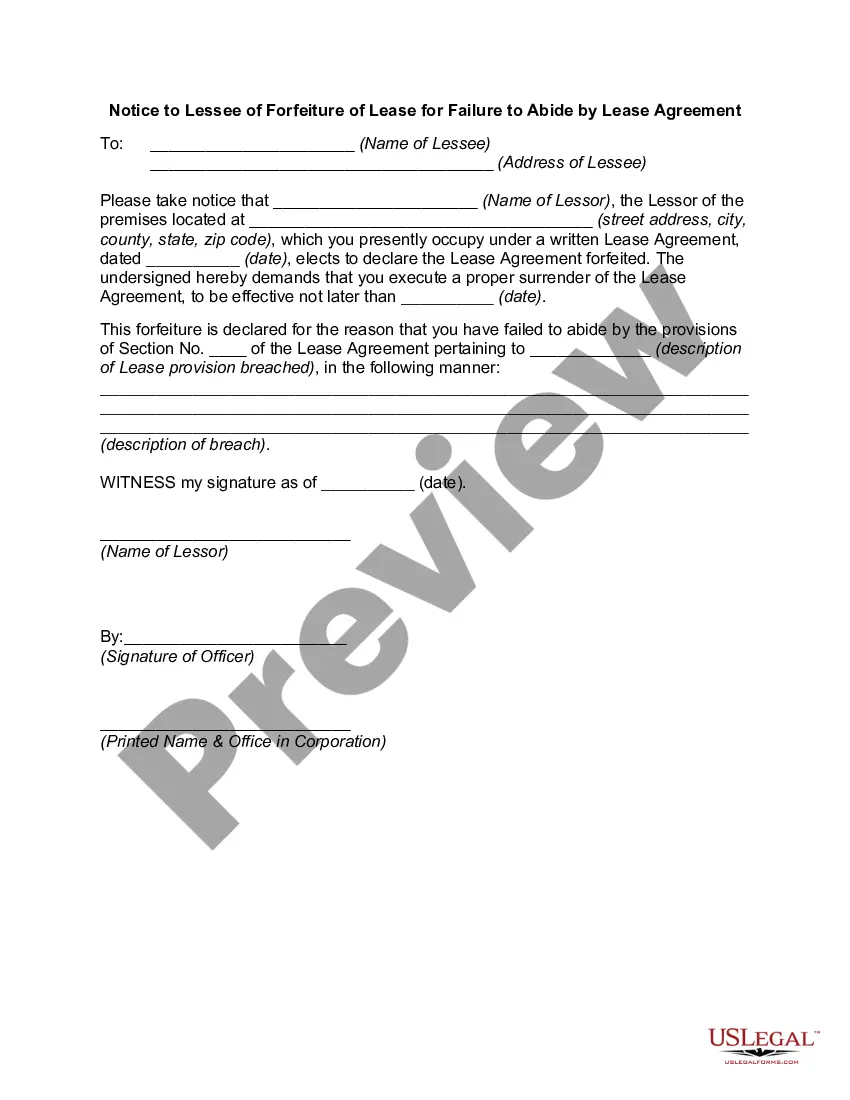

- Be sure you have picked out the correct type to your town/area. Go through the Preview button to examine the form`s articles. See the type description to ensure that you have chosen the proper type.

- In case the type does not match your requirements, make use of the Look for discipline towards the top of the monitor to get the one that does.

- In case you are satisfied with the shape, verify your option by clicking the Purchase now button. Then, choose the prices program you favor and supply your qualifications to sign up to have an account.

- Procedure the transaction. Make use of your bank card or PayPal account to perform the transaction.

- Find the file format and acquire the shape in your device.

- Make alterations. Fill out, modify and print and signal the delivered electronically Ohio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Every single web template you included with your account lacks an expiration day and it is yours forever. So, if you wish to acquire or print one more version, just visit the My Forms portion and then click in the type you require.

Get access to the Ohio Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights with US Legal Forms, the most extensive library of legal papers web templates. Use thousands of professional and state-certain web templates that satisfy your small business or specific requires and requirements.

Form popularity

FAQ

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

In some cases, your RSUs may be taxed twice. The good news is that you will not owe taxes on your RSUs right away at grant. They do not have any real value until they vest, which can be years down the road depending on the company you work for and if they are public or private.

You're not liable for income tax until your stock grant vests, at which point you must report income equal to the value of the stock you received.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

An incentive stock option (ISO) gives employees?usually company executives?the opportunity to buy company stock at a discounted price. Employees do not owe federal income taxes when the option is granted or when they exercise the option. Instead, they pay taxes when they sell the stock.

Stock options are typically taxed at two points in time: first when they are exercised (purchased) and again when they're sold. You can unlock certain tax advantages by learning the differences between ISOs and NSOs.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.