Ohio Certificate of Commencement Case - B 206

Description

How to fill out Certificate Of Commencement Case - B 206?

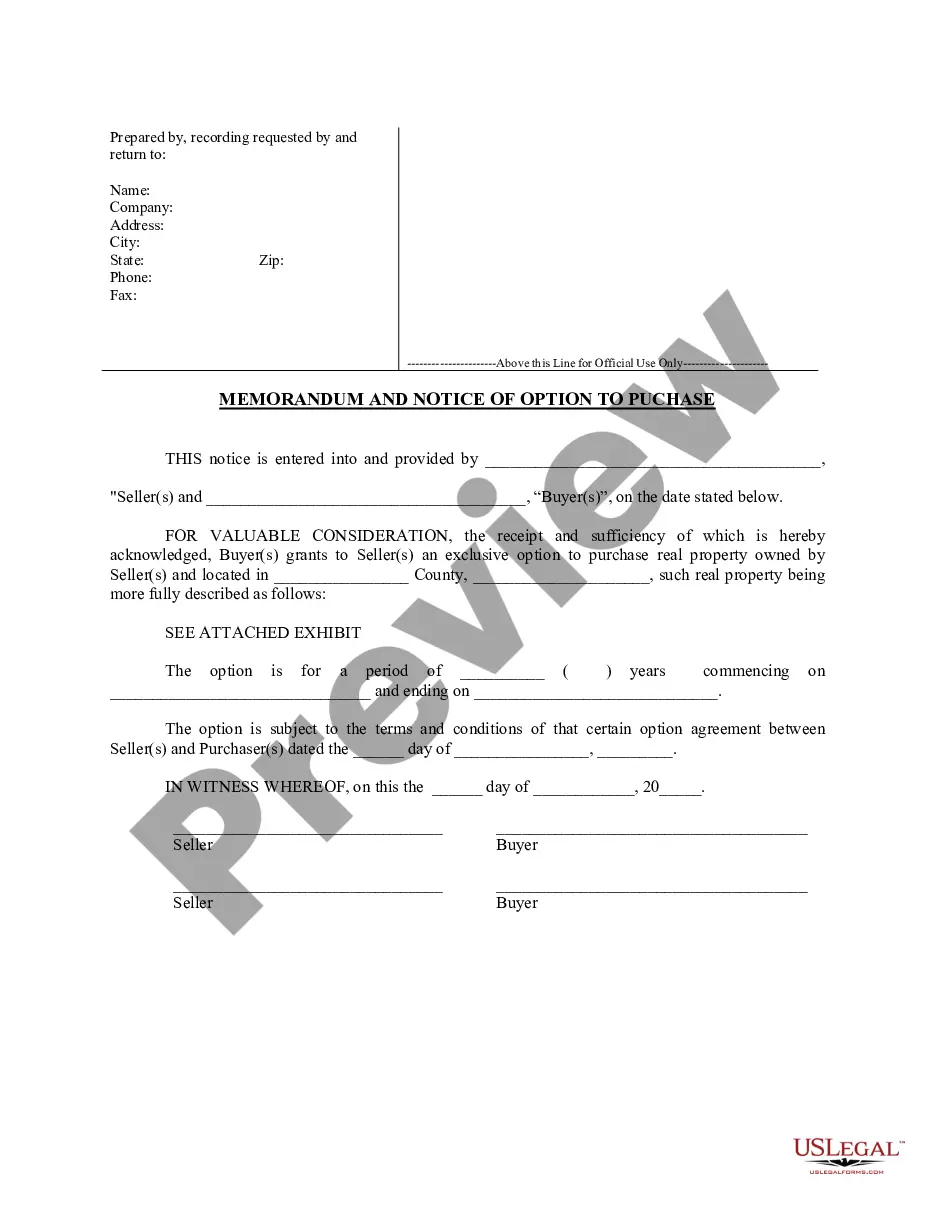

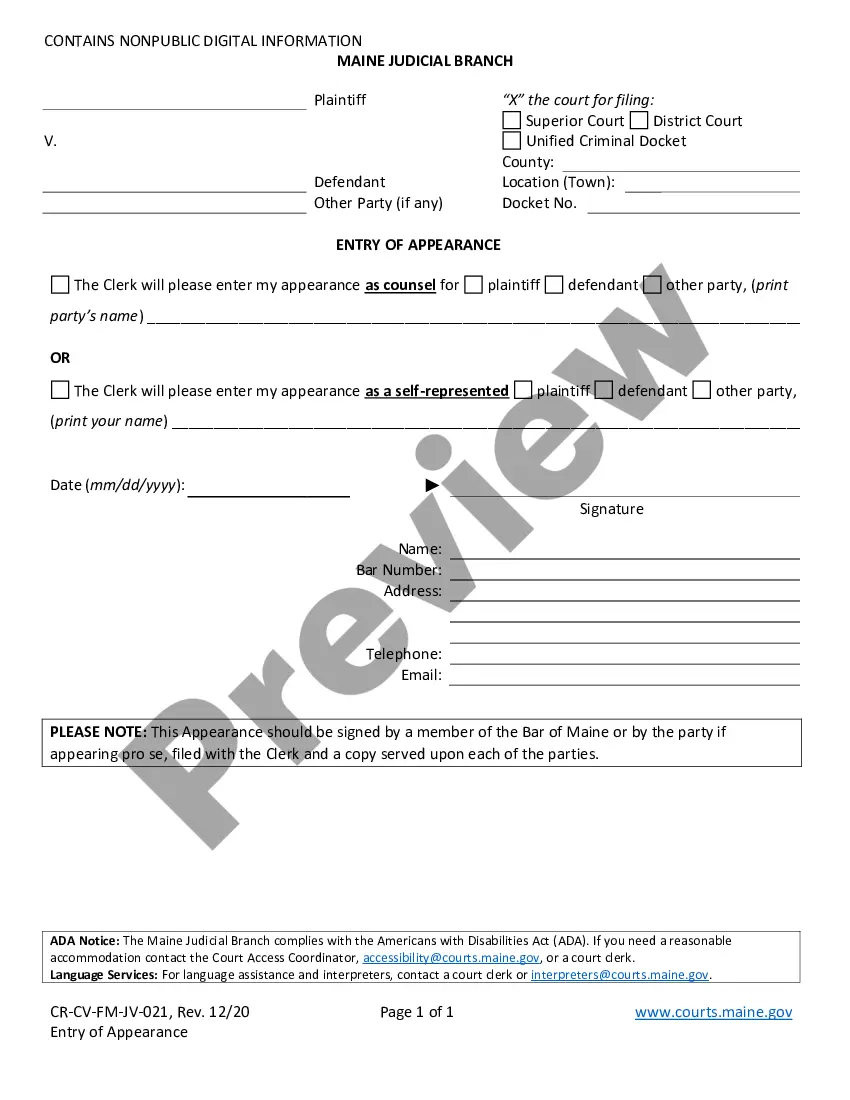

If you need to total, down load, or print out legitimate file layouts, use US Legal Forms, the biggest selection of legitimate varieties, which can be found online. Use the site`s simple and handy search to get the files you will need. Different layouts for enterprise and individual functions are categorized by classes and says, or key phrases. Use US Legal Forms to get the Ohio Certificate of Commencement Case - B 206 in just a number of click throughs.

If you are currently a US Legal Forms client, log in to your account and then click the Down load switch to find the Ohio Certificate of Commencement Case - B 206. You may also access varieties you in the past acquired in the My Forms tab of your respective account.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the appropriate city/country.

- Step 2. Make use of the Review choice to look over the form`s articles. Don`t forget about to read the explanation.

- Step 3. If you are unsatisfied using the type, take advantage of the Search industry at the top of the monitor to discover other variations from the legitimate type template.

- Step 4. Once you have discovered the shape you will need, click the Buy now switch. Opt for the rates program you favor and include your accreditations to sign up to have an account.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal account to finish the financial transaction.

- Step 6. Find the structure from the legitimate type and down load it on your product.

- Step 7. Full, revise and print out or indication the Ohio Certificate of Commencement Case - B 206.

Each and every legitimate file template you purchase is yours permanently. You have acces to each type you acquired in your acccount. Click on the My Forms segment and pick a type to print out or down load again.

Be competitive and down load, and print out the Ohio Certificate of Commencement Case - B 206 with US Legal Forms. There are thousands of expert and status-certain varieties you can use for your personal enterprise or individual requires.

Form popularity

FAQ

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

Hear this out loud PauseNot All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

Hear this out loud PauseIn many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, not only is Chapter 7 quicker, many people prefer the following two things as well: filers keep all or most of their property, and. filers don't pay creditors through a three- to five-year Chapter 13 repayment plan.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

Hear this out loud PauseMost consumer debt is dischargeable in bankruptcy. Chapter 7 bankruptcy wipes out medical bills, personal loans, credit card debt, and most other unsecured debt. Debt that is related to some kind of ?bad act? like causing someone injury or lying on a credit application can't be wiped out.

Debts have different degrees of priority. The debts that must be repaid in Chapter 13 are priority debts including child support, alimony, certain taxes, and wages owed to employees. Your plan must also address your secured debts. Secured debts are those that are secured by collateral, such as a mortgage or car loan.