Ohio Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

While utilizing the website, you can access thousands of documents for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of documents like the Ohio Acknowledgment Form for Consultants or Self-Employed Independent Contractors in just seconds.

If you hold a membership, Log In to obtain the Ohio Acknowledgment Form for Consultants or Self-Employed Independent Contractors in the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained documents from the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the payment.

Retrieve the format and download the document onto your device. Make modifications. Fill out, edit, and print and sign the downloaded Ohio Acknowledgment Form for Consultants or Self-Employed Independent Contractors. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the Ohio Acknowledgment Form for Consultants or Self-Employed Independent Contractors with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct document for your locality/region.

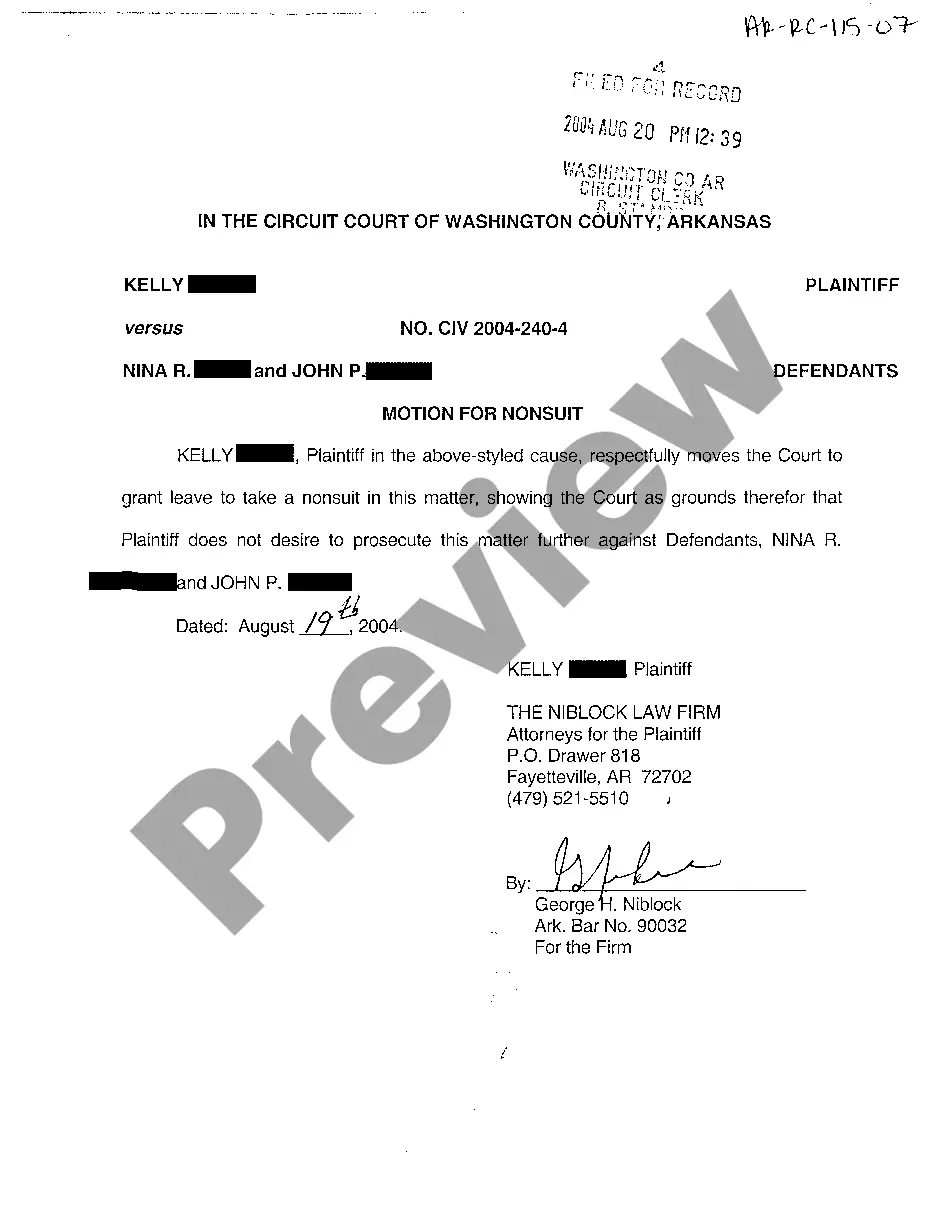

- Click the Preview button to view the content of the document.

- Check the document description to confirm you’ve chosen the appropriate document.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Download now button.

- Then, choose the pricing plan you want and provide your information to sign up for the account.

Form popularity

FAQ

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Before you can apply for a state contractor license in Ohio, you need to be 18 years old and a United States citizen or legal alien, and you must have at least five years of experience in your trade unless you're an engineer. Engineers registered in the state need only three years of experience.

Who is required to register with the Ohio Secretary of State? Any business entity, domestic or foreign, planning to transact business within Ohio, using a name other than their own personal name, must register with this office. Business entities must file the appropriate formation documents to register their business.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The Ohio Contractor Licensing Law (ORC 4740), requires building and health departments who have a registration in place to require the State License before issuing commercial permits. All local building and health departments regulate residential contractors.

The state of Ohio does not require a specific handyman license to perform minor repair work on residential property. However, you must possess a contractor specialty license to perform work in specialized trades such as refrigeration, hydronic, electrical, HVAC, and plumbing.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.