Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

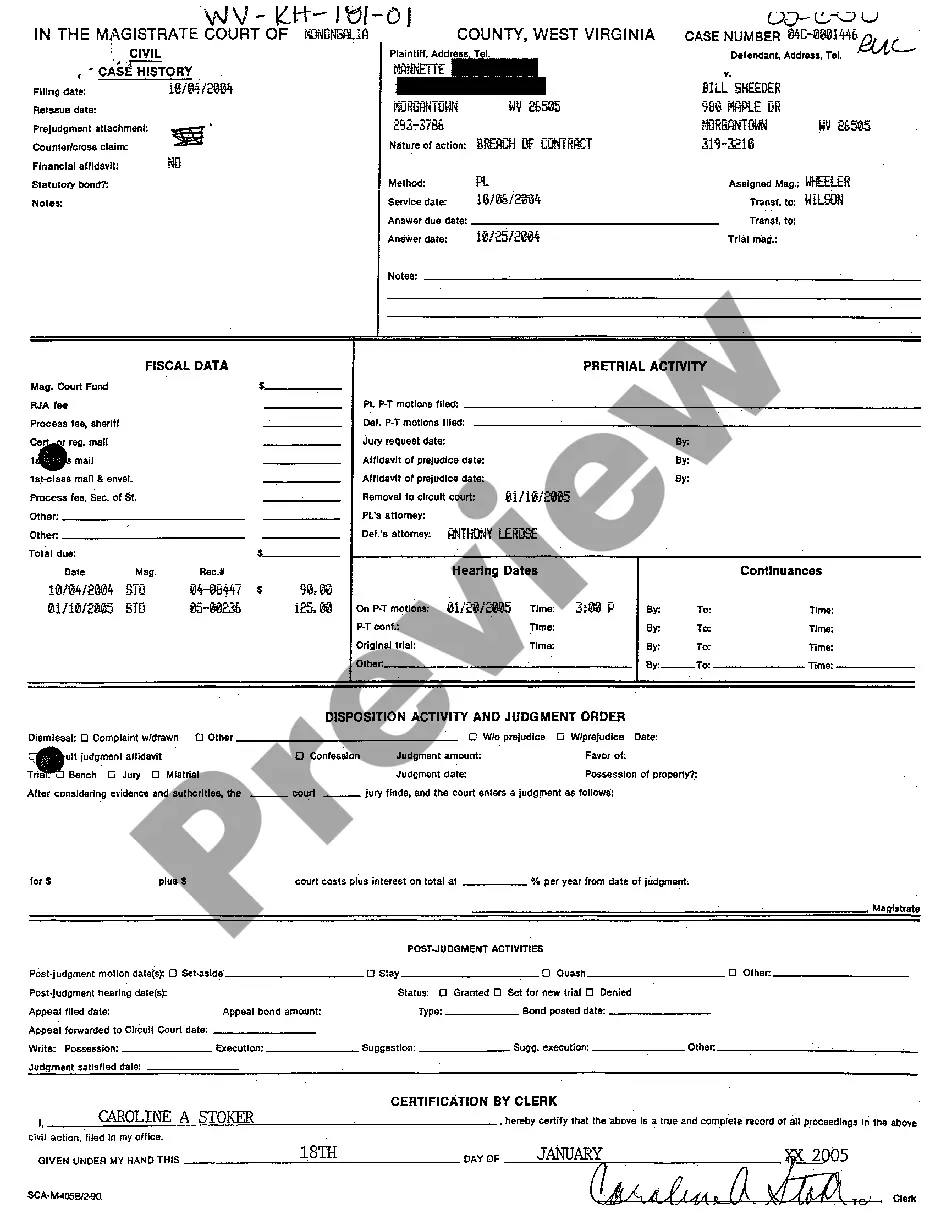

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you require to complete, acquire, or create valid document templates, utilize US Legal Forms, the leading selection of legal forms available online.

Make use of the website's simple and convenient search to locate the documents you seek.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- Utilize US Legal Forms to locate the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate in just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and select the Download button to retrieve the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have chosen the form for the appropriate area/region.

- Step 2. Use the Review feature to examine the form's details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, it is quite normal to find a personal guarantee required for commercial leases in Ohio. Such agreements protect landlords by ensuring they have recourse if a business fails to meet its lease obligations. As a tenant, understanding the terms and conditions of the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help you navigate your responsibilities effectively. Using platforms like US Legal Forms can simplify the process by providing clear and concise documentation.

While personal guarantees provide security, there can be loopholes that tenants take advantage of. For instance, certain guarantees may not cover all forms of financial distress, such as bankruptcy. Additionally, landlords sometimes overlook documentation specifics, which can leave them vulnerable. It is crucial to review terms thoroughly and consider the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure your legal rights are clearly defined.

In Ohio, a personal guarantee is quite common on both residential and commercial leases. Landlords often require this guarantee to minimize their risk when leasing property, especially in situations where the tenant is a business. This practice helps establish trust between the parties, ensuring the landlord can seek recourse if the tenant defaults. If you're navigating lease agreements, understanding the implications of an Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is essential.

A personal guarantee agreement is a legal document where an individual agrees to repay a debt if the primary borrower defaults. This agreement is common in business loans and leases, providing the lender with an additional layer of security. Understanding the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is vital for anyone involved in such agreements, as it outlines rights and obligations.

To effectively enforce a guaranty, the creditor must demonstrate that the borrower defaulted on the agreement. This often involves collecting documentation of the default and notifying the guarantor in writing. Utilizing legal platforms like uslegalforms can provide you with essential resources and templates to guide you through the enforcement process of the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guarantee is generally enforceable if it meets the legal requirements set forth under Ohio law. Courts typically recognize these agreements as binding, provided they are clear and contain all essential elements. Thus, understanding the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help you navigate its enforceability.

To protect yourself from a personal guarantee, consider negotiating terms with the lender to minimize your personal exposure. You might seek alternatives such as offering collateral or a lower guarantee amount. Additionally, it's wise to consult with a legal professional who can advise you on the implications of the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Filling out an Ohio residential lease agreement involves providing accurate information about the landlord, tenant, and property specifics. It is crucial to include lease terms, payment details, and any applicable conditions, such as the Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, if needed. Using a platform like uslegalforms can simplify this process by offering templates and guidance for creating a compliant lease.

The main difference between a guarantee and a personal guaranty lies in the party providing the assurance. A general guarantee can be issued by a business or entity, while a personal guaranty specifically involves an individual taking on responsibility. This distinction is particularly important in the context of an Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, which highlights the individual's financial commitment.

A personal guaranty on a lease is an agreement where an individual takes personal responsibility for the lease obligations of another party. This commitment is vital for landlords seeking security, especially when leasing to tenants with less-than-stellar credit. Using an Ohio Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can foster trust and protect the financial interest of all parties involved.