Ohio Employee News Form

Description

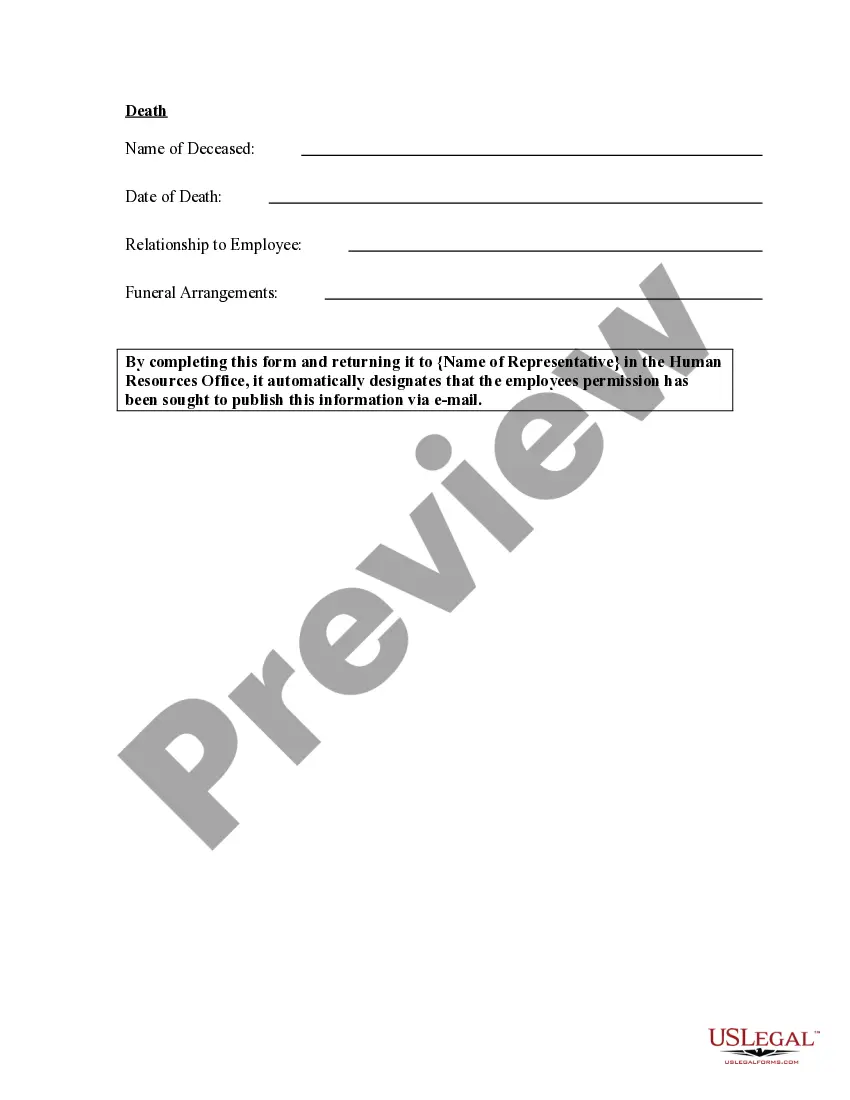

How to fill out Employee News Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive selection of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Ohio Employee News Form instantly.

If you already have an account, Log In to download the Ohio Employee News Form from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms within the My documents tab in your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Ohio Employee News Form. Every template you add to your account has no expiration date and is yours indefinitely. So, if you need to download or print another copy, simply go to the My documents section and click on the form you need. Access the Ohio Employee News Form with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Read the form description to confirm you have the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by selecting the Purchase now button.

- Then, choose your pricing plan and provide your details to register for an account.

Form popularity

FAQ

Personal and Dependent Exemption amounts are indexed for tax year 2020. If Modified Adjusted Gross Income is: 2022 Less than or equal to $40,000, the exemption amount is $2,400. Greater than $40,000 but less than or equal to $80,000, the exemption amount is $2,150. Greater than $80,000, the exemption amount is $1,900.

For tax year 2021, Ohio's individual income tax brackets have been modified so that individuals with Ohio taxable nonbusiness income of $25,000 or less are not subject to income tax. Additionally, Ohio taxable nonbusiness income in excess of $110,650 is taxed at 3.99%. All other rates were reduced by 3%.

When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year.

One may claim exempt from 2020 federal tax withholding if they BOTH: had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. If you claim exempt, no federal income tax is withheld from your paycheck; you may owe taxes and penalties when you file your 2020 tax return.

Every employer maintaining an office or transacting business within the state of Ohio and making payment of any compensation to an employee, whether a resident or nonresident, must withhold Ohio income tax.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Line 3: You are allowed one exemption for each dependent. Your dependents for Ohio income tax purposes are the same as your dependents for federal income tax purposes. See R.C. 5747.01(O).

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Ohio allows a dependent exemption for dependent children and persons other than yourself and your spouse to whom you provide support and claim on your federal tax return. You are entitled to a $1,850 - $2,350 deduction for each dependent exemption depending on your modified adjusted gross income.